Premium Only Content

Deri Protocol Explained: The Future of On-Chain Derivatives in DeFi

🔗 Get started with Deri Protocol: https://deri.io/?ref=decentralised&chainId=42161

🔗 Read the complete review: https://decentralised.news/deri-decentralized-derivative-protocol-review

🔗For the best trading platforms, wallets & tools: https://decentralised.news/ecosystem

Ready to dive deep into one of the most advanced decentralized derivative platforms in DeFi? In this video, we break down Deri Protocol V3, the evolution of on-chain trading that combines capital efficiency, NFT tokenized positions, and external custody for next-level DeFi derivatives.

Whether you're hedging, speculating, or arbitraging, Deri Protocol offers a fully on-chain experience with unmatched composability and scalability. 🌐📊

Key Features Highlighted:

✅ Fully On-Chain Derivative Trading

✅ Tokenized Positions as NFTs

✅ External Custody via Vault Smart Contracts

✅ Multiple Base Token Support

✅ Dynamic Mixed Margin & Liquidity

✅ Real-Time Borrow Limits

✅ Governance + Privilege Token Utility (DERI)

✅ Cross-chain compatibility (Ethereum, BNB, zkSync, Polygon & more)

📢 Who Should Watch This?

DeFi traders looking to go beyond traditional exchanges

NFT & DeFi crossover enthusiasts

Developers exploring smart contract composability

Yield farmers & LPs seeking high capital efficiency

Anyone interested in DeFi 2.0 infrastructure 🌐

#DeriProtocol #DeFi #CryptoDerivatives #NFTFinance #DeriV3 #OnChainTrading #DeFi2 #CryptoTrading #CrossChain #YieldFarming #GovernanceToken #DERI #LiquidityProvision #VaultsInDeFi #BlockchainFinance #Web3

-

LIVE

LIVE

Game On!

18 hours agoFootball IS BACK! Cowboys vs Eagles Opening Night Kickoff!

5,289 watching -

LIVE

LIVE

The Bubba Army

21 hours ago#1 Documentary IN THE WORLD! - Bubba the Love Sponge® Show | 9/04/25

4,329 watching -

39:31

39:31

Her Patriot Voice

13 hours ago $1.07 earnedBlack Conservative Surrounded + ROBBED By Leftists!

2.06K19 -

13:25

13:25

The Gun Collective

13 hours agoWOW! A LOT of new GUNS just dropped!

2.84K5 -

LIVE

LIVE

BEK TV

22 hours agoTrent Loos in the Morning - 9/04/2025

254 watching -

8:13

8:13

Geoff_Tac

1 day agoMAC 1014 Shotgun (Benelli Clone)

2.51K2 -

22:30

22:30

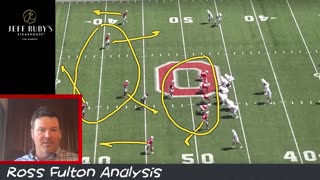

Ohio State Football and Recruiting at Buckeye Huddle

13 hours agoOhio State Football: How Matt Patricia Confused Arch Manning and Texas

8.98K -

9:07

9:07

MattMorseTV

18 hours ago $4.52 earnedTrump just BLASTED the CCP.

29.8K47 -

58:44

58:44

The Official Corbett Report Rumble Channel

12 hours agoTurning the Tide on 9/11 with Curt Weldon

9.71K17 -

10:47

10:47

Nikko Ortiz

16 hours agoThese Tik Tok Clips Are Extremely Painful...

24.5K3