Premium Only Content

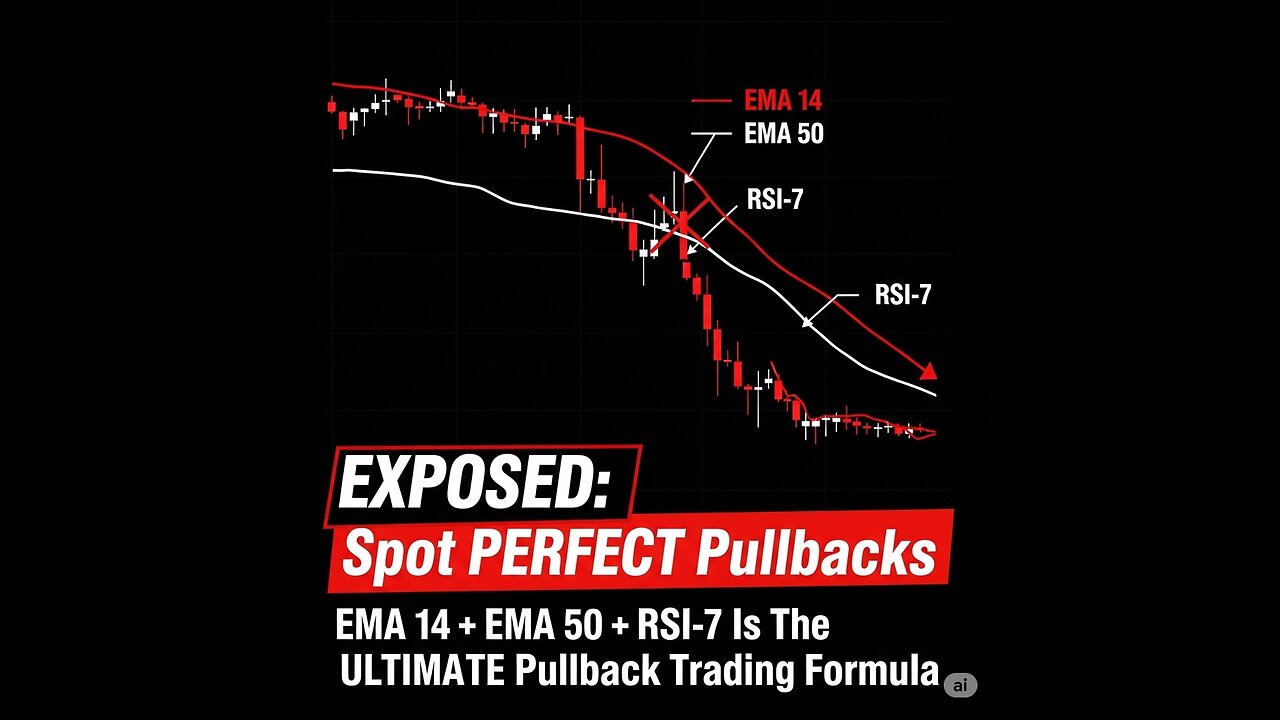

Spot PERFECT Trading Pullbacks-EMA 14 + EMA 50 + RSI-7 The ULTIMATE Pullback Trading Money Formula

Trading with EMA 14, EMA 50, and RSI-7 is a powerful way to spot clean pullbacks within strong trends. The EMA 14 acts as a fast-moving trend filter, closely tracking recent price action, while the EMA 50 serves as a slower, more stable directional bias indicator. When the EMA 14 is above the EMA 50, it signals an uptrend; when it’s below, it signals a downtrend. This dual-EMA setup ensures you’re only trading in the dominant market direction, which significantly reduces false signals and keeps you aligned with the bigger picture.

Open A FREE $50K Demo Account: https://pocketoptioncapital.com

Once trend direction is confirmed by the EMA alignment, the RSI-7 becomes the pullback trigger. In an uptrend, a pullback occurs when the RSI-7 dips into oversold territory—typically near 30—before reversing back upward. In a downtrend, a clean pullback can be identified when RSI-7 spikes toward the overbought zone near 70 before rolling over. These RSI readings help traders avoid chasing impulsive moves and instead wait for price to retrace into a value area where risk is smaller and reward potential is greater.

The key to executing this strategy effectively is patience and timing. Traders can enter on confirmation candles when the RSI starts turning back in the direction of the main trend, ideally near a confluence point where price also touches or bounces off the EMA 14 or EMA 50. Stop losses can be placed just beyond the recent swing high or low, and profit targets can be set using previous structure levels or a favorable risk-to-reward ratio. This EMA-RSI approach works best in trending markets and can produce high-probability setups with clear entry and exit rules, making it a reliable tool for disciplined traders.

What you’ll learn

How to set up EMA 14 + EMA 50 + RSI-7 in under a minute

Exact entry rules for CALL & PUT trades (trend + pullback + momentum + candle)

When to skip trades (flat EMAs, RSI around 50, post-news spikes)

Risk tips: keep it 1–2% per trade, avoid adding/martingale, journal every setup

Indicator settings

EMA 50 = Trend

EMA 14 = Pullback trigger

RSI (7) with levels 70 / 50 / 30 (quick momentum check)

Quick rules (summary)

CALL: EMA14 greater than EMA50 → price touches EMA14 → RSI above 50 and rising → bullish candle → 2-minute expiry

PUT: EMA14 less than EMA50 → price touches EMA14 → RSI below 50 and falling → bearish candle → 2-minute expiry

Open A FREE $50K Demo Account: https://pocketoptioncapital.com

Money Management:

It is important to follow up with this strict rule of investment:

If you have $100 in your account, each open position should be $5 tops

If you have $200 in your account, each open position should be $10 tops

If you have $500 in your account, each open position should be $25 tops

If you have $1,000 in your account, each open position should be $50 tops

If you have $2,000 in your account, each open position should be $100 tops

If you have $5,000 in your account, each open position should be $250 tops

We're currently in our 13th year helping traders become successful in the live markets so we know a thing or two about leveraging a small account into serious wins.

Risk Disclaimer:

Trading options involves financial risk and may not be appropriate for all investors. The information presented here is for information and educational purposes only and should not be considered an offer or solicitation to buy or sell any financial instrument. Any trading decisions that you make are solely your responsibility. Past performance is not necessarily indicative of future results.

-

6:17

6:17

Forex Partners

3 days agoMake Money Trading Online: The ONLY Trader Insight Tool You Need To Get Rich Trading Online FAST

22 -

10:00

10:00

TheMightyMcClures

22 days ago $1.31 earnedWe Fed 500 Families!

12.3K4 -

6:23

6:23

The Shannon Joy Show

13 hours agoWas Covid a MILITARY OPERATION?

11.9K5 -

LIVE

LIVE

The Bubba Army

22 hours agoTRUMP SIGNS EPSTEIN BILL! - Bubba the Love Sponge® Show | 11/20/25

1,847 watching -

27:24

27:24

DeVory Darkins

22 hours agoTrump secures RECORD BREAKING INVESTMENT as Charlotte Schools issue SHOCKING Update

38.5K48 -

34:15

34:15

ZeeeMedia

17 hours agoPolice Demand Government Critic Hands Over His BLOOD | Daily Pulse Ep 147

68.8K36 -

1:47:50

1:47:50

Side Scrollers Podcast

16 hours agoSide Scrollers Presents: OVERCOCKED

38.4K12 -

3:33:22

3:33:22

HLL8LLY

5 hours ago $1.47 earnedBattlefield 6 Live Gameplay

11.8K -

34:04

34:04

Code Blue Cam

20 hours agoTeen Plays Real-Life GTA… Ends Horrifically

29.3K11 -

13:33

13:33

MattMorseTV

18 hours ago $36.63 earnedThey actually TOOK THE BAIT…

88.8K70