Premium Only Content

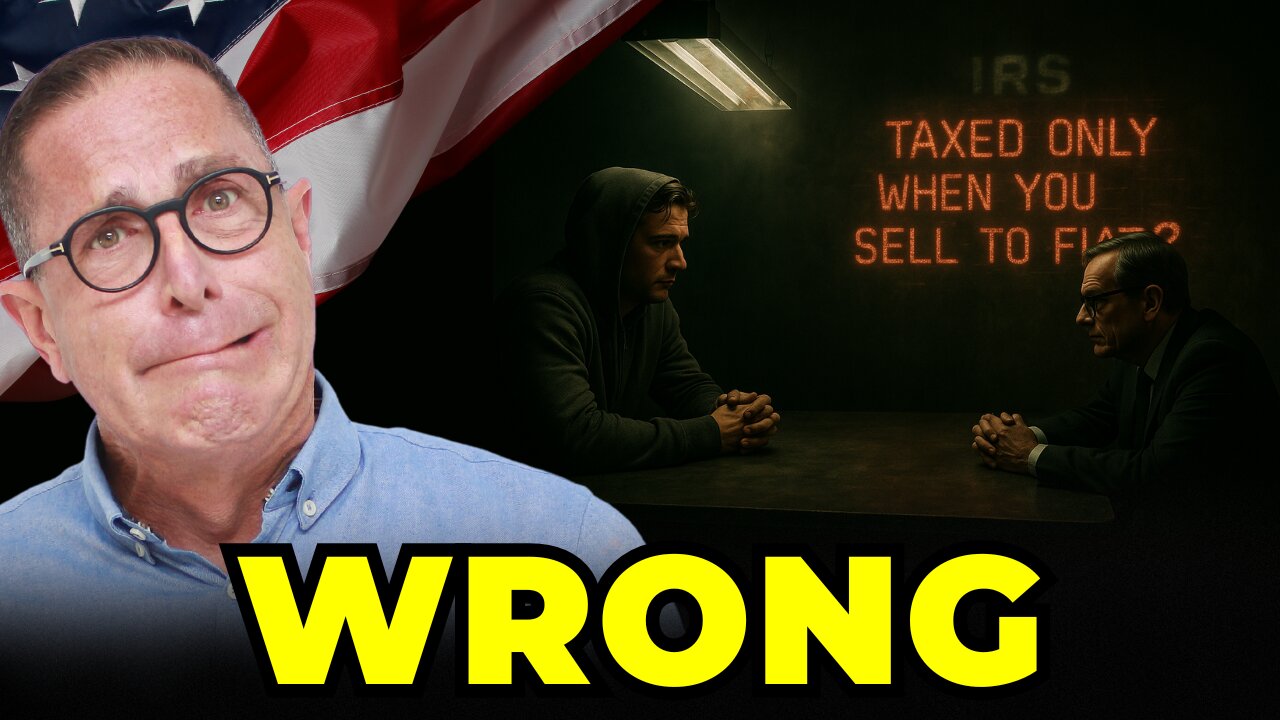

The Greatest Misconception US Crypto Traders Have About Taxes 🇺🇸

What is the greatest misconception US crypto traders have?

That you’re only taxed when you cash out to fiat. That’s just wrong.

In this video, we break down one of the most misunderstood crypto tax rules in the U.S.:

➡️ Every crypto swap, exchange, or stablecoin trade can be a taxable event

➡️ The IRS doesn’t care if you cashed out — they care if you gave up ownership

➡️ Staking and airdrops are considered income on the day you receive them

➡️ Selling junk coins before year-end can save you thousands

Whether you’re trading memecoins, farming airdrops, or just DCA'ing on Coinbase, this info could protect you from a surprise IRS tax bill in 2025.

💥 Don’t let a misconception wreck your tax season.

📘 Learn how to file crypto taxes the right way (even without a 1099):

https://www.youtube.com/playlist?list=PLlRL1XYAzH0lQlqJ4XIhHassQZHKGFVQK

🔔 Subscribe for more crypto tax facts, IRS warnings, and gain-saving strategies.

#CryptoTax #CryptoTrader #IRS #1099DA #CryptoGains #StakingTax #CryptoAirdrop #CryptoLosses #DeFiTax #CryptoTaxAudit

▬▬▬▬▬ SPONSOR ▬▬▬▬▬

🐋 Sponsor: CryptoTaxAudit

CryptoTaxAudit is the ultimate solution for ensuring your crypto taxes are precise and fully compliant with the latest regulations. With expert guidance and support, you can avoid costly penalties and enjoy complete peace of mind. Don't take any chances with your hard-earned assets. Become an IRS Guard Dog member today and take control of your financial future! Visit CryptoTaxAudit.com today.

Visit 👉 https://www.cryptotaxaudit.com/?afmc=yt

▬▬▬▬▬ NOTICE ▬▬▬▬▬

⚠️ 𝗕𝗘𝗪𝗔𝗥𝗘 𝗢𝗙 𝗦𝗖𝗔𝗠𝗠𝗘𝗥𝗦 𝗜𝗡 𝗢𝗨𝗥 𝗖𝗢𝗠𝗠𝗘𝗡𝗧𝗦 𝗔𝗡𝗗 𝗖𝗢𝗠𝗠𝗨𝗡𝗜𝗧𝗬 𝗖𝗛𝗔𝗡𝗡𝗘𝗟𝗦

We will never ask you for your personal information on social media. Beware of people masquerading as our host, guests, or sponsor company.

📜 Disclaimer

The content in this video is for educational and entertainment purposes only. While we aim to provide accurate and up-to-date information about cryptocurrency taxation, this is not intended as legal, tax, or financial advice. Always consult with a qualified tax professional to ensure compliance with IRS regulations and accurate reporting of your cryptocurrency transactions.

Related Search Terms: do you pay taxes when swapping crypto, is crypto taxed if I don't cash out, crypto to crypto taxable event, common crypto tax mistakes, IRS rules for crypto 2025, how crypto is taxed in the US, capital gains crypto 2025, how to avoid crypto tax penalties, crypto tax myths debunked, do staking rewards count as income, airdrop tax rules IRS, when does crypto become taxable, how to report crypto trades on taxes

-

8:34

8:34

The Clinton Donnelly Show

17 days agoPuerto Rican Act 60 Explained: How to Pay 0% Capital Gains Tax (Legally)

29 -

2:16:43

2:16:43

TheSaltyCracker

4 hours agoIt's Over Zelensky ReeEEStream 11-21-25

64.3K115 -

LIVE

LIVE

Drew Hernandez

21 hours agoMIKE HUCKABEE EXPOSED FOR OFF RECORD MEETING WITH CONVICTED ISRAELI SPY?

1,003 watching -

LIVE

LIVE

SynthTrax & DJ Cheezus Livestreams

14 hours agoFriday Night Synthwave 80s 90s Electronica and more DJ MIX Livestream SYNTHWAVE / ANIME NIGHT

203 watching -

14:25

14:25

Tactical Advisor

12 hours agoReal Life John Wick Suit | Grayman & Company

11.8K2 -

LIVE

LIVE

I_Came_With_Fire_Podcast

12 hours agoAlien Enemies Act | Dismantling the Department of Education | Valhalla VFT & America First

200 watching -

19:53

19:53

MetatronHistory

3 hours agoRome VS Greece - Ultimate Clash of Civilizations Explained

7.74K2 -

33:09

33:09

Exploring With Nug

5 hours ago $2.84 earnedThey Weren’t Ready for Nightfall on Blood Mountain… So I Helped Them Down

27.7K1 -

1:16:42

1:16:42

Sarah Westall

4 hours agoBoardroom and Government Infiltration: The Silent Erosion of American Power w/ Mike Harris

16.4K2 -

LIVE

LIVE

JahBlessCreates

1 hour ago🎉WE BACK!! MUSIC | VIBES | GAMES

22 watching