Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Understanding IRS Notice 12C: Fix Your Incomplete Tax Return

1 month ago

8

If you’ve received IRS Notice 12C, it means your tax return is missing important information. This notice can delay processing and even lead to penalties if not addressed promptly. Tax attorney Nick Nemeth and his team help taxpayers understand and respond to IRS Notice 12C quickly and correctly to avoid further complications with the IRS. https://youtu.be/pF-xfz4Gk6A

Loading 1 comment...

-

6:04

6:04

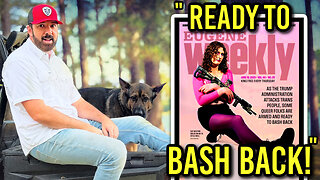

Buddy Brown

2 days ago $0.41 earnedEugene’s SICK Newspaper Cover is a WARNING to Us All! | Buddy Brown

6038 -

16:23

16:23

Actual Justice Warrior

1 day agoMom Sucker Punched By Repeat Offender In Chicago

3.21K27 -

56:28

56:28

Professor Nez

1 day ago🚨Not Only is Epstein NOT Going Away… It Just Got Worse!

19.9K24 -

8:09

8:09

MattMorseTV

17 hours ago $9.43 earnedTrump scores 17th CONSECUTIVE Supreme Court VICTORY.

71.3K58 -

2:11:25

2:11:25

Side Scrollers Podcast

18 hours agoUK JAILS TV WRITER FOR WRONG THINK + TWITCH ALLOWS CYBERSTALKING + MORE | SIDE SCROLLERS LIVE

30.5K8 -

10:47

10:47

Nikko Ortiz

1 day agoThese Tik Tok Clips Are Extremely Painful...

51K7 -

13:43

13:43

GritsGG

14 hours agoI Made a Brand New Warzone Account! Will I Get Bot Lobbies?

8.8K1 -

1:09:23

1:09:23

The HotSeat

14 hours agoTrump’s Parade = Mocked, China’s Parade = Praised: Leftist Hypocrisy EXPOSED

35K33 -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

218 watching -

4:34:26

4:34:26

Akademiks

8 hours agoICEMAN EPISODE 3

157K