Premium Only Content

U.S. Tax Filing for Non-U.S. Founders | Forms, Tips & Firstbase Help

Website Link Below:

https://get.firstbase.io/xa008h6rktb8

Starting a U.S. company as a non-U.S. founder? Filing taxes in the U.S. can seem overwhelming—but it doesn’t have to be. In this video, Product Lead Jacob Sheldon from Firstbase walks you through everything you need to know about filing taxes as a foreign founder. From choosing the right entity and tax designation (LLC, Corporation, Single-Member, or C-Corp) to understanding which federal forms you need—like Form 1120, Form 5472, 1099-NEC, 1065, and W-8BEN-E—this guide breaks down each step in plain English. Learn how to reduce your tax liability, avoid audits, and navigate issues like double taxation through tax treaties and reasonable salaries. Discover how Firstbase Tax Filing helps you handle IRS, state, and city requirements with expert support—so you can focus on growing your business. Whether you’re filing for a U.S. LLC or C-Corp from abroad, this video is your complete roadmap.

#ForeignFounder #USTaxFiling #FirstbaseTaxFiling #Form5472

-

LIVE

LIVE

Matt Kohrs

12 hours agoMASSIVE Market Swings Incoming! || Top Futures & Options Trading Show

595 watching -

LIVE

LIVE

Wendy Bell Radio

6 hours agoIt's All About the Benjamins

7,267 watching -

LIVE

LIVE

JuicyJohns

2 hours ago $2.89 earned🟢#1 REBIRTH PLAYER 10.2+ KD🟢

102 watching -

3:18:50

3:18:50

Times Now World

5 hours agoLIVE: NATO Chief Demands 5% of GDP for War Chest! Mark’s Bold Plan for Allies at IISS Prague Defence

20.2K1 -

15:54

15:54

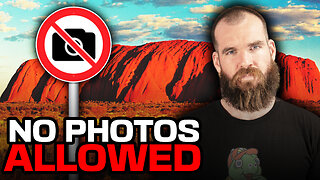

IsaacButterfield

6 hours ago $0.36 earnedAustralians BANNED from Taking Photos at Uluru

4.35K9 -

LIVE

LIVE

The Mike Schwartz Show

2 hours agoTHE MIKE SCHWARTZ SHOW with DR. MICHAEL J SCHWARTZ 09-04-2025

4,014 watching -

1:16:35

1:16:35

JULIE GREEN MINISTRIES

4 hours agoGOVERNMENTS AROUND THE WORLD ARE ABOUT TO COLLAPSE

81K149 -

1:54:16

1:54:16

Welcome to the Rebellion Podcast

14 hours ago $1.88 earnedDon3po is Live - WTTR Podcast Live 9/4

16.7K2 -

13:43

13:43

The Kevin Trudeau Show Limitless

1 day agoClassified File 3 | Kevin Trudeau EXPOSES Secret Society Brainwave Training

65.2K10 -

1:59:20

1:59:20

The Chris Salcedo Show

14 hours ago $3.29 earnedAmericans Are Tired Of Leftists & Fake-GOP Who Cater To Them

22.3K