Premium Only Content

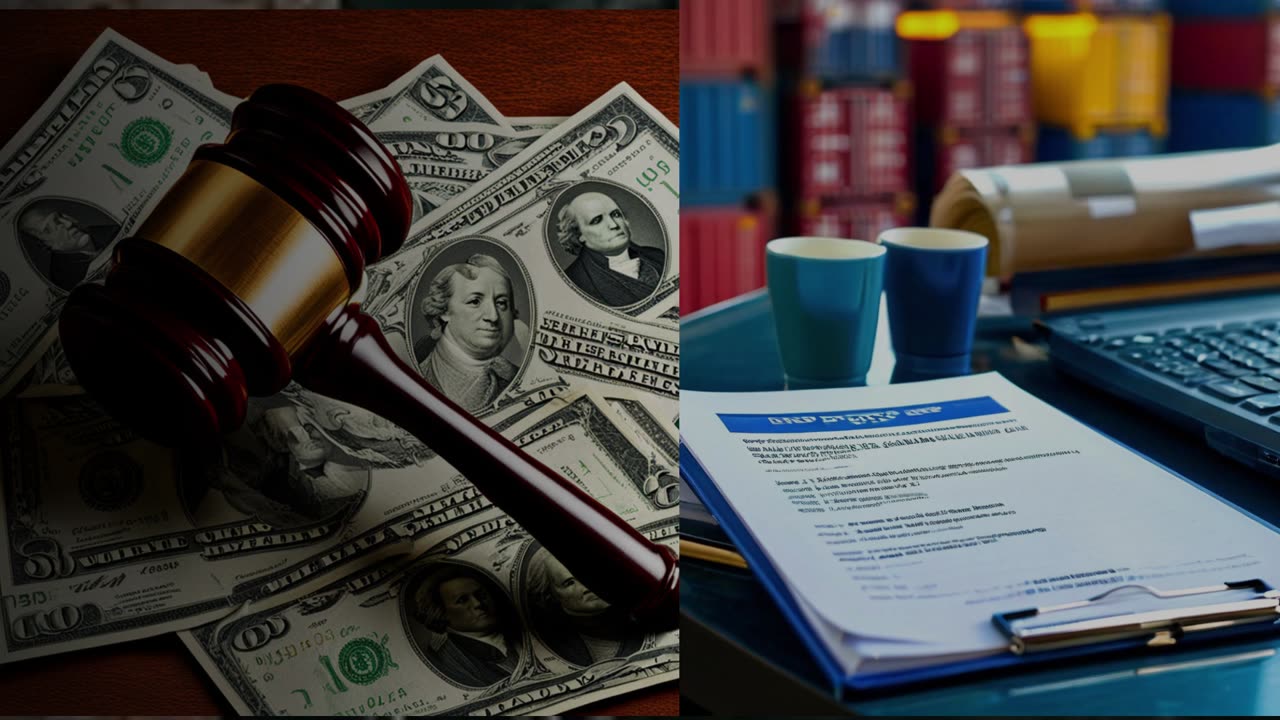

Mastering ISF Filing: Avoid Penalties and Ensure Compliance

ISF Depot // 661-246-8217 // customs@isfdepot.com // www.isfdepot.com

This response provides a deep dive into the concept of Importer Security Filing (ISF) and its compliance in customs brokerage. It emphasizes the importance of ISF filing for importers and outlines the penalties associated with non-compliance. The response offers valuable tips to ensure ISF filing is always in line with Customs and Border Protection (CBP) regulations, such as being proactive, working with a customs broker, utilizing technology solutions, double-checking all information, and staying informed about the latest customs regulations. The response concludes by emphasizing the significance of understanding and complying with ISF filing requirements to avoid financial and operational consequences.

#usimportbond #isfcustomsbroker #uscustomsclearing #isfentry

Video Disclaimer Here: This tutorial is independent and not affiliated with any US governmental entities.

1:16 - Failure to comply with ISF filing requirements can lead to significant penalties issued by CBP for inaccurate or incomplete information.

1:51 - Importers are responsible for ISF filing and must ensure accurate information within the required timeframe to avoid penalties.

2:29 - Use technology solutions and software to automate and streamline the ISF filing process.

2:57 - Regularly verify all information to avoid penalties for minor errors or omissions.

3:19 - Stay informed about customs regulations by checking CBP's website, attending industry seminars, and consulting with customs brokers.

3:36 - Compliance with ISF filing is crucial for importers in international trade to avoid financial and operational consequences.

4:06 - Follow for more informative videos on customs brokerage, customs bonds, and related topics. Like and subscribe for notifications about upcoming videos.

-

4:24

4:24

ISF Depot

1 day agoDemystifying ISF and Entry Summary Filing: A Guide for Importers

2 -

1:13:16

1:13:16

JULIE GREEN MINISTRIES

2 hours agoLIVE WITH JULIE

38.6K134 -

LIVE

LIVE

JuicyJohns

1 hour ago🟢#1 REBIRTH PLAYER 10.2+ KD🟢

101 watching -

19:37

19:37

BlaireWhite

1 day agoWe Need To Talk About The Trans Shooter, "Robin" Westman.

5148 -

12:22

12:22

Chad Prather

14 hours agoFinding God’s Timing in a World of Pressure

3.85K2 -

LIVE

LIVE

The Pete Santilli Show

2 hours agoMORNING STREAM Tuesday September 9, 2025 💣 THE PETE SANTILLI SHOW & SANTILLI REPORT (Monday 9/8)

476 watching -

LIVE

LIVE

The Chris Salcedo Show

12 hours agoWhat Does The Data & Science Say?

422 watching -

20:14

20:14

Jasmin Laine

17 hours agoSHOCKING SLIP-UP: Liberals Accidentally CONFIRM Oil & Gas PHASE-OUT

35.1K24 -

38:14

38:14

The Official Corbett Report Rumble Channel

1 day agoWar Is A Crime

10.6K23 -

2:02:17

2:02:17

BEK TV

1 day agoTrent Loos in the Morning - 9/09/2025

10.6K