Premium Only Content

Trump: Nancy Pelosi should be investigated

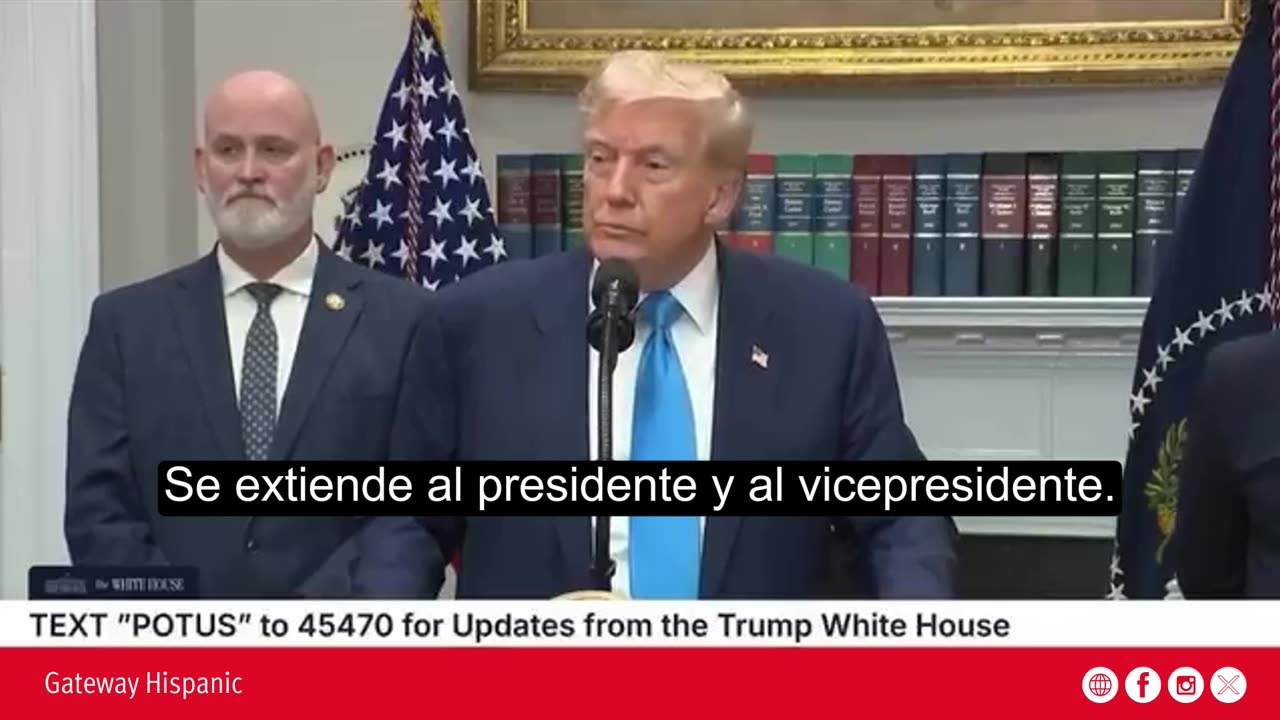

Calls to investigate former Speaker of the House Nancy Pelosi have intensified following renewed scrutiny of her stock trading activities while holding public office. Critics, including President Donald Trump and Senator Josh Hawley, claim that Pelosi and her husband significantly benefited from insider knowledge about upcoming legislation, giving them a financial edge that many consider unethical—if not outright illegal.

Trump has openly called for Pelosi to be investigated, stating that she achieved “one of the greatest returns in Wall Street history,” allegedly by purchasing stocks just before key government announcements that caused prices to rise. “She should be investigated,” Trump asserted, accusing her of knowing “exactly what’s going to happen” and using that information to enrich herself. “It’s a disgrace,” he added.

These accusations have gained traction with Senator Hawley’s introduction of a bill, originally known as the PELOSI Act and later reintroduced as the HONEST Act. This legislation would prohibit members of Congress—as well as the president and vice president—from owning or trading individual stocks. The bill was initially named in reference to Pelosi due to widespread criticism of her trading activities while serving as Speaker. Although Pelosi has repeatedly denied any wrongdoing, public records show that her husband, Paul Pelosi, executed numerous trades in companies directly impacted by congressional decisions, particularly in the tech sector.

While no formal investigation into Pelosi has begun, growing bipartisan concern over potential financial conflicts of interest in Congress has put significant pressure on lawmakers. Various watchdog groups and public opinion polls reflect broad support for stricter regulations—or even an outright ban—on stock trading by elected officials. The 2012 STOCK Act, which requires members of Congress to disclose their stock trades, has proven inadequate according to critics, as it does not prohibit the activity itself and has been weakly enforced.

Hawley argues that Pelosi’s conduct illustrates a broader systemic problem and believes banning lawmakers from trading stocks is essential to restoring public trust. “The American people deserve to know that their representatives are working for them, not for their own financial portfolios,” he stated.

Although Pelosi has not been formally accused of any crime, political pressure to investigate her for potential insider trading continues to mount. The debate is likely to intensify in the coming months, especially as the HONEST Act progresses through Congress and Trump and his allies keep the spotlight on Pelosi’s financial history.

-

0:52

0:52

Gateway Hispanic

1 day agoJeffrey Carroll on National Guard Attack in DC

10 -

LIVE

LIVE

Price of Reason

8 hours agoThanksgiving Special - Is Stranger Things 5 any good and other SURPRISES!

5,943 watching -

14:14

14:14

Robbi On The Record

3 hours agoThe Identity Crisis No One Wants to Admit | Identity VS. Personality

1041 -

31:10

31:10

The Why Files

3 days agoThe First Earth Battalion: America's Strangest Military Experiment

40.3K26 -

4:18:02

4:18:02

SpartakusLIVE

4 hours ago#1 Pilgrim of PAIN Gives Thanks HAPPILY as he DESTROYS Enemies and BAGS LOOT

157K6 -

59:47

59:47

iCkEdMeL

5 hours ago $26.81 earnedBREAKING: National Guard Soldier Dies + New Video Shows Suspect Opening Fire

18.1K29 -

1:20:38

1:20:38

Flyover Conservatives

23 hours agoThanksgiving’s Hidden History: Islamic Pirates, Spanish Threats, and Socialism - Bill Federer | FOC Show

26.6K3 -

25:43

25:43

Russell Brand

1 day agoThis Is Getting Out Of Hand

119K112 -

LIVE

LIVE

The Quartering

13 hours agoThanksgiving Day Yule Log!

1,784 watching -

15:32

15:32

IsaacButterfield

20 hours ago $2.29 earnedAussie Reacts To UNHINGED Woke TikToks!

14.7K11