Premium Only Content

"🔥 What Really Happened with House Bill 30 (HB 30) 🔥

This bill got sold as “taxpayer protection.” But here’s what it actually does—and why it matters.

✅ The Good News (at first glance):

HB 30 says that after a natural disaster, local governments can’t raise your property taxes above a certain threshold unless they follow a stricter formula or get voter approval. Sounds fair, right? Nobody wants to be hit with higher taxes when they’re still picking up the pieces.

❗But here’s what got buried in the fine print:

Local control gets stripped.

Before, cities and counties could raise tax rates temporarily after a disaster to fund emergency response—without jumping through election red tape. HB 30 removes that tool and ties local hands, even when FEMA delays payments for months or years.

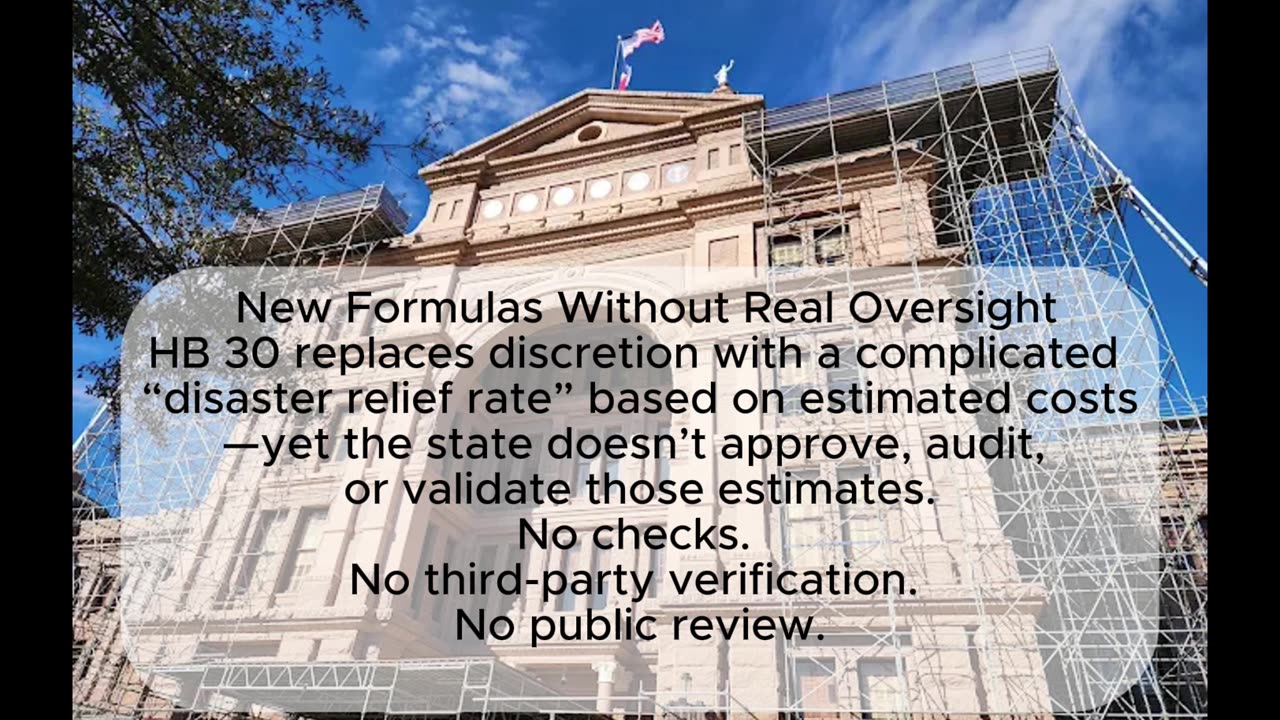

New ""disaster relief rate"" lets some places still raise taxes—but only with a complicated formula and cost estimate.

If your city gets hit, they now have to calculate their disaster-related costs like the federal government would, submit them to the state, and hope it qualifies. No fast action. No guaranteed approval. No oversight of those estimates.

No safeguards, no audits.

The bill requires cities to submit their numbers to the Texas Division of Emergency Management—but doesn’t require anyone to check if those numbers are fair or inflated. Bigger counties with consultants might game the system. Smaller ones? Out of luck.

Quiet carve-outs.

The original version included school districts. The final version doesn’t. That means these new rules only apply to cities and counties—not schools. Why the uneven playing field?

It sounds like accountability. But it’s actually central control.

HB 30 takes away emergency taxing options from your local leaders and pushes everything up to the state—without giving the state real responsibility to review or help.

💬 What this means for you:

If your town floods, burns, or freezes and needs to clear debris, fix roads, or reopen clinics—it won’t be able to raise the funds fast unless it plays by these new rules. That could mean slower recovery, longer waits, and more dependence on state politics.

Who pushed for this bill?

Anti-tax groups like Texas Public Policy Foundation and Americans for Prosperity. They don’t want property taxes going up—no matter what. Cities and counties across Texas opposed the bill because it limits their ability to protect you in a crisis.

Bottom line:

This bill talks about “protecting taxpayers.” But it really protects big property owners from temporary tax hikes—and makes it harder for communities to bounce back from disaster.

Watch what they pass. Not just what they promise."

-

22:13

22:13

iCkEdMeL

2 hours ago $2.80 earnedMass Shooting at Wedding Reception — Witnesses Say Shooter Yelled “Free Palestine”

19.6K13 -

0:36

0:36

Danny Rayes

2 days ago $1.58 earnedFacebook Needs To Be Stopped...

16.4K6 -

LIVE

LIVE

Total Horse Channel

17 hours agoAMHA World Show 2025 9/21

783 watching -

1:29:02

1:29:02

Game On!

1 day ago $6.80 earnedTHEY'RE BACK! NFL Wise Guys Return For Week 3 BEST BETS!

39.8K4 -

6:16

6:16

China Uncensored

3 hours agoHow Trump Plans on Stopping Russia and China—Without Firing a Shot!

65.7K31 -

33:13

33:13

Ohio State Football and Recruiting at Buckeye Huddle

15 hours agoOhio State Football: 10 Things We Learned Watching Washington's Win over Colorado State

36K -

1:14:04

1:14:04

NAG Entertainment

16 hours agoKickback w/ Leon - Rocket League: Road to GC

32.9K -

30:13

30:13

Degenerate Plays

3 hours ago $0.44 earnedBritish Insults Are Hilarious - Call of Duty: Modern Warfare 2 (2009) : Part 2

18.5K2 -

6:42

6:42

NAG Daily

20 hours agoCharlie Kirk: His Words. His Vision. His Movement.

41.6K26 -

21:42

21:42

Jasmin Laine

21 hours ago“Kimmel Isn’t a Victim, Charlie Kirk Was”—Gutfeld OBLITERATES Liberal Media Over FAKE Outrage

39.5K34