Premium Only Content

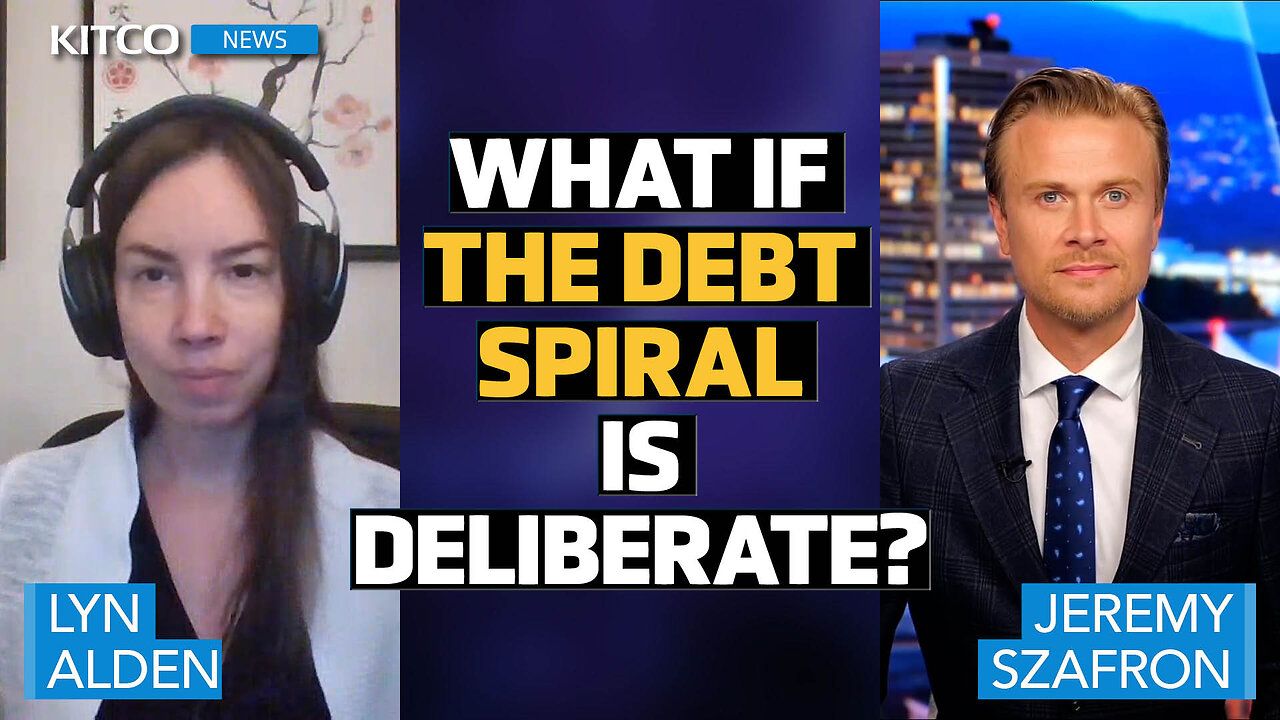

Fed Trapped in Engineered Crisis as Tariffs Fuel Breakdown Warns Lyn Alden

America’s debt spiral is no accident—it’s fiscal dominance by design. With deficits topping 7% of GDP and interest costs eclipsing tax revenue, Lyn Alden joins Kitco News to explain why the U.S. is trapped in a self-made monetary breakdown. In this hard-hitting interview with Jeremy Szafron, Alden breaks down why tariffs could speed up the collapse, how Bitcoin’s surge past $120K signals capital flight, and why gold’s $3,300 level is more than just a technical milestone.

Alden also unpacks the real threat behind stealth CBDCs in new crypto legislation, the role of stablecoins like Tether in funding U.S. liabilities, and why traditional bond markets may never recover. If you're an investor looking to survive what comes next, this is essential viewing.

Follow Jeremy Szafron on X: @JeremySzafron (https://x.com/JeremySzafron)

Follow Kitco News on X: @KitcoNewsNOW (https://x.com/KitcoNewsNOW)

Follow Lyn Alden on X: @LynAldenContact (https://x.com/LynAldenContact)

00:00 Introduction

01:08 Fiscal Dominance and Economic Shifts

03:06 Inflation and Tariff Impacts

06:48 Federal Reserve and Interest Rates

11:33 Investment Strategies in a Changing Market

13:45 Bitcoin vs. Gold: A Comparative Analysis

18:10 Stablecoins and Global Market Implications

19:55 Stablecoins and Dollar Dominance

22:28 Legislation and Regulatory Challenges

25:23 Bitcoin's Role in Financial Privacy

28:23 Custodial Concentration and Market Risks

30:15 Corporate Treasury and Crypto Adoption

32:03 Gold vs. Bitcoin: Investment Strategies

35:21 Macro Trends and Fiscal Deficits

37:56 Conclusion

#LynAlden #Bitcoin #Gold #Stablecoins #CBDC #Inflation #DebtCrisis #FiscalDominance #KitcoNews #CryptoRegulation #Tether #InterestRates #PortfolioStrategy #MonetaryPolicy #Tariffs #M2Liquidity

__________________________________________________________________

Like, share, and subscribe to Kitco News—and turn on alerts to stay current with expert interviews, market insights, and breaking news coverage.

FOLLOW US:

X: https://x.com/kitconewsnow

Instagram: https://www.instagram.com/kitconews

Facebook: https://www.facebook.com/KitcoNews

LinkedIn: https://www.linkedin.com/company/kitconews

Visit: https://Kitco.com/ for live gold, silver, and crypto prices, the latest mining news, and macroeconomic insights.

Live gold price and chart: https://www.kitco.com/charts/gold

Live silver price and chart: https://www.kitco.com/charts/silver

Live crypto market data: https://www.kitco.com/price/crypto

Learn more about Kitco News: https://www.kitco.com/news/about/

For more information on advertising, sponsorship and marketing promotions – please visit our online media kit at: https://www.kitco.com/advertising

Disclaimer:

The videos are not intended to provide trading advice, and the views expressed do not necessarily reflect those of Kitco Metals Inc. Kitco News, its anchors, producers, and reporters are not responsible in any way for the performance or actions of any sponsor, advertiser or affiliate of Kitco News. In no event will Kitco and its employees be held liable for any indirect, special, incidental, or consequential damages arising out of the use of the content in this video.

-

34:23

34:23

Kitco NEWS

22 days agoEconomist E.J. Antoni Says The American Consumer Is Officially Out of Money

4532 -

19:53

19:53

MetatronHistory

20 hours agoRome VS Greece - Ultimate Clash of Civilizations Explained

49.6K14 -

LIVE

LIVE

The Big Mig™

6 hours agoThe Big Mig Show's Greatest Hits w/ Americas Future, Karmageddon, Operation Gideon,..

179 watching -

1:32:33

1:32:33

VapinGamers

5 hours ago $6.08 earnedTools of the Trade - EP12 The Art of Story Telling with MidnightinTheMountains - !rumbot !music

34.9K4 -

3:09:50

3:09:50

SOLTEKGG

5 hours ago🔴LIVE - Battlefield 6 - Going Pro in RED SEC

33.5K2 -

5:19:03

5:19:03

Midnight In The Mountains™

6 hours agoThe Midnights Play Arc Raiders | Loot Scoot and KILL | Crypto Wallet up n running GO JOIN THE BETA!

26.1K4 -

53:25

53:25

X22 Report

8 hours agoMr & Mrs X - Trump Is Using The Same Tactic As Our Founding Fathers To Rebuild America - EP 17

102K37 -

3:15:31

3:15:31

PudgeTV

5 hours ago🟣 Arc Raiders - Gaming on Rumble | Going Topside w My Daughter’s Husband

18.9K2 -

2:05:43

2:05:43

LFA TV

1 day agoRUMBLE RUNDOWN WEEK 7 with SHAWN FARASH 11.22.25 9AM

152K15 -

3:23:01

3:23:01

ttvglamourx

5 hours ago $1.84 earnedGLAMOURX VS CALL OF DUTY LOBBIES !DISCORD

21.5K4