Premium Only Content

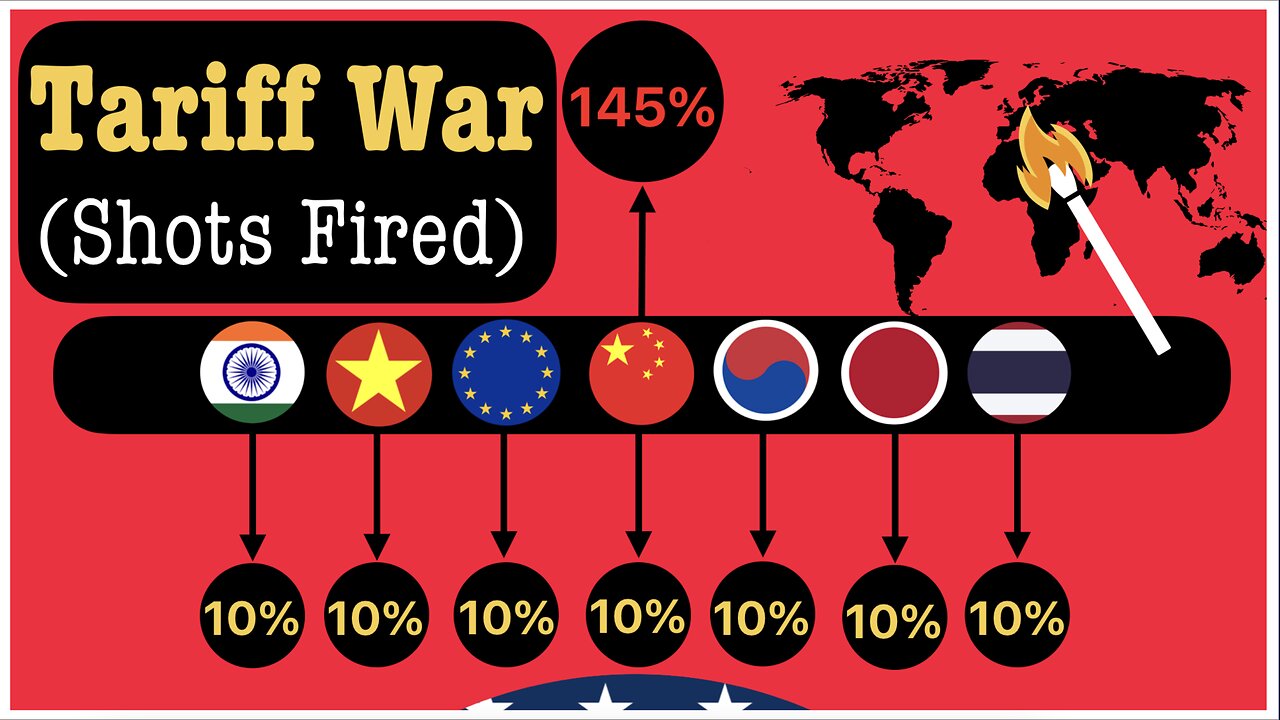

Stress Testing China: Trump’s Trade War

In this video, we’ll examine some of the factors that may contribute to the success or failure of Trump’s bold strategy to re-draw the global economic order and mitigate China’s growing dominance over the global economy. China’s strength may lie in its industrial and export dominance, but this position also comes with a structural vulnerability. The enormity of the US market, central to the world economy, can be the source of tremendous opportunities, or, it can be a barbed snare.

The current international trade environment is greatly shaped by China’s over-supply of manufactured goods. Industrial over-production, subsidized by the Chinese government, enables China to rapidly displace manufacturing operations in other developed countries—destroying their competitiveness while building industrial dependence.

As Chinese production out-paces global demand, the profit margins on Chinese manufactured products decrease. In September of 2024, China’s industrial profits fell 17.8% year-over-year. For all of 2024, industrial profits fell 3.3%—the third straight year of contraction. In order to keep prices as low as possible, China has avoided building domestic demand for its own products, instead, choosing to keep wages as low as possible. Growing its domestic market would require increasing the amount of disposable income for its population, which, would lower its ability to under-cut foreign manufactured products on a cost-basis. Escaping the middle income trap, would mean losing its primary geopolitical strategy of creating critical industrial dependencies.

-

1:50:43

1:50:43

Tucker Carlson

1 hour agoChris Williamson’s Advice to Men: How to Survive a World of OnlyFans and AI Girlfriends

32.3K32 -

19:57

19:57

Neil McCoy-Ward

7 hours agoThinking Of Relocating? (You'd Better Act FAST! 🚨)

6684 -

UPCOMING

UPCOMING

Jeff Ahern

31 minutes agoMonday Madness with Jeff Ahern

-

1:07:25

1:07:25

Timcast

3 hours agoBomb DETONATED At Harvard, Attacks On Ice Agents SKYROCKET

149K120 -

1:55:31

1:55:31

Steven Crowder

5 hours agoTucker Carlson & MAGA: Everyone is Missing the Point

377K293 -

1:11:22

1:11:22

The Rubin Report

4 hours agoWatch Joe Rogan’s Face as Elon Musk Exposes How Dems Are Cheating in Plain Sight

62.1K76 -

1:01:07

1:01:07

VINCE

6 hours agoThe Walls Are Closing In On The Deep State | Episode 160 - 11/03/25

245K150 -

LIVE

LIVE

LFA TV

20 hours agoLIVE & BREAKING NEWS! | MONDAY 11/3/25

2,010 watching -

1:31:18

1:31:18

Graham Allen

6 hours agoErika Fights Back: Vows To EXPOSE TRUTH & DEMANDS Trial Goes Public!! Left Says Her Grief Is FAKE!

159K83 -

2:08:47

2:08:47

Badlands Media

10 hours agoBadlands Daily: November 3, 2025 – Tariff Wars, SNAP Panic & Brennan Gets Confronted

78.9K20