Premium Only Content

U.S. Business Taxes Explained: What Every Founder Needs to Know

Website Link Below:

https://get.firstbase.io/xa008h6rktb8

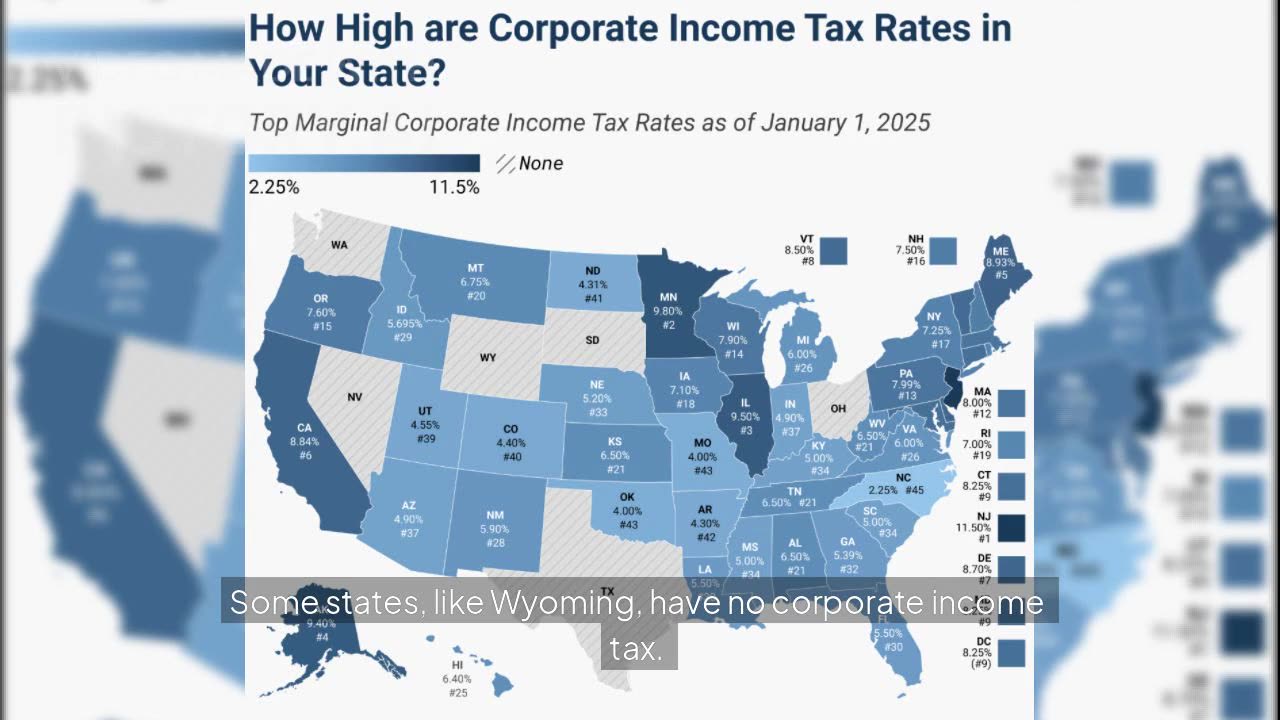

Running a business in the U.S. means staying compliant with a complex web of taxes—from federal to local filings, franchise tax, and employment taxes. In this video, Firstbase Product Lead Jacob Sheldon walks through everything founders need to know about U.S. business tax obligations. You’ll learn the key differences between federal, state, and local tax structures, how entity types like C-corporations, S-corps, LLCs, and partnerships are taxed, and what forms you need to file. We also cover franchise taxes in states like Delaware and Texas, employment tax compliance (FICA & FUTA), and lesser-known taxes like excise, gross receipts, and environmental taxes. Whether you’re an early-stage startup or scaling quickly, this guide helps you avoid costly mistakes and stay focused on growth. Use Firstbase Tax Filing to file all your taxes—federal, state, and city—in minutes, with professional support included.

#USTaxFiling #StartupTaxes #BusinessCompliance #Firstbase

-

LIVE

LIVE

LFA TV

11 hours agoLFA TV ALL DAY STREAM ! | MONDAY 9/22/25

14,452 watching -

LIVE

LIVE

JULIE GREEN MINISTRIES

1 hour agoLIVE WITH JULIE

18,897 watching -

LIVE

LIVE

The Bubba Army

2 days ago90K Honor Charlie Kirk At Memorial - Bubba the Love Sponge® Show | 9/22/25

4,885 watching -

38:21

38:21

Stephen Gardner

2 days ago🔥Is Kash Patel HIDING DETAILS About Charlie Kirk & Jeffrey Epstein? Judge Joe Brown

66.1K194 -

26:33

26:33

DeVory Darkins

1 day ago $58.50 earnedRep Omar EMBARRASSES herself in a painful way as Newsom PANICS over Kamala confrontation

98.1K330 -

3:28:14

3:28:14

Badlands Media

1 day agoThe Narrative Ep. 39: The Sovereign Mind

125K39 -

2:17:35

2:17:35

TheSaltyCracker

12 hours agoThe Charlie Kirk Effect ReeEEStream 9-21-25

137K378 -

2:03:07

2:03:07

vivafrei

12 hours agoEp. 283: Charlie Kirk Memorial and other Stuff in the Law World

235K214 -

9:13:12

9:13:12

The Charlie Kirk Show

23 hours agoLIVE NOW: Building A Legacy, Remembering Charlie Kirk

2.19M970 -

1:55:20

1:55:20

The White House

15 hours agoPresident Trump Participates in the Memorial Service for Charlie Kirk

120K97