Premium Only Content

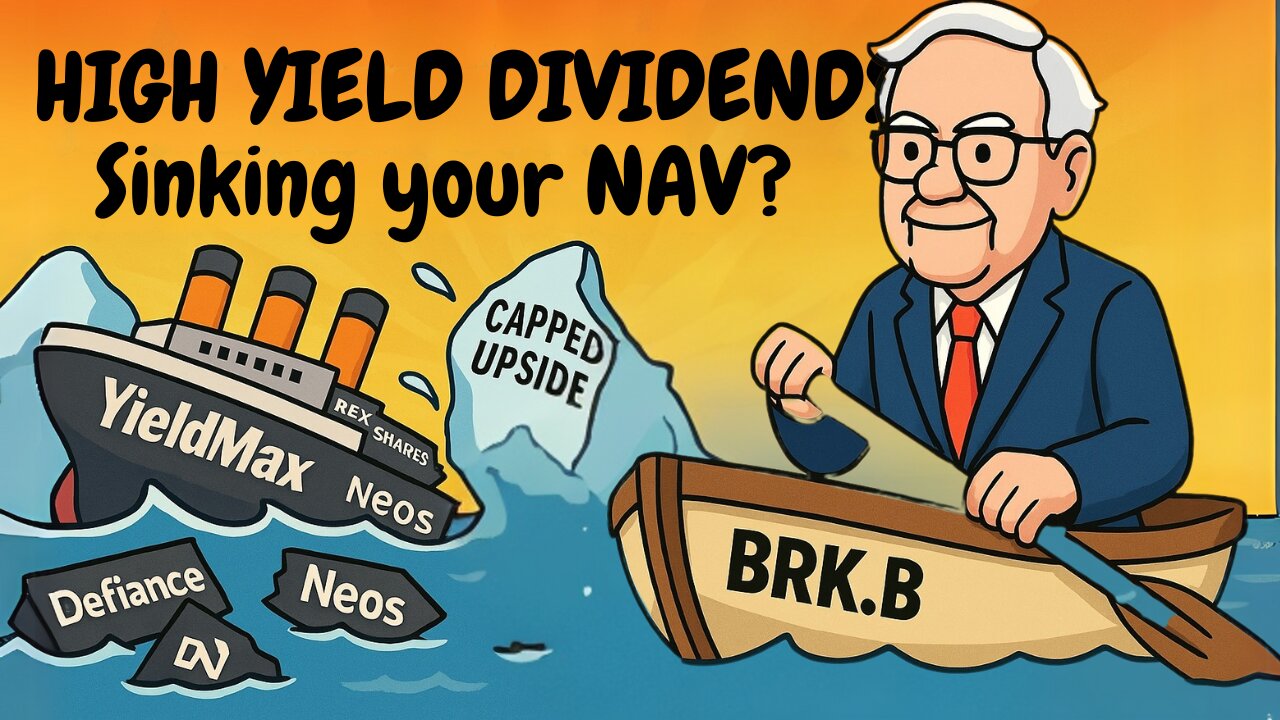

How BRK.B Can Hedge Risk in YieldMax, REX, Defiance, KURV, and Neos ETFS etc...

Everyone wants high yield. But what happens when the market dips and your income ETFs hit their cap?

In this video, we break down why BRK.B — Berkshire Hathaway’s Class B stock — could be the smartest hedge in your high-income portfolio.

You’ll learn:

The hidden risks of YieldMax, REX Shares, Defiance, and NEOS funds

Why “capped upside” can sink total returns

How BRK.B offers uncapped equity growth, drawdown resilience, and value exposure

What Buffett’s top holdings reveal about long-term wealth preservation

Don’t wait for the tide to go out. See who’s been swimming naked — and how to avoid it.

Disclaimer: This is my personal journey, and markets can change, and results can vary drastically. Also, I have only been in these for a short period of time, who is to say it would continue to work out. Disclaimer: I am NOT a financial advisor. This is for entertainment purposes only. Please speak with a financial advisor, accountant, and lawyer and do your own due diligence before making any investment decisions. Please use your own judgment and take your own risks when investing. Past performance is not indicative of future gains.

The content may be incorrect, inaccurate, contain errors, subject to interpretation, situational, or not hold up in the long term.

-

4:02:20

4:02:20

Nerdrotic

17 hours ago $29.88 earnedKimmel MELTDOWN | Hollywood Boycotts Disney | Friday Night Tights 372 with Kaida

134K22 -

34:08

34:08

Bannons War Room

11 hours agoMEGYN KELLY: Jimmy Kimmel and Sore Cultural Losers, and Charlie Kirk's Spiritual Revival, w/ Bannon

97K93 -

59:27

59:27

NAG Podcast

12 hours agoBrandon Straka: BOLDTALK with Angela Belcamino

88.2K13 -

59:43

59:43

Sarah Westall

10 hours agoVietnam Shuts down 86 Million Bank Accounts, The Fourth Turning & more w/ Andy Schectman

67.3K17 -

1:17:51

1:17:51

Flyover Conservatives

17 hours agoMary Flynn O’Neill and Clay Clark: The Church Must Rise or America Falls | FOC Show

66.3K12 -

3:36:01

3:36:01

I_Came_With_Fire_Podcast

19 hours agoThe Global ANTIFA Connection You've Never Heard Of | The Israel Question

54.2K18 -

16:38

16:38

RTT: Guns & Gear

1 day ago $6.50 earnedExtar EP9 Review: The Best Budget 9mm PCC?

64.1K6 -

7:53

7:53

Rethinking the Dollar

20 hours agoMass Firings in Tech: The Real Agenda Behind 166,000 Cuts

65.9K18 -

1:02:28

1:02:28

BonginoReport

14 hours agoFeds Monitor Threats Ahead of Kirk Memorial - Nightly Scroll w/ Hayley Caronia (Ep.138)

272K160 -

55:51

55:51

Candace Show Podcast

13 hours agoWho Moved The Camera Right Above Charlie's Head? | Candace Ep 239

129K694