Premium Only Content

1. Continuous Penetration of Traditional Capital and Macro Allocation The global fiat currency and bond markets are enormous, with Bitcoin accounting for less than 1%. However, traditional financial institutions' BTC holdings are steadily increasing. Large-scale institutional purchases and use cases such as Dubai real estate indicate that long-term capital continues to lay out in BTC. 2. Disputes Intensify Over Bull Market Ultimate End and New Highs There is a clear divergence in discussions about the end of the bull market and new highs. On one side, bears are wary of liquidity withdrawal, while on the other, bulls are betting on new highs in this cycle. Overall sentiment is mixed but bullish forces prevail. 3. Mining Company Rating Differentiation Reflects Cost and Efficiency Games JPMorgan has upgraded the ratings of efficient mining companies and downgraded those with higher costs, highlighting profit differentiation and hash rate concentration in the mining industry, resulting in a layered impact across the sector. 4. Fluctuation Range and Trading Opportunities In the short term, the fluctuation range is between MA30 and $120,000, with clear support and resistance. Technical indicators show bullish signals and a double-bottom pattern, providing entry points for buying on dips. However, be cautious about trading volume spikes and the risk of corrections.

-

LIVE

LIVE

LFA TV

15 hours agoLIVE & BREAKING NEWS! | THURSDAY 10/30/25

4,028 watching -

1:01:50

1:01:50

VINCE

3 hours agoThe Rabbit Hole Goes MUCH Deeper Than Anyone Thought | Episode 158 - 10/30/25

145K78 -

1:04:23

1:04:23

Benny Johnson

2 hours agoBehind the Scenes With JD Vance on Air Force 2 | VP Gives FLAMETHROWER Speech as Stadium Crowds ROAR

17.6K9 -

LIVE

LIVE

Athlete & Artist Show

17 hours agoBombastic Bets & Games w/ Canadian World Champion!

33 watching -

LIVE

LIVE

The Mel K Show

1 hour agoMORNINGS WITH MEL K - Reversal of Fortune for Lawfare Operatives & Their Benefactors - 10-30-25

625 watching -

LIVE

LIVE

The Shannon Joy Show

1 hour agoConservative CRACK UP Over Nick Fuentes, Tucker Carlson & Candace Owens * TACO Trump’s China Deal * SNAP Riots & America’s Gold Plated Economy LIVE With Bonk DaCarnivore!

212 watching -

LIVE

LIVE

Grant Stinchfield

23 hours agoColleges Cash In While Taxpayers Get Robbed

67 watching -

1:36:10

1:36:10

Graham Allen

4 hours agoBiden Admin EXPOSED For Spying On Senators!! + Erika Kirk/JD Vance Take Over Ole Miss!

97.3K47 -

2:17:22

2:17:22

LadyDesireeMusic

2 hours ago $0.08 earnedLive Piano & Convo

18.5K3 -

1:07:17

1:07:17

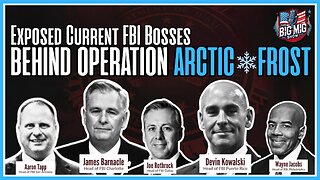

The Big Mig™

3 hours agoExposed, Current FBI Bosses Behind Operation Arctic Frost

1.64K12