Premium Only Content

The Hidden Market That Might CRASH the U.S. Economy in 2025

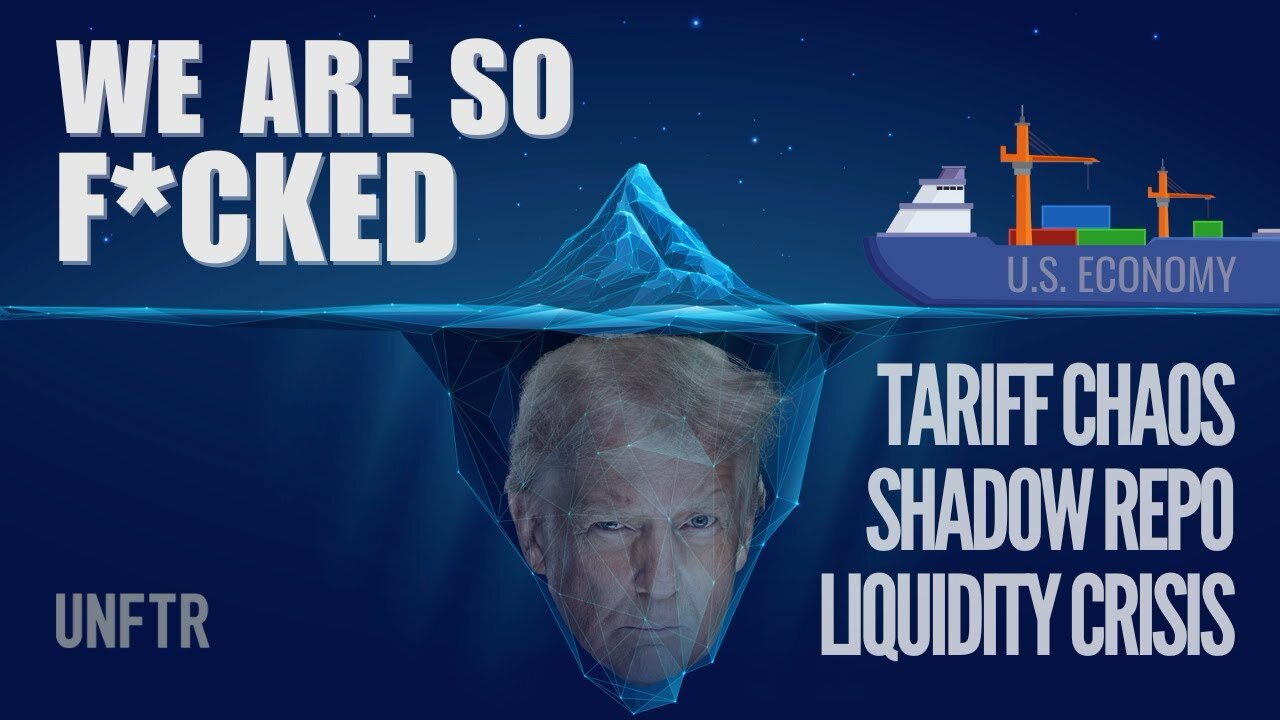

There's a hidden market that might crash the economy in 2025. Tariff chaos. Leverage in the Repo Market. A burgeoning liquidity crisis. There's an iceberg, dead ahead only we can't see below the surface to know how big it is.

In this video Max takes a big swing at the existential crisis brewing beneath the surface in the financial markets.

Trump's tariffs, declining economic data and slumping global demand will potentially neutralize half of the Fed's crisis response arsenal. The logical and expected response to what is shaping up to be a catastrophic summer is the

"Fed Put." In other words, another bailout. But if the Fed looks to expand its balance sheet to accomplish this during a liquidity crisis, will the buyers of U.S. debt show up?

Inflation and a weak dollar, frayed nerves in the bond market and more reckless behavior coming out of the White House could cause a run on the big banks and other firms that live in the "shadow repo" market leaving the Fed balancing the world on its shoulders.

CHAPTERS

00:00 - Preview

00:27 - Introduction

02:50 - Benchmarking the Current Economy

07:59 - UNFTR Break

08:53 - Capitalism, U.S. Hegemony & Financialization of the Economy

17:21 - Trump's Big Gamble

21:15 - Danger of Leverage in the Repo Markets

31:53 - Assessing What Comes Next

35:13 - Credits

-

2:07:44

2:07:44

Inverted World Live

5 hours agoPentagon Says it Solved UFO Cases, Tyler Robinson "Roommate" Missing | Ep. 113

27K13 -

2:30:00

2:30:00

Badlands Media

11 hours agoDevolution Power Hour Ep. 392: Psyops, Paper Tigers, and the Path to Sovereignty

69.8K9 -

3:02:08

3:02:08

TimcastIRL

6 hours agoLeftist Terror Attack On ICE In Dallas, Jimmy Kimmel Doubles Down Insulting MAGA | Timcast IRL

329K136 -

1:17:35

1:17:35

Man in America

11 hours agoIs Starlink RIPPING Us Apart from the Inside Out? w/ Cory Hillis

41K14 -

55:40

55:40

TheSaltyCracker

5 hours agoIdiots Chug Tylenol PT2 ReeEEStream 9-24-25

80.1K216 -

Akademiks

6 hours agoYoung Thug Dissing YFN Lucci. Ready to Go back to Jail. Offset vs Cardi b

47.4K2 -

7:07

7:07

Colion Noir

14 hours agoCalifornia Just Banned All Glocks

47.6K38 -

Adam Does Movies

7 hours ago $0.90 earnedTalking Movies + Ask Me Anything - LIVE

39K1 -

1:23:56

1:23:56

Jamie Kennedy

5 hours agoChoosing Good in a World Gone Dark | Ep 223 HTBITY with Jamie Kennedy

33.9K6 -

DVR

DVR

SpartakusLIVE

8 hours ago#1 Challenge CHAMPION of WZ || Ridin' The GRAVY Train w/ GloryJean

73.4K1