Premium Only Content

3 Cycles of Bitcoin Price: Secrets of the 2030s | Hashpower Academy

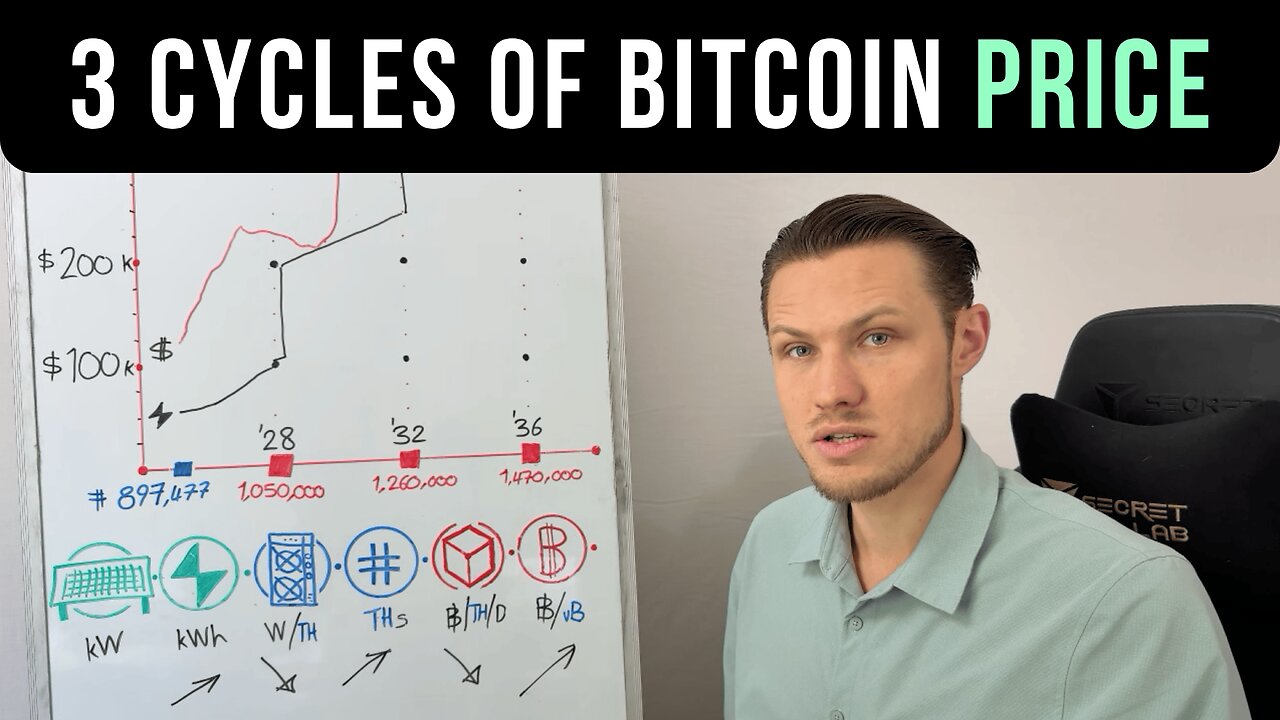

Bitcoin’s price is a wild beast, but miners’ production floor—energy cost to mine 1 BTC—sets its energy exchange rate (BTC/kWh). I dive into 3 halving cycles (2028, 2032, 2036) to model 2030s prices. Halvings cut rewards, doubling miners’ costs, pushing the floor higher—think 2020’s $4k crash to $8k rebound. In a world where difficulty and markets shift, halvings are the only sure bet. Forget price guesses; the production floor’s rise signals Bitcoin’s value. Watch now—crack the energy code for 2036!

Hashpower Academy Donations (Thank You!):

L1 Bitcoin: bc1qlgkc4pyrz22cykrx49cmuku3zyy2nuequu6r9y

L2 Lightning: academy@walletofsatoshi.com

Free Bitcoin Course! (Big Picture Basics):

https://www.hashpower.academy

I got my Bitcoin Mini-Miner from IXTech (10% off with code JAKE):

https://ixtech.xyz/?ref=JAKE

Align a meeting if you are looking to discuss Mining/Hosting and other Business Inquiries:

https://calendly.com/terahash/30min

Financial Disclaimer:

This video serves educational and informational purposes only and should not be construed as financial advice or investment recommendation. The views expressed are those of the presenter and do not represent Hashpower Academy’s official stance. Information is provided ‘as is’ without warranties, express or implied, as to its accuracy or completeness. Engaging with Bitcoin involves high risk, including potential financial loss, market volatility, and energy costs, and is suitable only for those who can bear these risks. Always conduct your own research and consult with a qualified financial or technical advisor before making decisions related to Bitcoin.

#bitcoin

#PricePrediction

#bullish

#BitcoinHalving

#Crypto

#BitcoinPrice

#CryptoInvesting

#Finance

#Investing

#QuantAnalysis

#ProductionFloor

#BTCkWh

#BitcoinCycles

#BTC

#CryptoFuture

#Bitcoin2030

#MiningCosts

#EnergyExchange

#CryptoQuant

#BitcoinAnalysis

#HalvingPrice

#BitcoinEnergy

-

1:26:34

1:26:34

Man in America

10 hours agoExposing the Cover-Up That Could Collapse Big Medicine: Parasites

37.8K18 -

4:53:00

4:53:00

CHiLi XDD

6 hours agoTekken Fight Night

19.6K1 -

9:25:57

9:25:57

ItsLancOfficial

11 hours agoFREAKY FRIDAY-GETTING FRIED-WELP! #TOTS

18.3K4 -

1:09:11

1:09:11

Sarah Westall

7 hours agoRead the Signs: Are We Already Operating in a New Financial System? w/ Andy Schectman

32.8K7 -

1:32:53

1:32:53

Flyover Conservatives

10 hours agoRicky Schroder Exposes How Hollywood Planted Him as a Child Star | FOC Show

40.3K9 -

JahBlessCreates

5 hours ago🎉 TEKKEN TING, and maybe some music...

20K14 -

LIVE

LIVE

GritsGG

6 hours agoTop 250 Ranked Grind! Dubulars!🫡

52 watching -

4:31:29

4:31:29

StuffCentral

5 hours agoStar Stuffy

7.49K4 -

6:02

6:02

Blackstone Griddles

7 hours agoPrime Rib Brisket Burgers on the Blackstone Griddle

11K3 -

3:35:06

3:35:06

HELMETFIRE

4 hours ago🟢HELMETFIRE PLAYS: Silksong Part 4🟢

3.87K