Premium Only Content

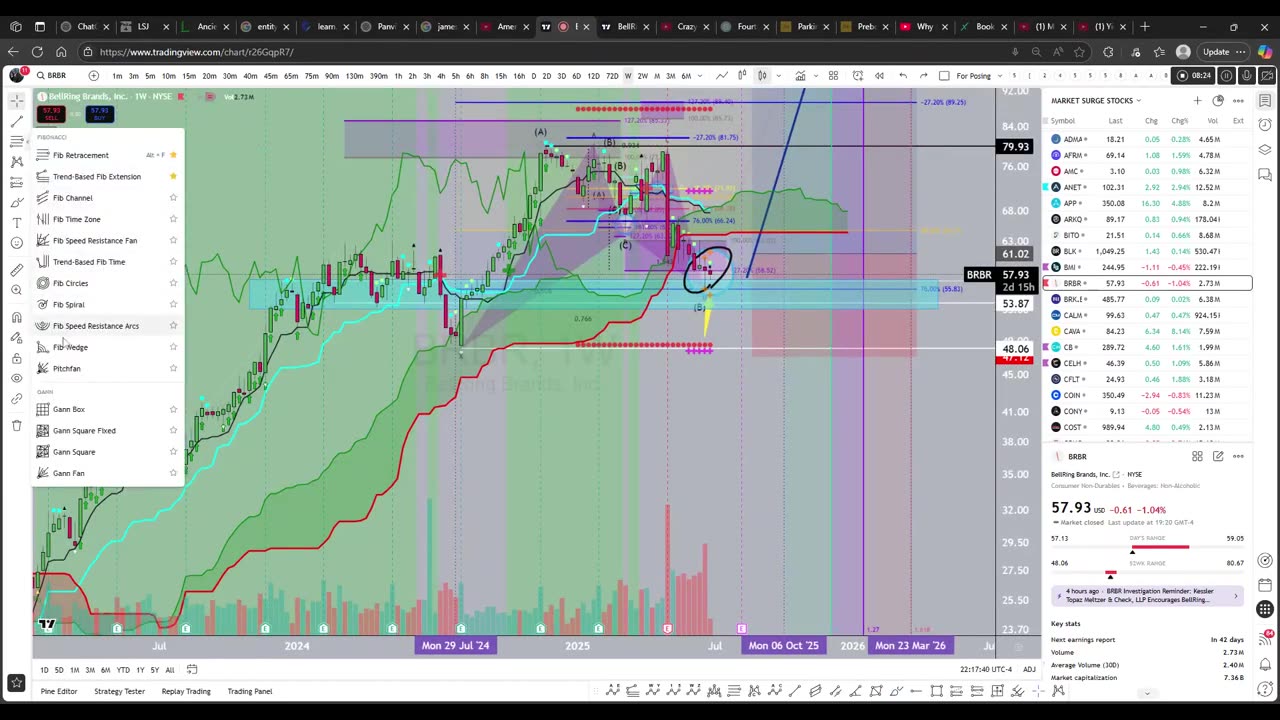

BellRing Brands (BRBR) - Gartley Pattern + Kijun Confluence

BellRing Brands (BRBR) Stock Analysis (video version):

In March 2025, I previously took a look at this budding public company BellRing Brands, Inc. for a long-term investment horizon. It was priced around 74 at the time, then the fall of the overall market status put additional pressure on its stock, although the company itself is booming and meets my fundamental parameters.

Since then, we had an awesome and confident forward guidance from the company in the last earnings call in May 2025: bellring.com/news/bellring-brands-reports-results-second-quarter-2025-affirms.

Now, looking at BellRing Brands (BRBR) once again, on a weekly chart, key technical patterns have formed that look very promising and solid with its many confluences.

TECHNICALS:

WEEKLY:

Many weekly confluences have appeared from a technical perspective. Here is what I see:

(1) There is a clear Bullish Gartley-ish pattern in a weekly retracement to 50% followed by a retracement to 78.6% of a preceding move.

(2) The price is around 78% fib support.

(3) Horizontal area of support: The 50 - 58 area is a whole prior area of horizontal support that was a prior resistance area back in July 2024, and the price has landed back on that area. You know what we say as technicians and investors: past resistance = future support.

(4) MACD Hidden Bullish Divergence (weekly)

(5) The price tested the weekly cloud and broke through; however, bullish extremes were triggered when that happen, which is rare based on all my personal studies. In fact, the current level 55-58 marks the end of a bearish double top cycle that began around March 2025.

(6) A weekly Doji with volume support (classified as a "dVa" in my old notes of Volume Price Analysis).

MONTHY:

BRBR is poised to rally Q3 and Q4 2025.

We have a potential monthly bounce of the kijun forthcoming along with good fundamentals going forward supporting the growth of the company in the long term.

** potential monthly Kijun Trend Bounce **

Target:

Currently, the price is 58.54. My tentative target is around 140 by March 2026.

Thus, with all the fundamental support, good forward-looking guidance, and the technical I believe that BellRing Brands (BRBR) is at a great price right now. It is prime to continue its stretch of growth for 2025. Looking forward with investor foresight, the case for BellRing Brands and its stock (BRBR) is not only a high-probability outlook of positivity, but a high odds outcome of technical price pattern success. What a great discount.... :)

-

54:36

54:36

MattMorseTV

2 hours ago $11.59 earned🔴The Democrats just SEALED their FATE.🔴

16.1K27 -

8:07:01

8:07:01

Dr Disrespect

10 hours ago🔴LIVE - DR DISRESPECT - ARC RAIDERS - SOLO RAIDING THE GALAXY

92K11 -

1:32:00

1:32:00

Kim Iversen

5 hours agoThe World’s Most “Moral” Army — Kills 40 Kids During "Ceasefire" | Socialism's Coming: The Zohran Mamdani Agenda

62.6K106 -

1:04:50

1:04:50

TheCrucible

4 hours agoThe Extravaganza! EP: 63 with Guest Co-Host: Rob Noerr (10/30/25)

59.5K5 -

LIVE

LIVE

GritsGG

4 hours agoQuads! #1 Most Wins 3880+!

96 watching -

2:51:31

2:51:31

Spartan

4 hours agoFirst playthrough of First Berserker Khazan

11.9K -

5:48:29

5:48:29

The Rabble Wrangler

18 hours agoBattlefield 6 - RedSec with The Best in the West

17.3K -

37:53

37:53

Donald Trump Jr.

5 hours agoAmerican Dominance vs Dems' Delusion | TRIGGERED Ep.287

35.7K58 -

1:14:57

1:14:57

The White House

7 hours agoPresident Trump and the First Lady Participate in Halloween at The White House

32.8K19 -

1:05:02

1:05:02

Candace Show Podcast

4 hours agoBREAKING NEWS! The Egyptian Military Was In Provo On 9/10. | Candace Ep 255

64.1K186