Premium Only Content

Tax Relief and Historic Reform

Well, first of all, it means that the American people won’t face a $4 trillion tax hike at the end of the year if the Big, Beautiful bill is passed. That’s what we’re trying to prevent and avoid.

It also adds a number of new tax provisions. It eliminates taxes such as, as the President has pointed out, taxes on tips, taxes on overtime, reduces taxes for Social Security recipients. There are many things in there, Martha, that benefit middle-income families. For example, there’s an increase in the child tax credit.

So it’s preventing a massive tax hike, providing more relief to the American people in the form of tax cuts, and putting more money in their pockets so they send less to Washington. That’s what it’s all about, first and foremost.

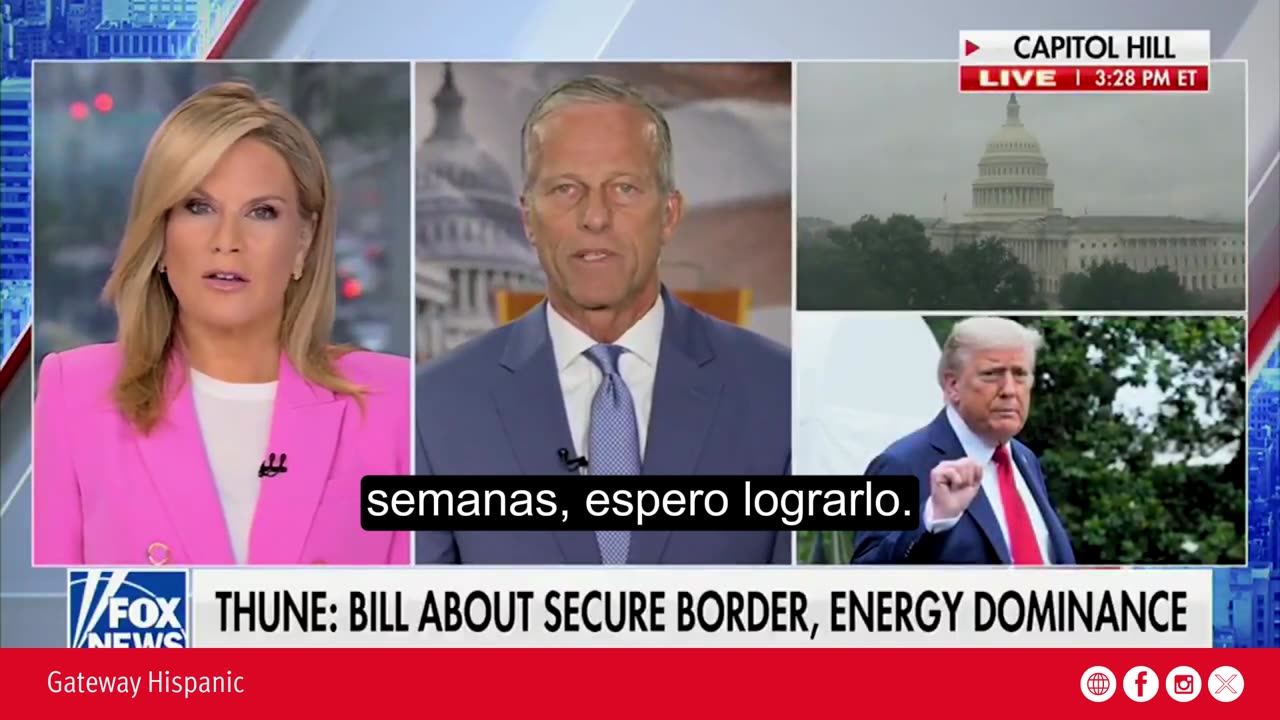

But it’s also about securing the border. It’s about modernizing our military. It’s about ensuring we remain dominant in energy moving forward.

There are a lot of components in this bill, and perhaps most important for many people is that it includes the largest spending cut in history and reforms to programs that haven’t been attempted around here in decades.

This is a bill we need to get across the finish line. It’s more difficult in the Senate. We have different rules to follow compared to the House, and we’re in the process of working through that. But in the coming weeks, I’m hopeful we’ll get it done.

-

1:29

1:29

Gateway Hispanic

1 day agoJD Vance breaks down how Democrats broke the law under Joe Biden

96 -

48:15

48:15

SouthernbelleReacts

1 day ago $3.15 earnedWeapons (2025) REACTION | Josh Brolin, Julia Garner, Alden Ehrenreich | Horror-Mystery Thriller

8.62K17 -

39:36

39:36

mizery

4 days ago $0.18 earnedI Mastered Fortnite in 30 Days

2.91K5 -

25:50

25:50

ChopstickTravel

18 days ago $0.79 earned24 Hours With Sri Lanka’s Vedda People!! (Barehand Honey Harvest)

6.87K4 -

8:13

8:13

Danny Rayes

1 day ago $0.81 earnedMost Hated Teacher on Tiktok

3.82K5 -

15:31

15:31

Chris Harden

9 days ago $1.10 earnedWhat Happened to Kewanee, Illinois?

5.26K6 -

10:13

10:13

JohnXSantos

1 day ago $0.33 earnedThis AI Tool Makes Product Manufacturing 10X Smarter (FOR FREE)

3.55K3 -

16:28

16:28

Artur Stone Garage

12 days ago $0.68 earned$1000 AUDI A4 — WILL IT START After 10 Years?

5.85K1 -

26:57

26:57

Advanced Level Diagnostics

18 days ago $0.31 earned2021 Ram Promaster - No Crank! Key Stuck In Ignition! Diag & Fix!

4.07K1 -

8:11

8:11

MattMorseTV

18 hours ago $18.73 earnedTrump's DECLARATION of WAR.

37K93