Premium Only Content

Why am I doing this?

There’s an estimated $980 billion of multifamily real estate debt coming due in the U.S. over the next four years.

A lot of that debt was issued at super low interest rates back when the owners took out their initial loans.

But now?

Now, that debt is coming due…

And since interest rates have soared over the past year…

The owners of amazing properties all across the country have to refinance at much higher interest rates.

The bottom line is: Many won’t be able to hold onto their properties because of this.

And dozens of banks will likely fail as loans go bad.

But there’s a silver lining for you and me.

All of these properties will have to be put up for sale.

Which means we’ll see world-class assets flood the market… properties we might NEVER see for sale again in our lifetime…

And of all sizes… 4 units… 16 units… 32 units… all the way up to the monster multi-hundred unit deals.

This is a massive opportunity for real estate investors who know how to find and close on these deals.

This wealth transfer is already happening this month.

And it’s only going to get bigger.

In total, nearly $1 trillion is going to change hands over the coming years…

Want to know how to get your piece?

-

1:33

1:33

AI-Driven Investment Strategy

2 days agoConceptual Foundation: Cryptocurrency as Free Speech Pavlovski Views.

31 -

LIVE

LIVE

Flyover Conservatives

13 hours agoFrom Demonic Deception to Divine Direction: Sid Roth’s Radical Encounter With God | FOC Show

778 watching -

LIVE

LIVE

Chrissie Mayr

1 hour agoChrissie Mayr Reactions to Charlie Kirk, Liberal Celebrations, and More

199 watching -

LIVE

LIVE

AlaskanBallistics

1 hour agoRemembering Charlie Kirk

170 watching -

1:23:27

1:23:27

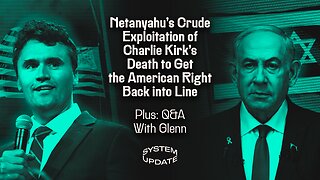

Glenn Greenwald

4 hours agoNetanyahu’s Crude Exploitation of Charlie Kirk’s Death to Get the American Right Back into Line; Plus: Q&A With Glenn on Charlie Kirk's Assassination, Online Civil Discourse, and More | SYSTEM UPDATE #514

155K96 -

4:10:25

4:10:25

Nerdrotic

7 hours ago $13.71 earnedCulture Is VITAL! Streaming BUST, Warner Bros. Buyout | Friday Night Tights 371 with Vara Dark

183K19 -

1:02:32

1:02:32

BonginoReport

5 hours agoCharlie Kirk’s Assassin In Custody, Details Emerge - Nightly Scroll w/ Hayley Caronia (Ep.133)

164K168 -

LIVE

LIVE

LFA TV

23 hours agoKILLER CAUGHT LIVE PRESSER! - FRIDAY 9/12/25

745 watching -

26:08

26:08

The Mel K Show

5 hours agoMel K & Ken Silva | Updates: Trump Attempted Assassination Trial, North Carolina Investigation, & Silver Bump! | 9-12-25

34.4K4 -

1:24:33

1:24:33

Kim Iversen

6 hours agoBlaming Nick Fuentes For Charlie Kirk's Death In 3...2...1...

94.2K266