Premium Only Content

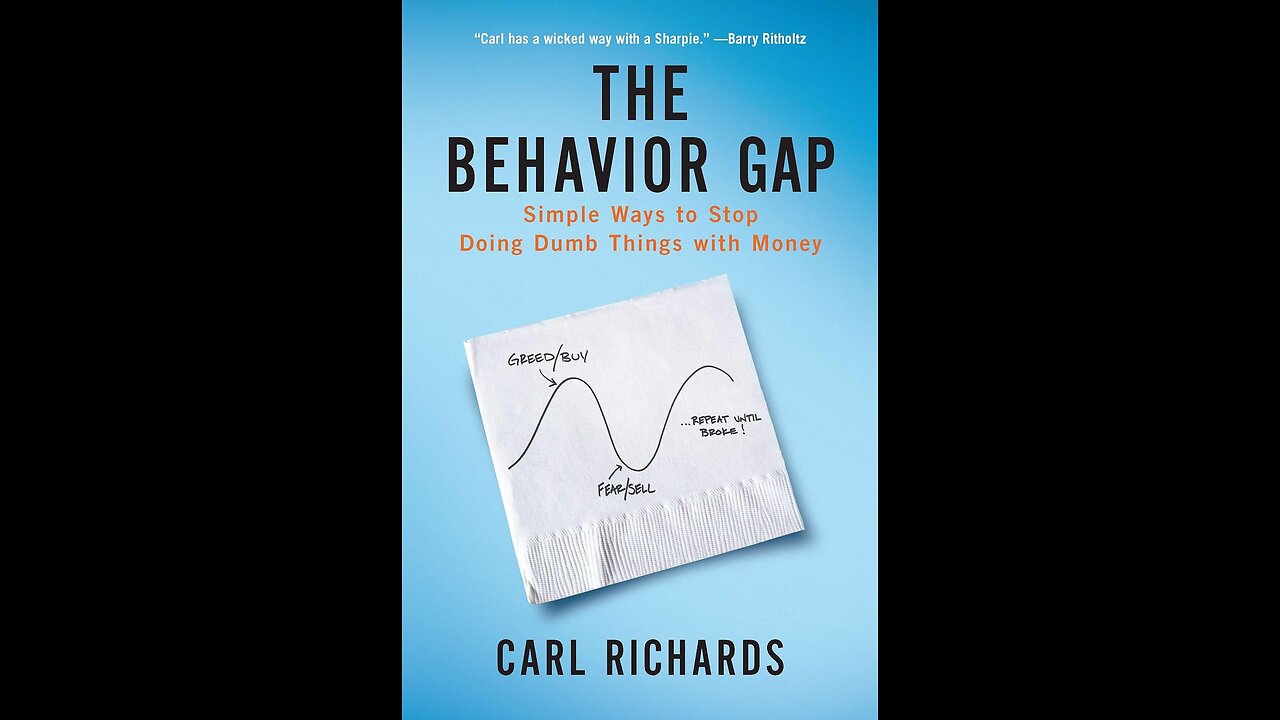

The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money by Carl Richards

I Bet You Won't Buy This Book On Amazon 👉 https://amzn.to/4nqVBoH

Understanding the Behavior Gap: Why We Make Poor Financial Decisions

In this episode, we explore the concept of the 'behavior gap' as outlined in Carl Richards' book, 'The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money.' We discuss why there's a disconnect between what we know about investing and the decisions we actually make. Topics include fear and greed, overconfidence, and the flaws in traditional financial planning. Learn how focusing on your own behavior, rather than market predictions or media advice, can bridge this gap and lead to greater financial success and personal happiness.

00:00 Introduction: The Behavior Gap

00:36 Understanding the Behavior Gap

01:21 Investor Behavior and Common Mistakes

03:21 Emotional Drivers: Fear and Greed

03:57 Overconfidence and the Greater Fool Theory

06:03 The Problem with Conventional Advice

09:17 The Value of Planning Over Plans

12:00 Focusing on Personal Economy

12:41 Connecting Money to Life Goals

15:14 Simple Choices for Financial Success

17:55 Conclusion: Controlling Your Own Choices

-

59:58

59:58

Man in America

13 hours agoHow Big Pharma Turned Cancer Into a TRILLION-DOLLAR Business

356K49 -

9:11:52

9:11:52

SpartakusLIVE

11 hours ago#1 Solo Savant stream DEEP into the night || PUBG Later Tonight?!

76K8 -

13:56

13:56

Clintonjaws

16 hours ago $36.30 earnedEntire Room Speechless As Poilievre Snaps & Puts TV Hosts In Their Place

54K27 -

4:23:32

4:23:32

EricJohnPizzaArtist

1 day agoAwesome Sauce PIZZA ART LIVE Ep. #67: HALLOWEEN SPECIAL tribute to “Need to Breathe”

62.7K17 -

2:26:26

2:26:26

Nerdrotic

12 hours ago $55.47 earned3I/Atlas : A Cosmic Horror or a New Interstellar Understanding? | Forbidden Frontier #122

211K22 -

54:56

54:56

Sarah Westall

9 hours agoHidden Biblical Writings: Evidence Based Investigation, Worlds First Collection w/ Matthew McWhorter

35K29 -

3:08:48

3:08:48

megimu32

9 hours agoOTS: Great Scott! How Back to the Future Changed Movies Forever

38K10 -

3:40:15

3:40:15

CassaiyanGaming

8 hours ago🟢LIVE - The OUTLAST Trials with JahBless & CatDog

26.9K5 -

10:54

10:54

Nate The Lawyer

2 days ago $19.28 earnedNEW Charges & Lawsuit For Fake Doctor Illegal Who Ran Schools For Decades

57.2K48 -

2:34:44

2:34:44

Joker Effect

8 hours agoSTREAMER NEWS: Adin Ross, LupLupka, SideScrollers, N3on, TrainwrecksTv, Cuffem, WestCol, BottedWTF.

26.8K14