Premium Only Content

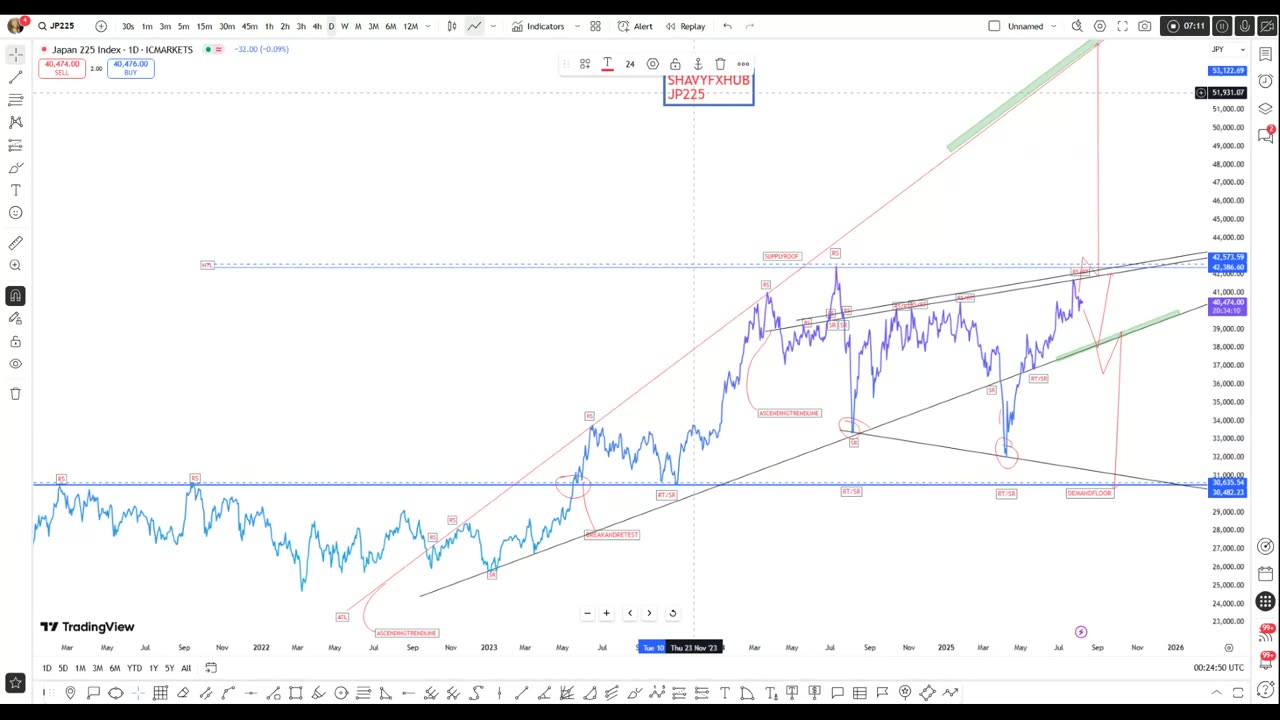

JP225 NIKKEI225

JP225 (Nikkei 225) Iis down by few popints and This recent downturn has been driven by global concerns, especially U.S. tariff escalations, a weaker-than-expected U.S. jobs report, and caution ahead of Bank of Japan policy updates. Major Japanese sectors such as technology, financials, and industrials have seen notable declines.

Despite this short-term dip, the index remains up about 2.5% in the past month and nearly 29% over the past year, reflecting powerful momentum in Japanese equities for 2025. The most recent all-time high was near 42,438 (July 2024), and the index is still trading near historic highs.

Technical and Market Drivers

Recent Volatility: Linked to external (U.S. tariffs, global growth) and internal (BOJ policy, earnings) factors.

Sector Weakness: Tech stocks (e.g., Advantest), financials (Mitsubishi UFJ), and heavyweight exporters (Toyota, Hitachi) have led the latest decline.

Sentiment: Investors are awaiting key signals from the Bank of Japan and further clarity on global trade and monetary policy developments.

Future Outlook for Nikkei 225

Short-Term:

The near-term outlook remains cautious. Analysts and forecasters expect the JP225 could see continued volatility, potentially testing support near 39,000–40,000, especially if global risk sentiment remains weak or BOJ signals tighter policy. However, the underlying fundamental backdrop—strong Japanese corporate earnings, robust foreign investment inflows, and yen weakness supporting exporters—still lends medium-term support.

Medium- and Long-Term:

Forecasts for End-2025: Consensus among strategists suggests potential for new highs by year-end. Some projections see the index reaching 44,000–45,400 or higher, especially if global and regional macroeconomic conditions stabilize and earnings growth persists.

Risks and Catalysts:

Global risk: Further U.S. tariff escalation, slowing global growth, or a sharp downturn in tech could weigh heavily.

Domestic support: Positive corporate governance reforms, sustained share buybacks, tax cut proposals, and improved domestic consumption are likely to underpin strength.

BOJ Policy: Changes in Bank of Japan monetary settings are a key source of both risk and potential upside; continued loose policy would be bullish, while unexpected tightening could trigger corrections.

#jp225 #japan #stocks

-

14:54

14:54

The Kevin Trudeau Show Limitless

1 day agoThe Hidden Force Running Your Life

30.5K6 -

UPCOMING

UPCOMING

freecastle

5 hours agoTAKE UP YOUR CROSS- Do not be deceived: 'Bad company ruins good morals.

1192 -

LIVE

LIVE

The HotSeat

1 hour agoWatching Them Implode.....Fun To Watch!!!

373 watching -

LIVE

LIVE

Owen Shroyer

1 hour agoOwen Report - 10-30-2025 - Trump Threatens To Bring Back Nuclear Bomb Testing

1,268 watching -

![[Ep 781] Arctic Treason – Smith, Boasberg, Deep State Coup | TPUSA Revival! | Joe Autopen](https://1a-1791.com/video/fww1/98/s8/1/E/H/c/v/EHcvz.0kob.1-small-Ep-781-Arctic-Treason-Smith.jpg) LIVE

LIVE

The Nunn Report - w/ Dan Nunn

2 hours ago[Ep 781] Arctic Treason – Smith, Boasberg, Deep State Coup | TPUSA Revival! | Joe Autopen

213 watching -

1:05:14

1:05:14

The Quartering

3 hours agoSocial Order Has Collapsed

93.6K20 -

1:12:11

1:12:11

DeVory Darkins

4 hours agoKamala STUNNED after brutal question from reporter as Trump DOMINATES CHINA MEETING

118K86 -

3:34:09

3:34:09

Due Dissidence

7 hours agoMegyn Kelly GASLIGHTS Candace Fan, Tucker TORCHES Christian Zionism, Israel BREAKS CEASEFIRE AGAIN

18.5K26 -

59:52

59:52

Mark Kaye

5 hours ago🔴 5 Reasons JD Vance WILL Be The Next President

27.3K7 -

21:08

21:08

Professor Nez

3 hours agoTrump Just BROKE the ENTIRE Democrat Party with one Line!

24K32