Premium Only Content

Ep. 20 | The National Debt Series | The Economic Principle You Need to Know

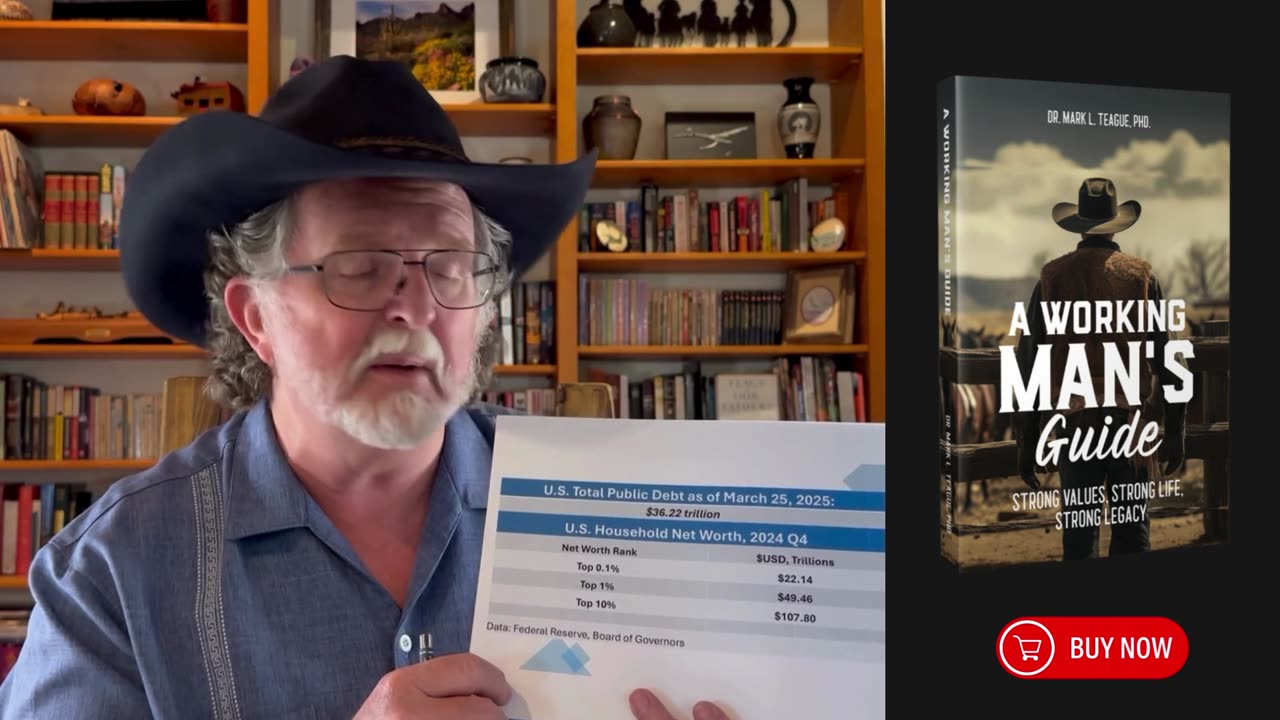

You can’t tax your way out of $36 trillion. Confiscating private property won’t fix the debt—it will destroy the economy. Let's review THE economic principle we can’t afford to ignore.

Transcript:

Hello. Dr Mark. L. Teague, welcome to A Working Man's Guide. So we're exploring this idea of taxing household wealth to solve the national debt.

Well, we looked at the top two groups before let's look at the top 10% there is about $108 trillion in that group. So you could spread it out. I mean, you only need about a third of what they have. Well, you still have the same problem, though, that that wealth is in company shares, in companies. It's engaged in production. It's in personal assets. It's in private property. You're going to completely reshape and essentially destroy the American economy.

And here's another problem, you only get to do that once you solve the debt. Well, the debt doesn't go away. It's continuing to accumulate. We've added over a trillion dollars in the last year. We haven't solved anything. So you've wrecked to the economy. You've not solved a thing. There is no solution, ladies and gentlemen, other than going back to the basic Maxim, we need to make our own money and pay our own bills, we've accumulated this debt 36 trillion by trying to pay each other's bills. That has to stop.

Here's where we have to understand an iron clad rule, a deep, abiding principle within economics that can't be compromised. If you look at the things that are required for a free market to prosper, for people to find prosperity, for household well being to increase, there's something at the bottom of that that you must have, and that is secure private property rights. There is no substitute for that. it's a must have. If you destroy those you destroy our ability to create wealth, that's an ironclad principle. So we must honor those, they must be intact for the United States to be a prosperous nation. Thank you very much.

-

2:03:41

2:03:41

TimcastIRL

5 hours agoTrump To Deploy National Guard To Chicago, Federal TAKEOVER Begins | Timcast IRL

199K162 -

2:52:40

2:52:40

PandaSub2000

10 hours agoLIVE 10pm ET | SILENT HILL F w/TinyPandaFace

22.6K1 -

1:26:00

1:26:00

Glenn Greenwald

11 hours agoNick Fuentes On Censorship, Charlie Kirk's Assassination, Trump's Foreign Policy, Israel/Gaza, the Future of the GOP, and More | SYSTEM UPDATE #523

122K325 -

5:49:04

5:49:04

StevieTLIVE

6 hours ago#1 Kar98 Warzone POV Monday MOTIVATION

18.3K1 -

4:45:45

4:45:45

a12cat34dog

6 hours agoTHE *NEW* SILENT HILL :: SILENT HILL f :: IS IT GOOD!? {18+}

16K3 -

1:00:21

1:00:21

Akademiks

4 hours agonba youngboy live show.

47.6K2 -

2:51:15

2:51:15

The Quartering

4 hours agoThey Just Stopped Another Attack, Trump Defeats Youtube, Hasan PIker Meltdown & More

62.1K42 -

2:03:20

2:03:20

megimu32

4 hours agoOn The Subject: Football Movies of the 90s & 2000s

13.2K3 -

2:55:20

2:55:20

Technically Mexican

4 hours agoI Play Hollow Knight: SILKSONG! #18

7.88K -

3:12:55

3:12:55

SlingerGames

3 hours agoMega Monday | Skate and More

5.4K