Premium Only Content

Ep. 3 | The Federal Reserve Series | What's Happened to the Dollar in Your Pocket?

Is your dollar holding its value? Check out my latest episode on The Federal Reserve where I break down 100+ years of inflation with exclusive charts from my book A Working Man's Guide: Strong Values, Strong Life, Strong Legacy.

Let me know what you think, folks.

Transcript:

Hello, welcome America. Welcome back to A Working Man's Guide. We're going into the notion of sound money and the role of The Federal Reserve. So, let's go back into the notion of stable purchasing power. That's a critical component.

The way you look at that is to look at a price index, basically a measure of inflation. Do similar costs of goods? Does it stay the same over time, or does it increase through price increases? We have a very good measurement, consumer and producer price indexes that we use today. Let's take a look at those, and we'll get a good sense of where we stand and what's been happening in our country.

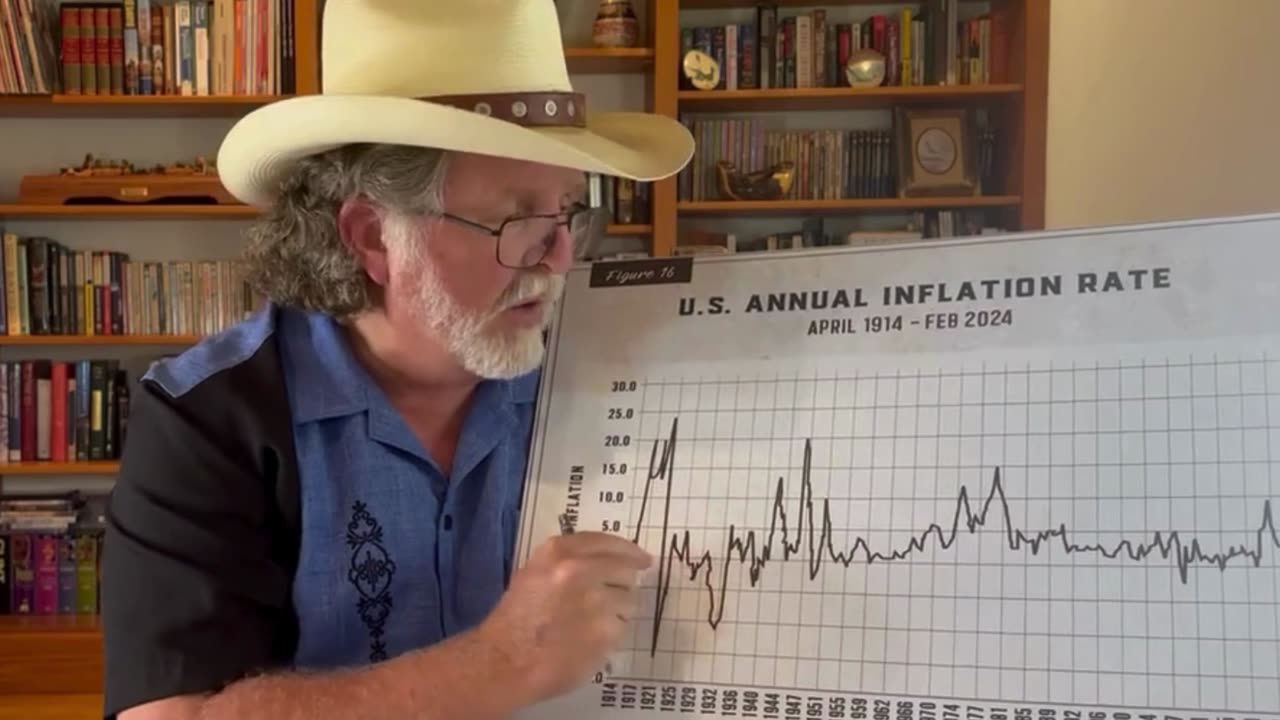

So here we have a time series from 1914 to February of 2024, in this chart. And this is also a Figure 16 in my book, A Working Man's Guide. You can find that in the appendix figure 16, it lays out the data, and you can source that. But first of all, let's look at an overview, and let's start with the good news. You can see, back in the early 1900s we had a great deal of volatility. In fact, over quite a bit of time, even through the 1980s a lot of volatility.

The overall story here is that we are getting better. Our money is more stable. If you look at this, center line around 0.0 that means there is 0% inflation. Prices are flat year over year. That's a very good thing. That should be your policy target. That's what you want. No change in general prices from one time period to the next. That means we can focus on value. The dollar in your pocket has similar purchasing power today as what it did a year ago, etc. And we we are getting better. That's the good news. Things are getting more stable over time, so we're improving, but we have a long ways to go.

Just look at this point out here on the far right. That's not good. We'll dig into that more next time thank you very much. Take care.

-

DVR

DVR

Stephan Livera

2 days agoDay 2 - Stephan Livera hosts Plan B Podcast in Lugano

45 -

DVR

DVR

vivafrei

15 hours agoLive from Lugano Plan B in Switzerland w/ Efrat Fenigson and Prince Filip Karađorđević!

44.1K1 -

46:40

46:40

Bitcoin Infinity Media

1 day ago $5.29 earnedBitcoin Infinity Academy at Plan B Forum 2025

22.4K1 -

18:12:15

18:12:15

Side Scrollers Podcast

1 day ago🔴SIDE SCROLLERS SUB-A-THON🔴FINAL DAY!🔴Craig Makeover + US Dart Throw + More!

559K31 -

2:05:58

2:05:58

TimcastIRL

12 hours agoSHOTS FIRED, Leftists ATTACK Coast Guard & Feds In SHOCK Terror Attack | Timcast IRL

262K188 -

1:07:25

1:07:25

Man in America

18 hours agoThe BRICS War on the Dollar Just Hit Endgame—What's Next Changes EVERYTHING

57K16 -

3:23:45

3:23:45

SOLTEKGG

9 hours ago🔴LIVE - Community Game Night - GIVEAWAY

44.6K2 -

8:22:30

8:22:30

SpartakusLIVE

11 hours ago#1 Friday Night HYPE, viewers GLUED to the screen

69.8K -

55:50

55:50

NAG Podcast

10 hours agoAda Lluch: BOLDTALK W/Angela Belcamino

36.3K2 -

2:45:31

2:45:31

VapinGamers

7 hours ago $17.43 earnedKellan Graves - Fallen - Game Review and Game KeyGiveaway - !rumbot !music

34.5K