Premium Only Content

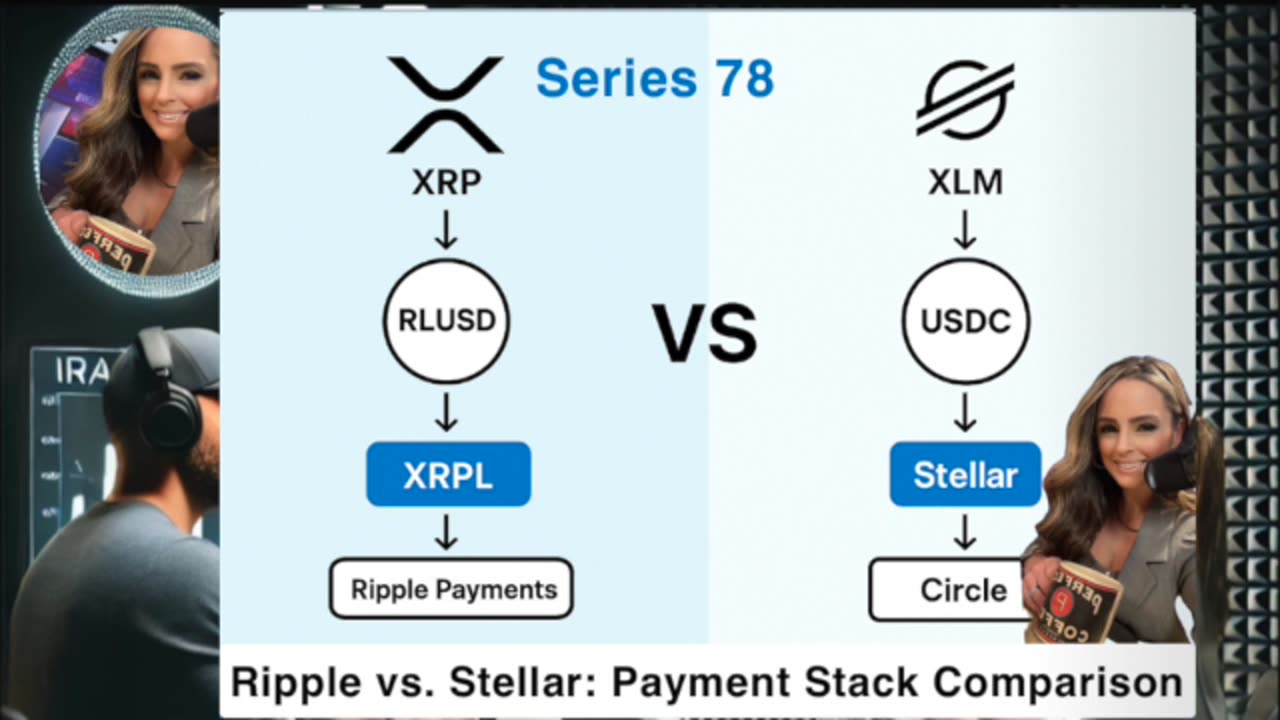

Series 78 Ripple vs. Stellar: Payment Stack Comparison

Series 78 offers a side-by-side comparison of two prominent digital payment ecosystems: Ripple's stack (XRP and RLUSD) and Stellar's stack (XLM and USDC). It explains how each system operates, detailing their ledger and settlement mechanisms, native digital assets, and stablecoin offerings. The information also highlights strategic partnerships and institutional integrations for both, outlining who benefits from each system including banks, fintechs, developers, and end-users. Finally, it provides a practical guide on when to choose one over the other based on specific business needs and existing infrastructure.

Seeding Donations are always helpful for Equipment Upgrades https://cash.app/$ULOOKLIKEWHA

Glossary of Key Terms

XRP Ledger (XRPL): A decentralized cryptographic ledger powered by a community of validators, known for its fast transaction speeds and low costs.

Ripple Payments/ODL (On-Demand Liquidity): Ripple's enterprise-grade cross-border payment solution that uses XRP as a bridge asset to facilitate real-time settlement without pre-funded nostro accounts.

RLUSD: A fiat-backed USD stablecoin issued by Ripple, native on XRPL and Ethereum, designed for stable settlement in cross-border payments.

Nostro Accounts: Accounts held by a bank in a foreign country in the currency of that country, used for international transactions; ODL aims to reduce reliance on these.

Stellar Network: An open-source, decentralized protocol for digital currency to fiat money transfers, allowing for low-cost, near-instantaneous transactions.

Stellar Consensus Protocol (SCP): The unique consensus mechanism used by the Stellar Network, a form of federated Byzantine agreement (FBA) that allows for fast and secure distributed agreement.

XLM (Lumens): The native cryptocurrency of the Stellar Network, used for network fees, to maintain network security, and for facilitating multi-currency transactions on Stellar's built-in orderbook.

USDC: A widely-used US dollar-pegged stablecoin issued by Circle, backed by fully reserved holdings of cash and short-term US Treasuries.

Circle Mint/API: Circle's platform and programming interface that allows businesses and developers to programmatically mint and redeem USDC.

FIS: A major financial technology company that provides a wide range of solutions for financial institutions, including payments and banking technology.

Fiserv: Another leading global provider of financial services technology solutions, including payment processing and digital banking.

Corpay: A company specializing in business payment solutions, including fleet, travel, and payroll payments, and now integrating USDC for cross-border transactions.

NYDFS (New York Department of Financial Services): A regulatory agency in New York responsible for overseeing financial services and products, including digital currency activities.

CPA Attestations: Independent verification by a Certified Public Accountant (CPA) confirming the accuracy of financial statements, in this context, the reserves backing a stablecoin.

EVM Sidechain: A blockchain compatible with the Ethereum Virtual Machine (EVM) that runs alongside a main blockchain (like XRPL), allowing for interoperability with Ethereum decentralized applications (dApps).

Chainlink: A decentralized oracle network that provides real-world data to smart contracts on blockchains, used here for pricing for RLUSD.

Federated Byzantine Agreement (FBA): A class of consensus algorithms, used by Stellar (SCP), where network participants agree on the order of transactions without requiring all nodes to agree or for a central authority to validate.

Disclaimer:

" Eco FutureWealth Deep Dive podcast is designed for informational, educational, and entertainment purposes only. It requires additional independent research and should not be interpreted as financial advice. Eco FutureWealth does not endorse or recommend any investments based on the content shared.

We are not financial advisors. Investors should evaluate their own financial situation, goals, and risk tolerance, and seek professional financial guidance before making any investment or purchase decisions.

This podcast and its presentations provide an overview of crypto and digital assets, emphasizing the volatility of crypto prices, regulatory risks, and the critical need for robust security measures. Episodes may include show notes and occasional glossaries to support understanding.

While this podcast does not offer financial advice, it introduces innovative concepts and underscores the importance of securing digital assets against potential threats."

-

LIVE

LIVE

Rallied

5 hours ago $4.88 earnedWarzone Challenges w/ Doc & Bob

184 watching -

DVR

DVR

StoneMountain64

5 hours agoNew Missions for Battlefield 6 Unlocks (+New Mouse and Keyboard)

31.4K1 -

2:09:47

2:09:47

Nerdrotic

10 hours ago $6.30 earnedHollywood's Long Dark Summer of the Soul - Nerdrotic Nooner 511

70.3K3 -

1:36:05

1:36:05

Side Scrollers Podcast

7 hours agoStreamer ATTACKS Men Then Cries Victim + Pronoun Rant Anniversary + More | Side Scrollers

51.5K -

12:06

12:06

Liberty Hangout

1 day agoDemocrat Woman Can't Define 'Woman'

64.7K88 -

8:56:27

8:56:27

GritsGG

10 hours agoRumble Customs! 3515 Ws! 🫡!

91K2 -

38:39

38:39

Grant Stinchfield

8 hours ago $3.36 earnedHow Local TV News LOST Its Soul

55.9K5 -

2:09:51

2:09:51

Badlands Media

18 hours agoBadlands Daily: Sept. 1, 2025 – Trump vs. Big Pharma, Giuliani Crash, and Mortgage Fraud Fallout

88.3K55 -

1:12:35

1:12:35

theoriginalmarkz

9 hours agoCoffee with MarkZ. 09/01/2025

68.5K15 -

2:59:48

2:59:48

Wendy Bell Radio

14 hours agoSunday, Bloody Sunday

150K274