Premium Only Content

SigzenERP - Setup Sales & Purchase Taxes in ERPNext | Powered By: ERPNext-15

Welcome to the Sigzen ERP Tutorial on Configuring Sales and Purchase Taxes in ERPNext! This video is ideal for both beginners and experienced users looking to streamline their tax configuration process within the ERP system. Follow along as we walk you through the essential steps to set up and manage sales and purchase taxes efficiently.

In This Tutorial, You'll Learn:

Configuring Sales Taxes:

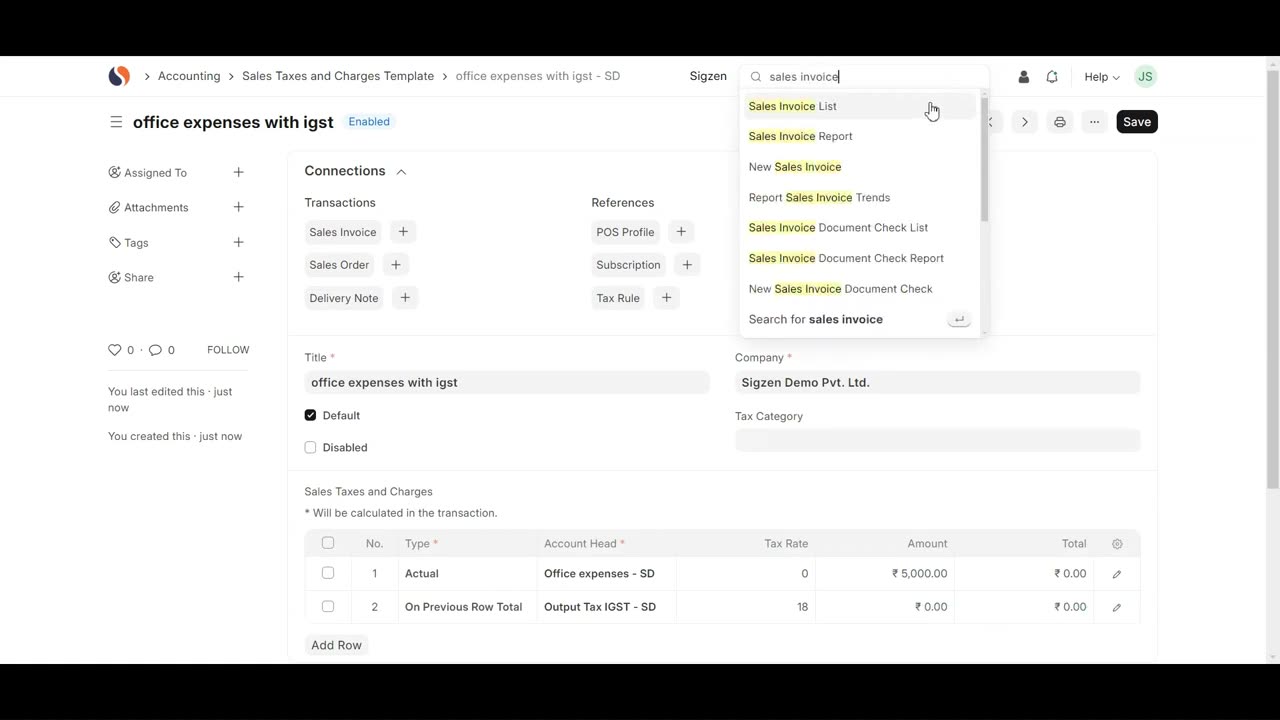

Navigating to Sales Taxes and Charges Template:

- Learn how to find the Sales Taxes and Charges Template using the search bar.

Adding Sales Taxes and Charges:

- Step-by-step instructions on creating a new sales tax template and setting it as default.

Setting Tax Details:

- Understand how to add rows for different tax details, including type, account head, rate, amount, and total.

Saving and Applying Tax Templates:

- How to save your configuration and apply the sales tax template to a sales invoice.

Configuring Purchase Taxes:

Navigating to Purchase Taxes and Charges Template:

- Discover how to locate the Purchase Taxes and Charges Template via the search bar.

Adding Purchase Taxes and Charges:

- Detailed steps for creating a new purchase tax template and marking it as default.

Setting Tax Details:

- Learn how to input tax details such as type, account head, rate, amount, and total.

Saving and Applying Tax Templates:

- Instructions on saving your setup and applying the purchase tax template to a purchase invoice.

Setting Up Tax Rules:

Navigating to Tax Rule List:

- Find out how to access the Tax Rule List and configure tax rules.

Configuring Tax Rules:

- Set the tax type (Sales or Purchase), select the tax template, and define customer groups and tax categories.

**Saving Tax Rules:**

- How to save your tax rule configurations and ensure they are valid.

Key Features Highlighted:

Efficient Tax Management:

- Seamlessly navigate and manage sales and purchase taxes within ERPNext.

Automated Tax Application:

- Simplify tax application with automated processes for sales and purchase invoices.

Comprehensive Configuration:

- Detailed guidance on configuring necessary tax details for accurate financial management.

Flexibility and Precision:

- Flexible options for setting default templates and specific tax rules for different customer groups.

Why Watch?

This step-by-step guide is designed to help you optimize the tax configuration functionality in Sigzen ERP. By following detailed instructions and practical examples, you’ll ensure accurate tax management and compliance, enhancing your overall financial operations.

If you have any questions, leave them in the comments below. Don't forget to like, share, and subscribe for more ERP tutorials tailored to your business needs. Happy tax configuring!

-

3:08:37

3:08:37

LumpyPotatoX2

4 hours agoWhere Winds Meet: New Level Cap + Rumble Wallet - #RumbleGaming

26.3K1 -

LIVE

LIVE

SOLTEKGG

3 hours ago🔴LIVE - Battlefield 6 - Going Pro in RED SEC

276 watching -

11:37

11:37

tactical_rifleman

2 days agoRare Breed BEATS THE ATF | FRT-15 | Tactical RIfleman

67.5K23 -

2:51:46

2:51:46

Pepkilla

3 hours agoMore GOLD Camo's PLEASE Grind Call Of Black Ops 7

11K1 -

1:35:54

1:35:54

LexTronic

3 hours ago $0.46 earnedMetroid Prime Remastered

7.05K2 -

12:32

12:32

MetatronGaming

18 hours agoBLIGHT looks AMAZING - Trailer Reaction

28.4K13 -

LIVE

LIVE

ProRedmanX

3 hours ago $0.63 earnedSunday Morning Coffee & Chaos ☕ | PUBG -> BF6 -> ??? #goonsquad

72 watching -

5:23

5:23

Memology 101

22 days ago $18.10 earnedReporter HUMILIATES Kamala Harris over "WORLD-CLASS" dodge during interview

28.6K53 -

LIVE

LIVE

ItsJustChrisTV

3 hours ago $0.62 earnedRescue Rangin'! Lets (try to) Save Some Folks!

33 watching -

![[Arc Raiders] Time for Some Keys, Increase This Stash, Scrappy and Tables Are All Max. Time for More](https://1a-1791.com/video/fwe2/ac/s8/1/4/g/x/C/4gxCz.0kob-small-Arc-Raiders-Time-for-Some-K.jpg) 1:11:44

1:11:44

Palermozeto

3 hours ago[Arc Raiders] Time for Some Keys, Increase This Stash, Scrappy and Tables Are All Max. Time for More

4.55K