Premium Only Content

Treasury decisions under internal revenue laws of the United States.

The video discusses the importance of government admissions regarding tax law and the challenges in legal arguments about citizenship status.

Government Admissions

• The speaker emphasizes the significance of government documents acknowledging certain truths about tax law.

• They highlight the necessity for the government to provide authoritative citations from the Secretary of Treasury.

Legal Arguments

• The government must either present a treasury decision contradicting the speaker's claims or falsely categorize U.S. citizens as non-resident aliens.

• The speaker asserts that the latter argument has been debunked by courts since the 1980s.

Implications

• The speaker believes that the government's inability to fulfill these requirements indicates a strong position for their argument.

• They express confidence that the government will not succeed in presenting a valid counterargument.

RESEARCH and EDUCATION

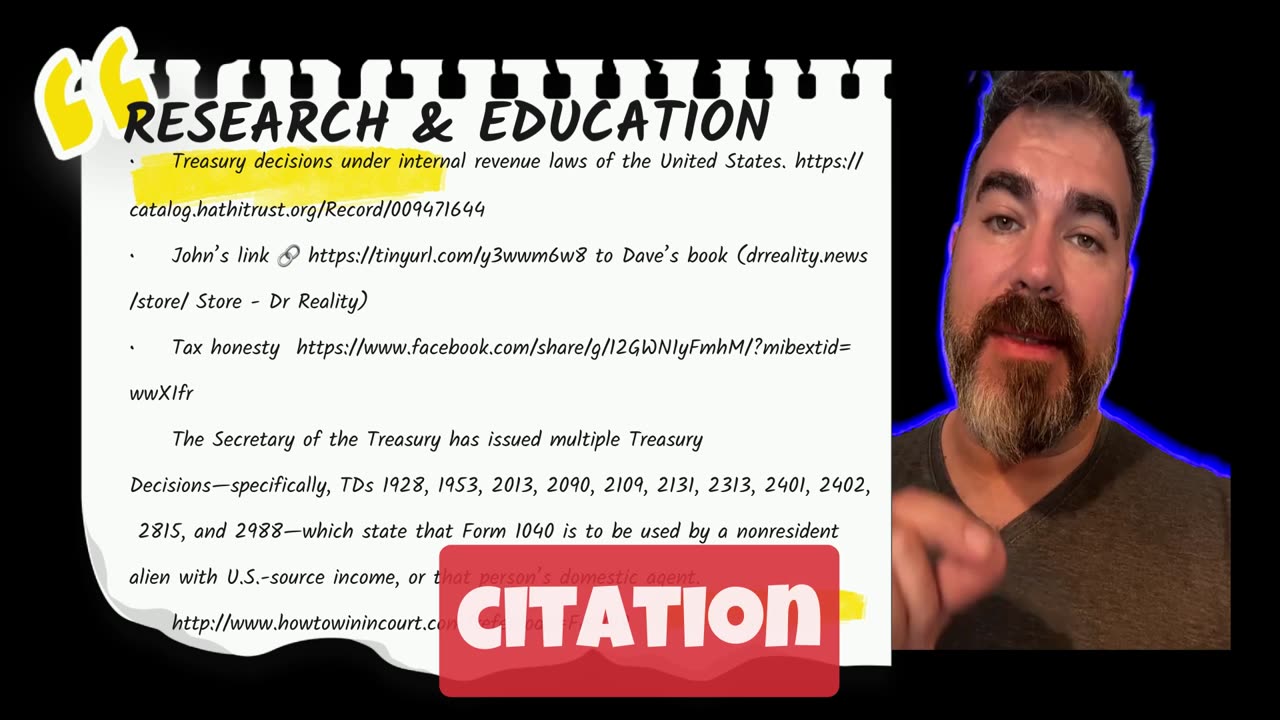

• Treasury decisions under internal revenue laws of the United States.

https://catalog.hathitrust.org/Record/009471644

• John’s link 🔗 https://tinyurl.com/y3wwm6w8 to Dave’s book (drreality.news/store/ Store - Dr Reality)

• Tax honesty https://www.facebook.com/share/g/12GWN1yFmhM/?mibextid=wwXIfr

• How to win in court: http://www.howtowinincourt.com?refercode=FA0019

To Whom It May Concern:

I am writing in response to IRS Notice CP59 dated June 23, 2025, which alleges that I am required to file a 2023 Form 1040 income tax return.

The Secretary of the Treasury has issued multiple Treasury Decisions—specifically, TDs 1928, 1953, 2013, 2090, 2109, 2131, 2313, 2401, 2402, 2815, and 2988—which state that Form 1040 is to be used by a nonresident alien with U.S.-source income, or that person’s domestic agent.

I am neither a nonresident alien with U.S.-source income, nor am I acting as a “U.S. person” on behalf of a foreign person’s U.S.-source income. Therefore, based on the Secretary of the Treasury’s own directives, I have determined I am not required to file Form 1040.

If you believe there is another relevant tax form that I am required to file, please disclose that information to me and I shall confirm that in accordance with the Secretary of the Treasury’s directives.

Please correct and update your records.

-

11:37

11:37

The Pascal Show

12 hours agoTHEY WANT TO END HER?! Candace Owens Claims French President & First Lady Put A H*t Out On Her?!

1.57K1 -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

259 watching -

24:30

24:30

DeVory Darkins

14 hours agoMarjorie Taylor Greene RESIGNS as Minnesota dealt MAJOR BLOW after fraud scheme exposed

66.5K112 -

2:19:48

2:19:48

Badlands Media

1 day agoDevolution Power Hour Ep. 409: Panic in the Narrative — Epstein, Israel, and the Manufactured Meltdowns

156K40 -

1:52:38

1:52:38

Man in America

11 hours agoCommunists VS Zionists & the Collapse of the American Empire w/ Michael Yon

65.3K26 -

4:09:34

4:09:34

Akademiks

5 hours agoSheck Wes exposes Fake Industry. Future Not supportin his mans? D4VD had help w disposing his ex?

39.6K3 -

6:43:43

6:43:43

SpartakusLIVE

9 hours agoTeam BUNGULATORS || From HUGE WZ DUBS to TOXIC ARC BETRAYALS

113K3 -

2:44:56

2:44:56

BlackDiamondGunsandGear

5 hours agoAre You that guy? / Carrying a Pocket Pistol /After Hours Armory

25.6K -

Camhigby

6 hours agoLIVE - Riot Watch Portland, DC, NC

28.5K20 -

2:54:58

2:54:58

CAMELOT331

8 hours agoYouTube Just Told Me I OWE THOUSANDS $ TO THEM... update

34.3K5