Premium Only Content

Impact of Tariffs Was Overestimated

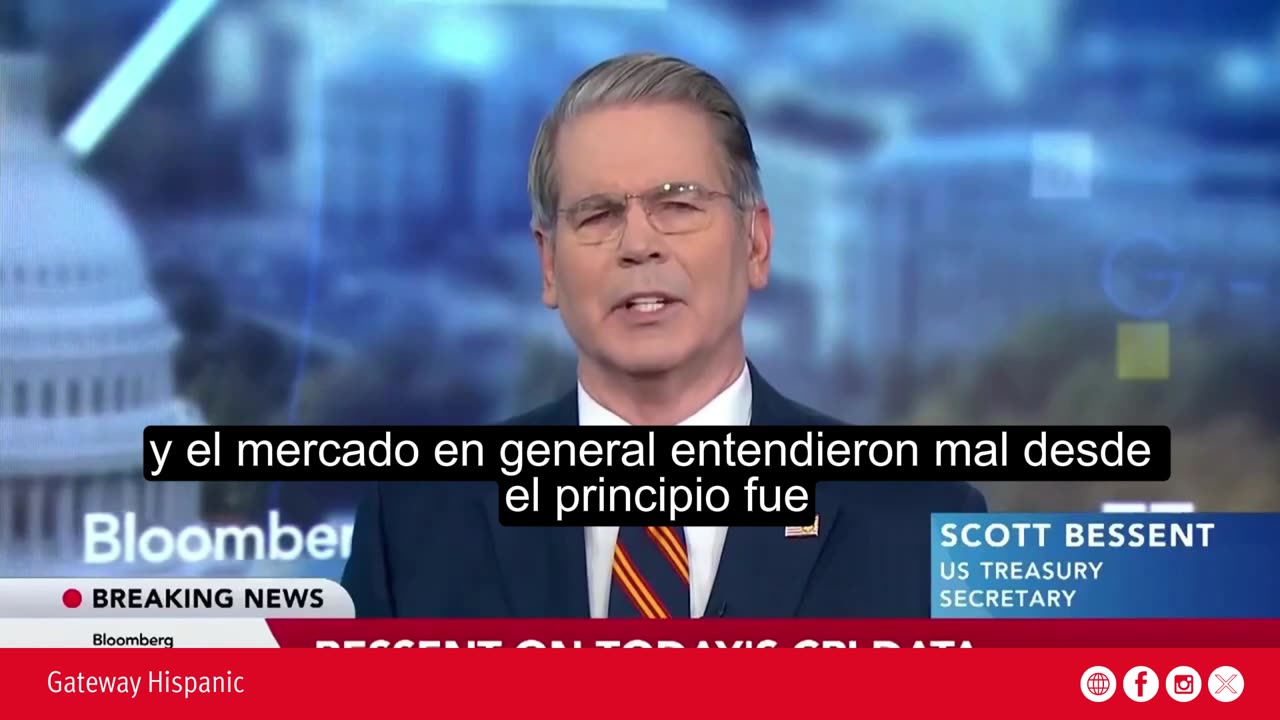

Scott Bessent: But I wouldn't put too much emphasis on a single number. I think it's the trend, and I think something that Wall Street, many economists, and the market in general misunderstood from the beginning was that the tariffs were going to cause a substantial increase in prices — which simply hasn't happened.

Scott Bessent, a key economic advisor in the Trump administration, has pointed out that too much emphasis should not be placed on a single economic figure, such as a monthly reading of the Consumer Price Index (CPI), but rather on the overall trend. According to Bessent, many economists, Wall Street analysts, and financial media have misunderstood the impact of tariffs by assuming they would cause a substantial increase in consumer prices, which simply has not happened.

The most recent data supports his view. In June 2025, core inflation rose by just 0.3%, a figure lower than expected, reinforcing the idea that tariffs are not fueling an inflationary spiral. Bessent has indicated that part of the misdiagnosis stems from the assumption that American consumers would directly bear the cost of the tariffs, when in reality many exporters, such as China, are absorbing part of those costs.

In this context, the stock market has remained strong. Major U.S. banks exceeded expectations in their quarterly earnings, and both the S&P 500 and Nasdaq reached record highs. This suggests that investors do not share concerns that tariffs are damaging the economy in the short term. However, bond markets indicate some unease: long-term interest rates reflect expectations of a slowdown, which could open the door for future rate cuts by the Federal Reserve.

Bessent argues that tariffs are part of a broader strategy that includes tax cuts, deregulation, and incentives for domestic investment. According to his estimates, these measures could boost economic growth at a rate of 3% annually and generate additional tax revenues that would allow for a reduction of the deficit by around $300 billion per year. Moreover, the use of tariffs as a tool of leverage in bilateral negotiations has been central to President Trump’s foreign economic policy agenda, having been used with countries such as China, Brazil, Canada, and Mexico.

Finally, Bessent has been mentioned as a possible successor to Jerome Powell at the helm of the Federal Reserve, although no official decision has been made. His close relationship with Trump and his views on monetary policy—more aligned with the need to keep interest rates low to stimulate growth—position him as a key figure in shaping U.S. economic policy in the coming years. In summary, Bessent argues that the tariff policy has not caused the expected inflation and is part of a more ambitious strategy to strengthen U.S. industrial competitiveness and ease the tax burden on the middle class.

-

1:15

1:15

Gateway Hispanic

21 hours agoPope Leo XIV calls for dignified treatment of immigrants

33 -

LIVE

LIVE

AP4Liberty

10 hours agoTrump–Musk Alliance 2.0: What Their Sudden Reconciliation Means for America’s Future

402 watching -

22:20

22:20

World2Briggs

17 hours ago $0.12 earnedEveryone Is Leaving These 15 States. Truth Behind the Trend.

22.1K7 -

4:24

4:24

Gamazda

18 hours ago $1.65 earnedDeep Purple – Smoke On the Water (Live Piano Cover in a Church)

12.9K13 -

12:54

12:54

Brad Owen Poker

13 hours agoI Make Final Table! I’m Going To $10,400 WPT World Championship!!

10.8K1 -

10:00

10:00

TheMightyMcClures

22 days agoWe Fed 500 Families!

12.3K4 -

6:23

6:23

The Shannon Joy Show

13 hours agoWas Covid a MILITARY OPERATION?

11.9K4 -

LIVE

LIVE

The Bubba Army

22 hours agoTRUMP SIGNS EPSTEIN BILL! - Bubba the Love Sponge® Show | 11/20/25

1,902 watching -

27:24

27:24

DeVory Darkins

21 hours agoTrump secures RECORD BREAKING INVESTMENT as Charlotte Schools issue SHOCKING Update

38.5K48 -

34:15

34:15

ZeeeMedia

17 hours agoPolice Demand Government Critic Hands Over His BLOOD | Daily Pulse Ep 147

68.8K36