Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

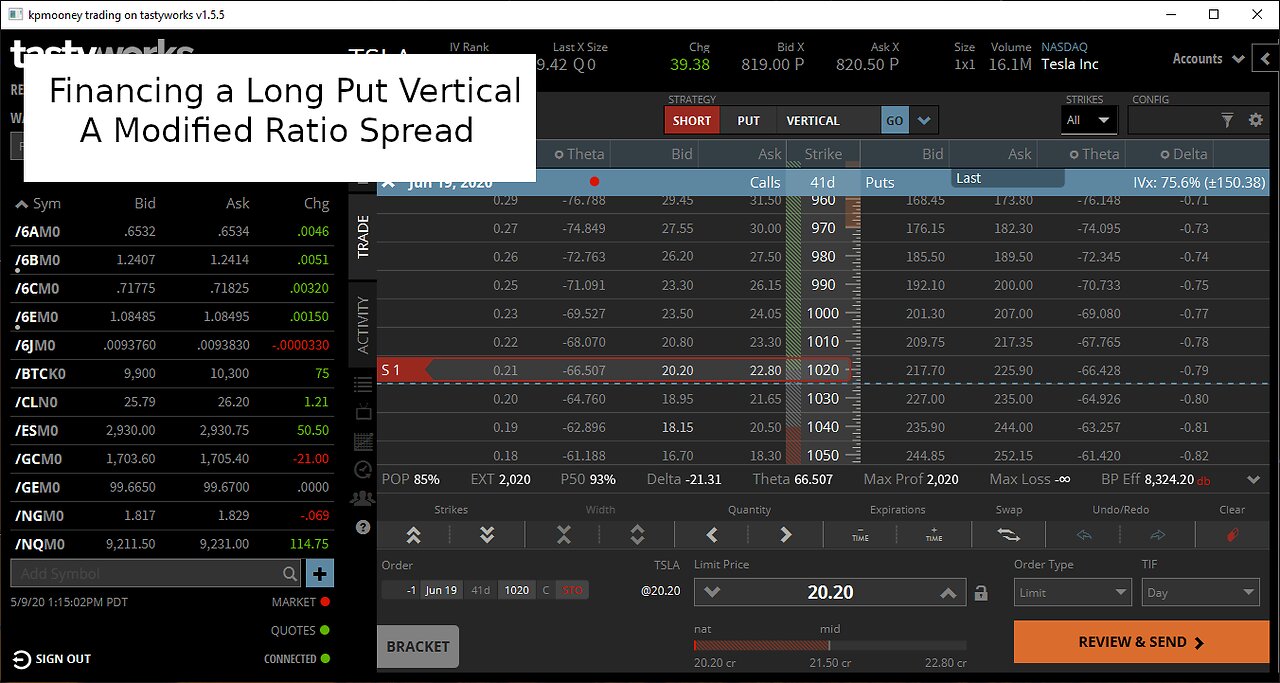

Financing a Log Put Spread: A Modified Ratio Spread

1 month ago

12

In this video, we look at financing the purchase of a long put vertical for a bearish market plat. This is done by selling a short put whose credit is big enough to pay for the long spread. This trade does have downside risk on account of the short put, but our beak-even point is significantly lower than our naked short strike. This trade has no risk to the upside. In fact, we make a small credit if the market rallies. Traded on 07/23/2025.

Tipjar: https://paypal.me/kpmooney

Loading 2 comments...

-

2:42:52

2:42:52

TimcastIRL

5 hours agoTrump To Deploy National Guard To Chicago, Baltimore, Democrats Call To Resist | Timcast IRL

202K55 -

3:22:30

3:22:30

Laura Loomer

6 hours agoEP141: Muslims Call For Political Assassinations At Michigan Palestinian Conference

31.6K24 -

4:39:32

4:39:32

Barry Cunningham

7 hours agoBREAKING NEWS: PRESIDENT TRUMP IS GOING TO TAKE CHICAGO! LFG!!! (IT'S MOVIE NIGHT!)

79.8K55 -

1:23:59

1:23:59

Man in America

9 hours agoTrump Demands Big Pharma Come Clean on Covid Shots w/ Dr. David Martin

34K27 -

1:40:27

1:40:27

megimu32

4 hours agoOTS: Labor Day Sitcom Blowout - Tim, Ray, & Relatable Chaos!

30K4 -

4:09:30

4:09:30

StevieTLIVE

5 hours agoWarzone Wins w/ FL Mullet Man

24.5K1 -

1:04:01

1:04:01

BonginoReport

8 hours agoLefties Wish Death on Trump but He’s BACK! - Nightly Scroll w/ Hayley Caronia (Ep.125)

183K83 -

3:18:28

3:18:28

Tundra Tactical

5 hours ago $0.51 earnedWe Survived the Military… But Not This Basement

27.8K -

20:12

20:12

Clownfish TV

13 hours agoDisney Needs MEN Back?! They ADMIT Star Wars and Marvel are DEAD!

23.7K37 -

1:37:00

1:37:00

Anthony Rogers

12 hours agoEpisode 381 - Tim Kelleher

15.9K1