Premium Only Content

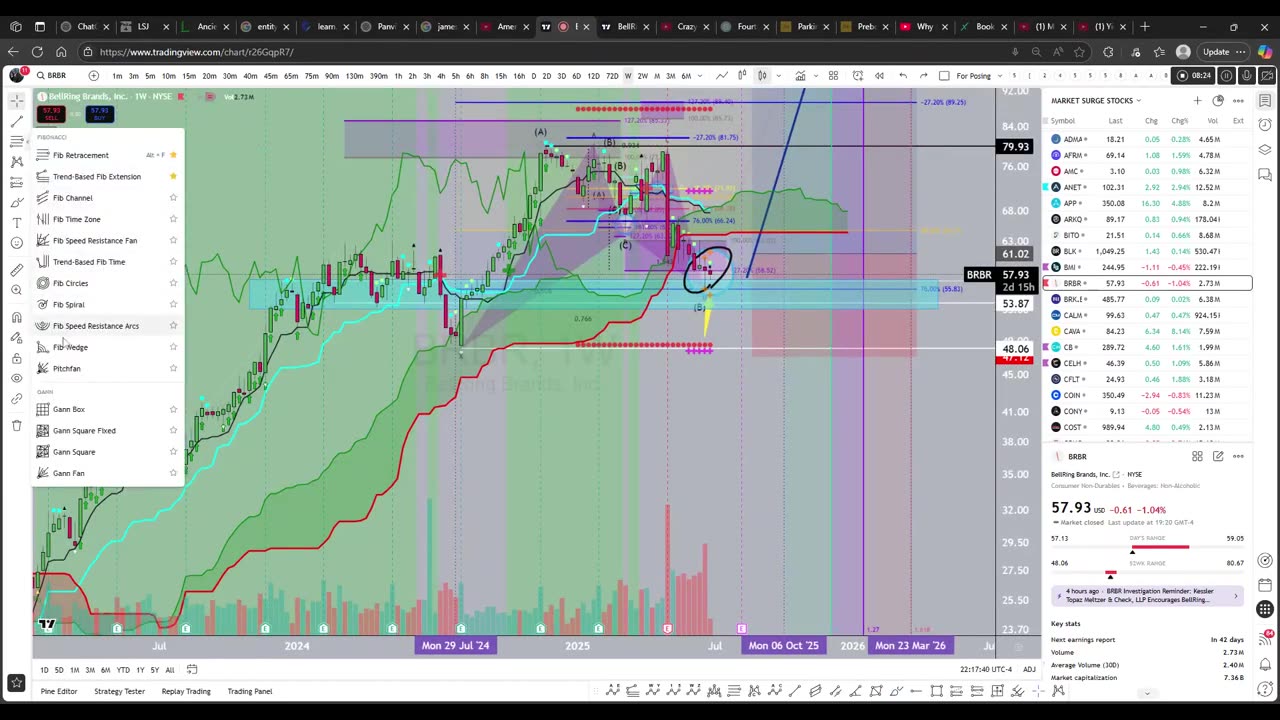

BellRing Brands (BRBR) - Gartley Pattern + Kijun Confluence

BellRing Brands (BRBR) Stock Analysis (video version):

In March 2025, I previously took a look at this budding public company BellRing Brands, Inc. for a long-term investment horizon. It was priced around 74 at the time, then the fall of the overall market status put additional pressure on its stock, although the company itself is booming and meets my fundamental parameters.

Since then, we had an awesome and confident forward guidance from the company in the last earnings call in May 2025: bellring.com/news/bellring-brands-reports-results-second-quarter-2025-affirms.

Now, looking at BellRing Brands (BRBR) once again, on a weekly chart, key technical patterns have formed that look very promising and solid with its many confluences.

TECHNICALS:

WEEKLY:

Many weekly confluences have appeared from a technical perspective. Here is what I see:

(1) There is a clear Bullish Gartley-ish pattern in a weekly retracement to 50% followed by a retracement to 78.6% of a preceding move.

(2) The price is around 78% fib support.

(3) Horizontal area of support: The 50 - 58 area is a whole prior area of horizontal support that was a prior resistance area back in July 2024, and the price has landed back on that area. You know what we say as technicians and investors: past resistance = future support.

(4) MACD Hidden Bullish Divergence (weekly)

(5) The price tested the weekly cloud and broke through; however, bullish extremes were triggered when that happen, which is rare based on all my personal studies. In fact, the current level 55-58 marks the end of a bearish double top cycle that began around March 2025.

(6) A weekly Doji with volume support (classified as a "dVa" in my old notes of Volume Price Analysis).

MONTHY:

BRBR is poised to rally Q3 and Q4 2025.

We have a potential monthly bounce of the kijun forthcoming along with good fundamentals going forward supporting the growth of the company in the long term.

** potential monthly Kijun Trend Bounce **

Target:

Currently, the price is 58.54. My tentative target is around 140 by March 2026.

Thus, with all the fundamental support, good forward-looking guidance, and the technical I believe that BellRing Brands (BRBR) is at a great price right now. It is prime to continue its stretch of growth for 2025. Looking forward with investor foresight, the case for BellRing Brands and its stock (BRBR) is not only a high-probability outlook of positivity, but a high odds outcome of technical price pattern success. What a great discount.... :)

-

14:38

14:38

Nikko Ortiz

20 hours agoADHD vs Autism

62.2K42 -

LIVE

LIVE

TonYGaMinG

1 hour ago🟢 INDUSTRIA 2 PLAYTEST / ACTIVE MATTER LATER

48 watching -

LIVE

LIVE

FoeDubb

1 hour ago🏰KINGDOM MENU: 🎮SHORT SATURDAY SESH ON DECK DILLY DILLY!!

69 watching -

LIVE

LIVE

GlizzyPrinceChristian

1 hour agoCOD SATURDAYS DIGGY DIGGY DIGGY| We Testing Out This Beta

28 watching -

LIVE

LIVE

MrR4ger

4 hours agoSCARETOBER DAY 4 - AMNESIA: THE BUNKER - ACTIVE MATTER WITH GUMO AN TONY #PARTNERED STREAM

27 watching -

LIVE

LIVE

FyrBorne

14 hours ago🔴Warzone/Black Ops 7 M&K Sniping: From the Zone to Zombs

202 watching -

LIVE

LIVE

blackfox87

4 hours ago🟢 SUBATHON DAY 3 | Premium Creator | #DisabledVeteran

76 watching -

4:12:25

4:12:25

EXPBLESS

4 hours agoArena Breakout (This Game Is Hard But Fun) How Much Can We Make Today? #RumbleGaming

24.3K6 -

4:40

4:40

GritsGG

19 hours agoTwo Easter Eggs on Call of Duty Warzone!

51.2K4 -

2:08:19

2:08:19

Side Scrollers Podcast

1 day agoNetflix Execs to TESTIFY Over LGBTQ Agenda + IGN DESTROYS Xbox Game Pass + More | Side Scrollers

88.8K26