Premium Only Content

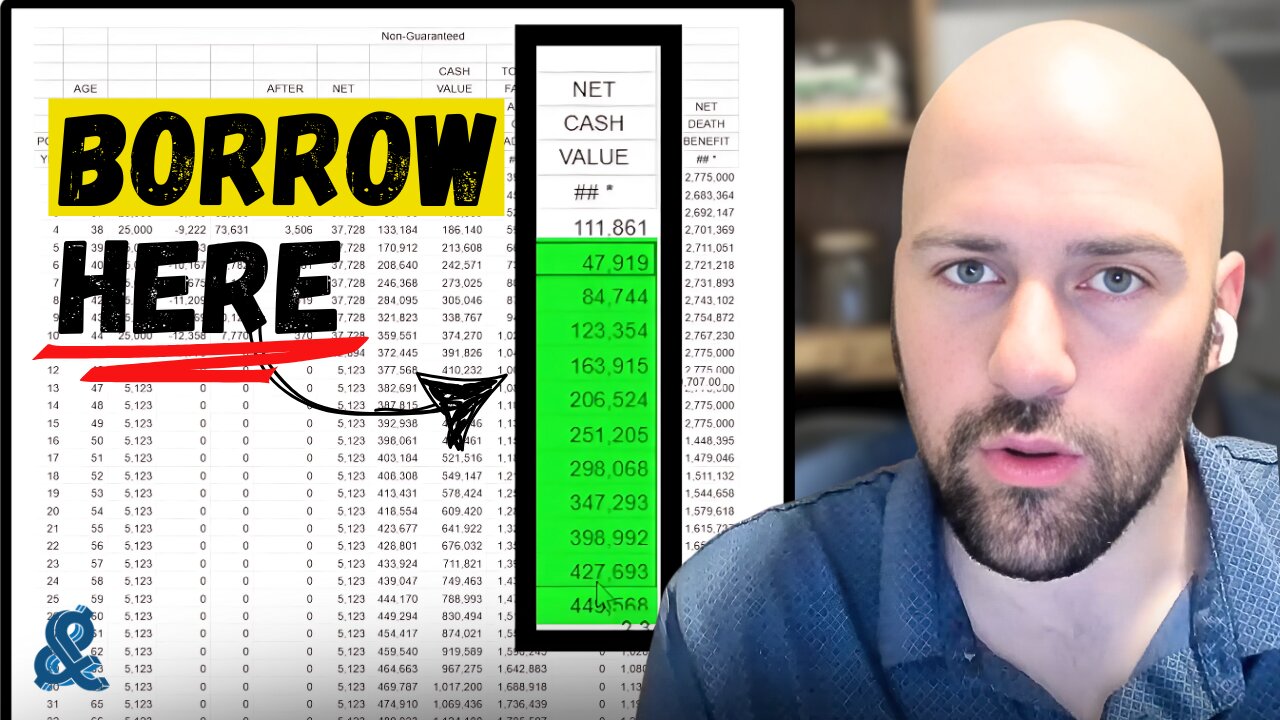

When Should You Borrow Against Your Life Insurance?

Should you borrow against your life insurance or just use cash? In this video, we unpack when it actually makes sense to take a policy loan, whether you’re really “paying yourself back,” how borrowing compares to using cash or saving, and the key advantages of leveraging uninterrupted compounding through high cash value life insurance. We’ll break down real examples, clear up common misconceptions, and help you understand the smartest ways to use your life insurance policy.

Want Us To Review Your Life Insurance Policy? Click Here: https://bttr.ly/yt-policy-review

Learn More About the And Asset: https://bttr.ly/andasset

00:00 Introduction

0:12 Borrowing Against Cash Value

1:00 The Comparison: Debtors vs. Savers

4:11 Leveraging Life Insurance for Growth

8:11 When to Borrow Against Your Policy

11:12 Best Use Case Of A Policy

10:13 Am I Paying Back the Interest to Myself or Not?

14:40 Maximizing Opportunities with Policy Loans

14:51 Real-Life Application of Policy Loans

DISCLAIMER: https://bttr.ly/aapolicy

*This video is for entertainment purposes only and is not financial or legal advice.

Financial Advice Disclaimer: All content on this channel is for education, discussion and illustrative purposes only and should not be construed as professional financial advice or recommendation. Should you need such advice, consult a licensed financial or tax advisor. No guarantee is given regarding the accuracy of information on this channel. Neither host or guests can be held responsible for any direct or incidental loss incurred by applying any of the information offered.

-

2:24:32

2:24:32

vivafrei

10 hours agoEp. 284: Ostrich Crisis Continues! Kirk Updates! Fed-Surrection Confirmed? Comey Indicted! AND MORE!

90.8K116 -

LIVE

LIVE

IsaiahLCarter

9 hours ago $1.65 earnedAntifa Gets WRECKED. || APOSTATE RADIO 030 (Guests: Joel W. Berry, Josie the Redheaded Libertarian)

337 watching -

2:43:09

2:43:09

putther

4 hours ago $4.80 earned⭐ GTA ONLINE BOUNTIES THEN GTA IV ❗

44.2K6 -

LIVE

LIVE

EricJohnPizzaArtist

6 days agoAwesome Sauce PIZZA ART LIVE Ep. #63: Charlie Sheen

120 watching -

6:31:38

6:31:38

GritsGG

7 hours agoQuad Win Streaks!🫡 Most Wins in WORLD! 3600+

52.4K1 -

1:20:13

1:20:13

Sports Wars

12 hours agoCollege Football UPSETS, MLB Playoff Drama, NFL Week 4

98.3K13 -

LIVE

LIVE

Spartan

4 hours agoOMiT Spartan | Watching TSM 5K with chat + Black Myth Wukong + Ranked on Infinite Maybe

65 watching -

![🔴[LIVE] Sept RCP #27💜 [English Chat] 😍DGG-a-Thon! Forever Skies maybe other game later ....💜](https://1a-1791.com/video/fwe2/ee/s8/1/0/t/e/m/0temz.0kob-small-LIVE-Sept-RCP-27-English-Ch.jpg) LIVE

LIVE

Deaf Gamer Girl

3 hours ago🔴[LIVE] Sept RCP #27💜 [English Chat] 😍DGG-a-Thon! Forever Skies maybe other game later ....💜

7 watching -

1:00:24

1:00:24

Jeff Ahern

10 hours ago $7.43 earnedThe Sunday Show with Jeff Ahern

65.5K15 -

4:30:10

4:30:10

OhHiMark1776

7 hours ago🟢 09-28-25 ||||| Act 3 Continue ||||| Baldur's Gate 3 (2023)

45.4K4