Premium Only Content

Treasury decisions under internal revenue laws of the United States.

The video discusses the importance of government admissions regarding tax law and the challenges in legal arguments about citizenship status.

Government Admissions

• The speaker emphasizes the significance of government documents acknowledging certain truths about tax law.

• They highlight the necessity for the government to provide authoritative citations from the Secretary of Treasury.

Legal Arguments

• The government must either present a treasury decision contradicting the speaker's claims or falsely categorize U.S. citizens as non-resident aliens.

• The speaker asserts that the latter argument has been debunked by courts since the 1980s.

Implications

• The speaker believes that the government's inability to fulfill these requirements indicates a strong position for their argument.

• They express confidence that the government will not succeed in presenting a valid counterargument.

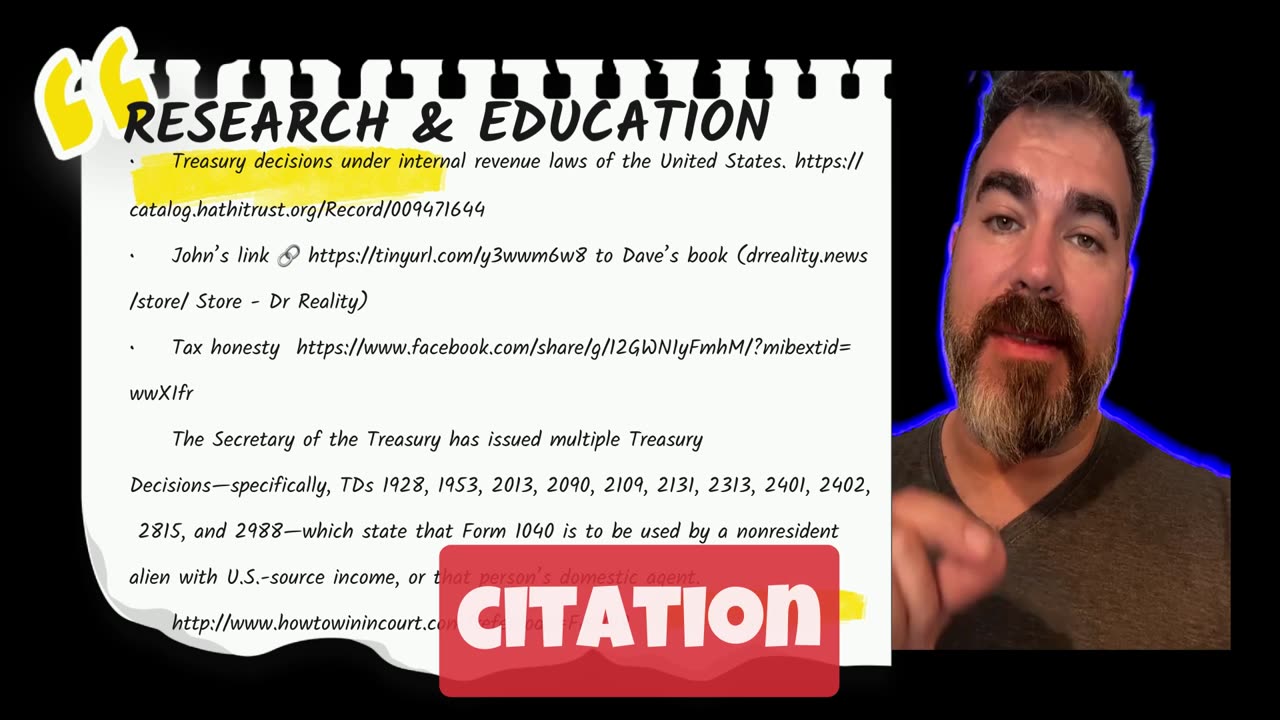

RESEARCH and EDUCATION

• Treasury decisions under internal revenue laws of the United States.

https://catalog.hathitrust.org/Record/009471644

• John’s link 🔗 https://tinyurl.com/y3wwm6w8 to Dave’s book (drreality.news/store/ Store - Dr Reality)

• Tax honesty https://www.facebook.com/share/g/12GWN1yFmhM/?mibextid=wwXIfr

• How to win in court: http://www.howtowinincourt.com?refercode=FA0019

To Whom It May Concern:

I am writing in response to IRS Notice CP59 dated June 23, 2025, which alleges that I am required to file a 2023 Form 1040 income tax return.

The Secretary of the Treasury has issued multiple Treasury Decisions—specifically, TDs 1928, 1953, 2013, 2090, 2109, 2131, 2313, 2401, 2402, 2815, and 2988—which state that Form 1040 is to be used by a nonresident alien with U.S.-source income, or that person’s domestic agent.

I am neither a nonresident alien with U.S.-source income, nor am I acting as a “U.S. person” on behalf of a foreign person’s U.S.-source income. Therefore, based on the Secretary of the Treasury’s own directives, I have determined I am not required to file Form 1040.

If you believe there is another relevant tax form that I am required to file, please disclose that information to me and I shall confirm that in accordance with the Secretary of the Treasury’s directives.

Please correct and update your records.

-

LIVE

LIVE

SpartakusLIVE

2 hours agoSpart Flintstone brings PREHISTORIC DOMINION to REDSEC

254 watching -

1:05:02

1:05:02

BonginoReport

5 hours agoKamala CALLED OUT for “World Class” Deflection - Nightly Scroll w/ Hayley Caronia (Ep.167)

95.9K58 -

54:36

54:36

MattMorseTV

3 hours ago $17.15 earned🔴The Democrats just SEALED their FATE.🔴

27.7K39 -

8:07:01

8:07:01

Dr Disrespect

10 hours ago🔴LIVE - DR DISRESPECT - ARC RAIDERS - SOLO RAIDING THE GALAXY

104K11 -

1:32:00

1:32:00

Kim Iversen

6 hours agoThe World’s Most “Moral” Army — Kills 40 Kids During "Ceasefire" | Socialism's Coming: The Zohran Mamdani Agenda

79.2K124 -

1:04:50

1:04:50

TheCrucible

5 hours agoThe Extravaganza! EP: 63 with Guest Co-Host: Rob Noerr (10/30/25)

72K6 -

LIVE

LIVE

GritsGG

4 hours agoQuads! #1 Most Wins 3880+!

91 watching -

2:51:31

2:51:31

Spartan

5 hours agoFirst playthrough of First Berserker Khazan

19.4K -

5:48:29

5:48:29

The Rabble Wrangler

19 hours agoBattlefield 6 - RedSec with The Best in the West

22.7K -

37:53

37:53

Donald Trump Jr.

5 hours agoAmerican Dominance vs Dems' Delusion | TRIGGERED Ep.287

40.7K59