Premium Only Content

How to Report AirBnB Income

Welcome to Automatic Tax Returns. The content on this channel, AutomaticTaxReturns, is for educational purposes only and does not constitute tax, legal, or financial advice. Please consult a licensed tax professional before making any decisions related to your personal situation. If you are new here, make sure to hit that subscribe or the follow button. Miss Reynolds who did not report 78 thousand dollars from Airbnb. She was sent an IRS Letter 2205. When she went to the audit, she found out that Airbnb reported to the IRS that they paid her the 78 thousand dollars. IRS questioned her about the income. She said that she did not receive a Form 1099. The auditing agent said that not getting a 1099 does not exempt you from reporting income, Miss Reynolds. Eventually, Miss Reynolds was sent a letter indicating she owes thirty six thousands three hundred sixty seven dollars with an installation plan. She did not pay any of the installations. IRS and the state filed tax liens against Miss Reynolds. Still no resolution so there was a tax levy. In other words, her property was taken. Drop a comment. Was it fair that Miss Reynold's house was taken? Subscribe for weekly money-saving tax tips. For those who are receiving rental income, here is the solution. Reporting passive income from Airbnb on your tax return depends on how you're using the property and the level of services you provide. The I R S treats Airbnb income as rental income, business income, or sometimes both, depending on number of rental days, personal use, Services provided such as cleaning, meals, concierge, etc.. If the rental does all the work or most of the work with little of your service, report on Form 1040 Schedule E. Include gross rental income, expenses such as mortgage interest, property taxes, repairs, cleaning, utilities and depreciation on the property and furnishings. If you provide substantial services like a hotel or B n B, report on a Form 1040 Schedule C and Schedule SE. If you rent out your home for 14 days or fewer during the year and live in it the rest of the time, you do not report the income. It is completely tax-free. Therefore, you cannot deduct any expenses. This concludes this topic, if you need a federal tax return, try the application in the description. It calculates, downloads all applicable federal tax forms, fills in the numbers and relevant information to respective tax forms, and merges all the form to a complete, print-ready federal tax return that is needed to be filed. Simply, input numbers/information that apply to you and select one of three options, which are Form 1040, Schedule C, or a Form 1120. That is it. It takes less than a minute or two to generate all completed merged federal tax forms into a completed portable document format federal tax return will open to be printed. Print, sign, and mail or upload online. This concludes this segment. Please like, follow or subscribe.

-

1:15:17

1:15:17

Awaken With JP

2 hours agoKaren Strikes Again, There is No Crime, Communism Succeeds! - LIES Ep 107

14.5K8 -

UPCOMING

UPCOMING

Stephen Gardner

15 minutes ago🔥Tucker HUMILIATES Mark Cuban + Democrat Mayors ABANDON Party!

-

11:37

11:37

Robbi On The Record

12 days agoThe Devil is in the Branding..

21.8K17 -

LIVE

LIVE

The HotSeat

55 minutes ago👉 STOP Blaming Each Other — Look at the Media!

151 watching -

![[Ep 744] ICE Storm Hits Chicago | Another Innocent Woman Slain in Auburn, AL | Islam Invasion](https://1a-1791.com/video/fww1/9b/s8/1/Y/a/w/g/Yawgz.0kob.1-small-Ep-744-ICE-Storm-Hits-Chica.jpg) UPCOMING

UPCOMING

The Nunn Report - w/ Dan Nunn

57 minutes ago[Ep 744] ICE Storm Hits Chicago | Another Innocent Woman Slain in Auburn, AL | Islam Invasion

10 -

1:39:20

1:39:20

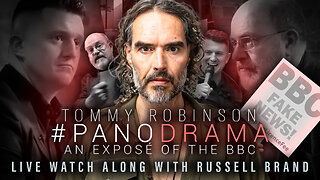

Russell Brand

4 hours agoMedia Lies & Setups? Tommy Robinson’s Panodrama Watch Along - SF630

100K15 -

1:56:56

1:56:56

MattMorseTV

3 hours ago $3.99 earned🔴Trump's MASSIVE Press Briefing UPDATE.🔴

9.82K27 -

1:35:04

1:35:04

Right Side Broadcasting Network

2 hours agoLIVE: Make America Healthy Again Commission Meeting - 9/9/25

14.3K2 -

1:57:40

1:57:40

The Charlie Kirk Show

4 hours agoWhere Do Rights Come From? + Lions and Scavengers + Midway Blitz | Shapiro, Yoo, McLaughlin | 9.9.25

43K16 -

1:19:45

1:19:45

The White House

6 hours agoPress Secretary Karoline Leavitt Briefs Members of the Media, Sep. 9, 2025

26.4K18