Premium Only Content

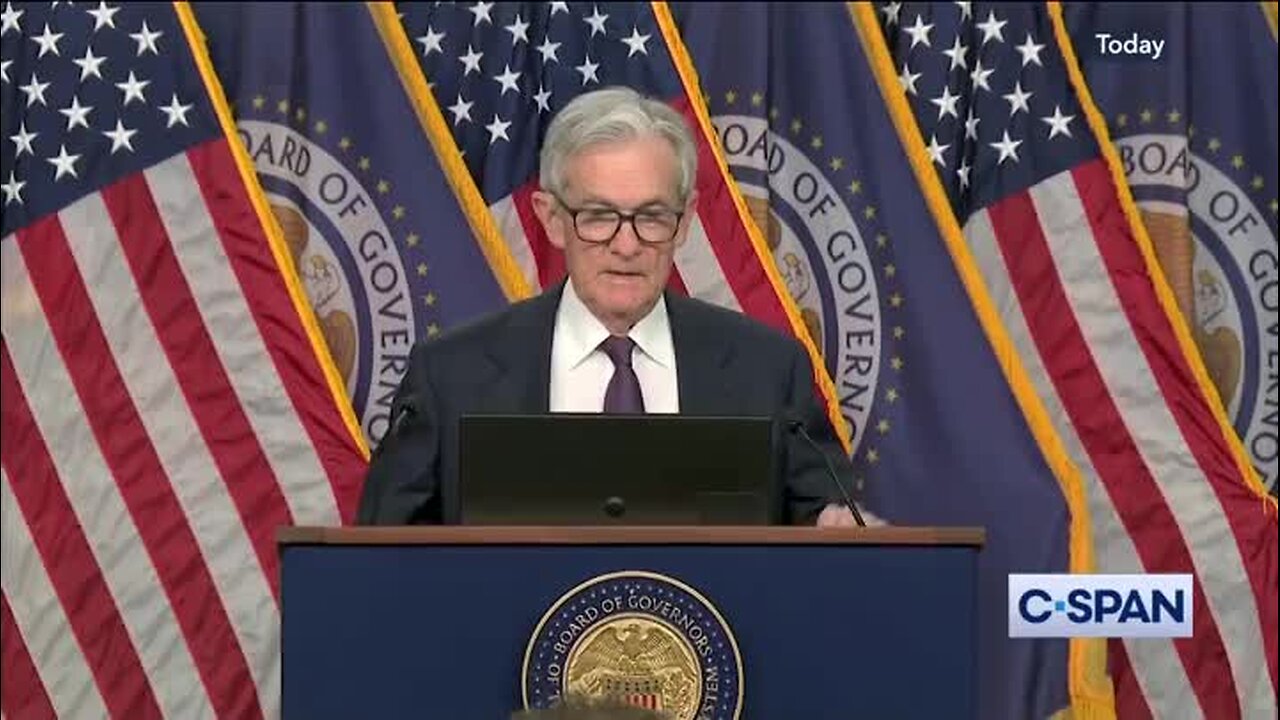

Jerome Powell Announces Fed Will Leave Interest Rates Unchanged: ‘Despite Heightened Uncertainty, the Economy Is Still in a Solid Position’

Powell: “My colleagues and I remain squarely focused on achieving our dual mandate goals of maximum employment and stable prices for the benefit of the American people. Despite heightened uncertainty, the economy is still in a solid position. The unemployment rate remains low and the labor market is at or near maximum employment. Inflation has come down a great deal but has been running somewhat above our 2 percent longer run objective. In support of our goals, today the Federal Open Market Committee decided to leave our policy interest rate unchanged. The risks of higher unemployment and higher inflation appear to have risen and we believe that the current stance of monetary policy leaves us well positioned to respond in a timely way to potential economic developments. I will have more to say about monetary policy after briefly reviewing economic developments. Pardon me. Following growth of 2.5 percent last year, GDP was reported to have edged down in the first quarter, reflecting swings in exports that were likely driven by businesses bringing in imports ahead of potential tariffs. This unusual swing complicated GDP measurement last quarter. Private domestic final purchases or PDFP, which excludes net exports, inventory investment and government spending, grew at a solid 3 percent rate in the first quarter. The same as last year’s pace. Within PDFP, growth of consumer spending moderated, while investment in equipment and intangibles rebounded from weakness in the fourth quarter. Surveys of households and businesses, however, report a sharp decline in sentiment and elevated uncertainty about the economic outlook largely reflecting trade policy concerns. It remains to be seen how these developments might affect future spending and investment. In the labor market, conditions have remained solid. Payroll job gains averaged 155,000 per month over the past three months. The unemployment rate at 4.2 percent remains low and has stayed in a narrow range for the past year. Wage growth has continued to moderate while still outpacing inflation. Overall, a wide set of indicators suggests that conditions in the labor market are broadly in balance and consistent with maximum employment. The labor market is not a source of significant inflationary pressures. Inflation has eased significantly from its highs in mid-2022, but remains somewhat elevated relative to our 2 percent longer run goal.”

-

0:46

0:46

Grabien

15 hours agoDem Comms Boss Floors Meet the Press Panel By Saying She’s ‘Very Excited About the Possibility’ Kamala Harris May Run Again

19 -

2:50:47

2:50:47

TimcastIRL

4 hours agoFOOD STAMPS OVER, Ending Nov 1, Food RIOTS May Spark Trump INSURRECTION ACT | Timcast IRL

206K93 -

2:18:46

2:18:46

Tucker Carlson

5 hours agoTucker Carlson Interviews Nick Fuentes

78.3K348 -

LIVE

LIVE

Drew Hernandez

14 hours agoCANDACE OWENS CALLS CHARLIE KIRK STAFF INTO QUESTION?

1,344 watching -

47:03

47:03

Barry Cunningham

7 hours agoPRESIDENT TRUMP MEETS WITH THE PRIME MINISTER OF JAPAN!! AND MORE NEWS!

39.8K28 -

1:18:29

1:18:29

Flyover Conservatives

23 hours agoThe Dollar Devaluation Playbook: Gold, Bitcoin… and the “Genius Act” - Andy Schectman | FOC Show

30.4K3 -

LIVE

LIVE

SpartakusLIVE

7 hours agoWZ Tonight || Battlefield 6 BATTLE ROYALE Tomorrow!

303 watching -

3:25:11

3:25:11

megimu32

4 hours agoON THE SUBJECT: Halloween Nostalgia! LET’S GET SPOOKY! 👻

27.2K1 -

1:24:56

1:24:56

Glenn Greenwald

6 hours agoThe Unhinged Reactions to Zohran's Rise; Dems Struggle to Find a Personality; DHS, on Laura Loomer's Orders, Arrests UK Journalist and Israel Critic | SYSTEM UPDATE #538

118K76 -

4:36:02

4:36:02

Spartan

6 hours agoBack from worlds. Need a short break from Halo, so single player games for now

22K