Premium Only Content

"TEXAS HB 9 – The Corporate Tax Break That’s Coming for Your Community

HB 9 was signed into law to give businesses a bigger tax exemption on the equipment and inventory they own. On the surface, it sounds like “relief for small businesses.” But the fine print reveals something much deeper—and much more dangerous.

🔍 What it does:

HB 9 raises the exemption on business property taxes from $2,500 to $125,000 per location. That means if a corporation has 30 stores in Texas, they can wipe $3.75 million off their taxable property—every single year.

It also lets businesses skip filing their property taxes entirely if they simply “believe” they’re under the limit. No proof required. No automatic checks.

📜 Here’s what makes it worse:

Self-Reporting Is Optional – Businesses don’t have to report anything unless they feel like their property might be over the threshold. That opens the door to massive underreporting and cheating.

Local Governments Are Forced to Play Along – Even though this bill depends on a November 2025 constitutional amendment, cities, counties, and school districts are legally required to act as if it’s already passed. If voters reject it, they’re stuck cleaning up the chaos.

State-Mandated Messaging on Tax Bills – Your local tax bill will now include a message written by the Legislature saying “look what we saved you,” even if the bill harms your local schools and services.

Short-Term Relief, Long-Term Pain – The state will temporarily cover school losses through 2026. After that, the bill leaves a hole in local budgets that could reach over $600 million per year.

🎯 Who wins?

Chain retailers

Oil & gas companies

Real estate developers

Telecom giants

Big-box franchises with multiple locations

All of these groups showed up in support of HB 9. They’re the ones positioned to gain the most from the exemptions and the lack of enforcement.

📉 Who loses?

Public schools

Local governments

Small towns with tight budgets

Homeowners and renters who will have to pick up the slack when local tax bases collapse

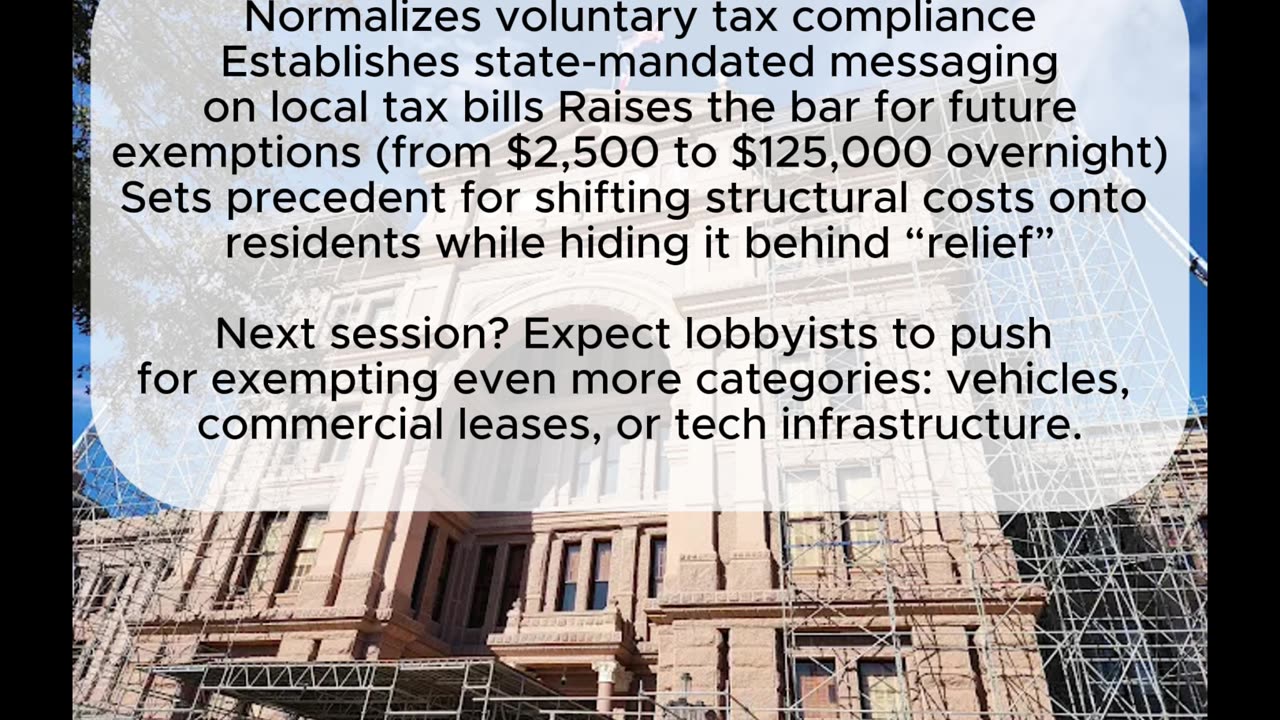

🛑 This isn’t just a tax cut. It’s a structural power shift.

HB 9 takes control away from local elected officials and gives it to the Legislature and business lobbyists. It rewrites the rules for who pays taxes in Texas—and who doesn’t.

And once it’s in place, it’ll be nearly impossible to undo.

Bottom line:

This bill was sold as “helping small businesses,” but it’s really about normalizing large-scale corporate tax avoidance and weakening the financial backbone of your local community.

We need to call it what it is: a quiet transfer of public responsibility into private hands.

Watch the November 2025 amendment vote closely. HB 9 depends on it.

Let’s keep the pressure on. Share this if you believe Texans deserve honest, accountable laws—not backdoor carveouts that help the powerful dodge their fair share.

#TexasLegislature #HB9 #LocalControl #TaxJustice #PublicSchoolsMatter #StopTheShift"

-

0:36

0:36

Danny Rayes

2 days ago $1.58 earnedFacebook Needs To Be Stopped...

16.4K6 -

LIVE

LIVE

Total Horse Channel

17 hours agoAMHA World Show 2025 9/21

783 watching -

1:29:02

1:29:02

Game On!

1 day ago $6.80 earnedTHEY'RE BACK! NFL Wise Guys Return For Week 3 BEST BETS!

39.8K4 -

6:16

6:16

China Uncensored

3 hours agoHow Trump Plans on Stopping Russia and China—Without Firing a Shot!

65.7K31 -

33:13

33:13

Ohio State Football and Recruiting at Buckeye Huddle

15 hours agoOhio State Football: 10 Things We Learned Watching Washington's Win over Colorado State

36K -

1:14:04

1:14:04

NAG Entertainment

16 hours agoKickback w/ Leon - Rocket League: Road to GC

32.9K -

30:13

30:13

Degenerate Plays

3 hours ago $0.44 earnedBritish Insults Are Hilarious - Call of Duty: Modern Warfare 2 (2009) : Part 2

18.5K2 -

6:42

6:42

NAG Daily

20 hours agoCharlie Kirk: His Words. His Vision. His Movement.

41.6K26 -

21:42

21:42

Jasmin Laine

21 hours ago“Kimmel Isn’t a Victim, Charlie Kirk Was”—Gutfeld OBLITERATES Liberal Media Over FAKE Outrage

39.5K34 -

33:59

33:59

ComedyDynamics

23 days agoBest of Jim Breuer: Let's Clear the Air

84.4K20