Premium Only Content

Survey reveals growing acceptance of frugality among Americans

Being “frugal” is ‘in’ according to a majority of Americans.

A survey of 2,000 Americans split evenly by generation and gender found that 61% agree that it’s less tacky to be “frugal” today than it was 10 years ago.

In fact, the word no longer holds a harsh connotation, as respondents were likeliest to say that it’s about being careful with money (46%) and avoiding unnecessary spending (43%) as opposed to being “cheap” (23%).

Moreover, nearly three-quarters of those surveyed agree that being honest and open about being on a budget is more socially acceptable today (72%), and respondents are even getting crafty with saving money.

Conducted by Talker Research on behalf of banking app Chime in honor of Financial Progress Month, the survey found that the definition of “financial progress” is unique for everyone. For Gen Z, it means being able to purchase whatever they want at the grocery store (32%), while for millennials, it’s more about finding ways to grow the money they already have (31%).

For the older generations, that definition expands to include having money left over after paying bills and expenses, or simply being able to put money into their savings.

Still, for 43% of all Americans polled, “financial progress” simply means being in a better position than they were a year ago.

Putting that to the test, the survey found that 43% believe their financial situation is generally better today than five years ago, while fewer (29%) said the exact opposite.

Gen Z, interestingly, was the likeliest to say that they’re doing better (55%), while baby boomers are the likeliest to say they’re doing worse (38%).

For some, these bumps in the road may have them turning to loved ones for support; but despite it becoming more socially acceptable, those conversations don’t come easy.

Americans would rather talk to friends about who they supported politically in the election (26%), medical concerns (19%) and how often they shower (18%) before they share how much money is in their bank account.

On the other hand, those from Gen X (14%) and baby boomers (9%) admitted they’d rather gossip about other people’s children before telling their friends how much money they have.

Debt is a sore spot, particularly, as one in five would rather talk to their co-workers about weight loss or dieting (20%), their religious views (18%) or politics (18%).

More than one in 10 Gen Z (14%) and millennials (13%) would even rather discuss their digestive issues over debts.

"Money has long been a taboo topic, but that’s changing. More people are realizing that open conversations about budgeting, saving, and financial challenges are key to building confidence and making informed decisions,” said Chime Chief Spending Officer, Janelle Sallenave. “We believe that being comfortable talking about finances — just like any other life goal — helps people take control of their financial future and support one another along the way."

Even where they have their own sensitive topics, half of younger Americans think that the older generations are too private about their finances (51%) — and they may be right.

One in six of all respondents expressed feeling less comfortable about “money talks” in the past five years, including 20% of baby boomers.

Still, 45% of all of those surveyed are more open to having candid conversations about money today than five years ago.

Respondents who have had an easier time with money talks said that they’ve found they get better advice by being open (42%), that they’re not ashamed of their struggles (25%) and that these talks lead to better money habits (32%).

In fact, only 13% of Gen Z wouldn’t be comfortable asking their friends and family questions such as “How much money should I have in savings?” or “What is a 401(k)?” compared to 44% of Gen X and an astounding 64% of baby boomers.

On the flip side, Americans struggle with these candid conversations not because they don’t know what to ask but because they say they are worse off financially than they used to be (33%).

Others believe that they should be in a better position than they are (31%) or are flat out embarrassed by their situation (29%).

Who are respondents finding financial solace in? While nearly a third of Americans would go to their parents first if they needed $100 (31%), they’d sooner lend it to their partner (34%) or best friend (31%).

But Americans are vying to pay it back. According to the results, being able to treat your family and friends is a top sign of “making it” financially (40%), second only to having more money in their savings than their checking account (49%).

"Younger generations are pushing for more transparency around money, and for good reason — open conversations lead to better financial habits and smarter decisions,” added Sallenave. “We're seeing this shift reflected in recent social media trends which encourage people to talk more openly about their finances. Breaking the silence helps people gain insights, reduce stress, and build healthier relationships with money. The more we talk about it, the more we can learn from one another!"

Survey methodology:

Talker Research surveyed 4,000 Americans evenly split by gender and generation; the survey was commissioned by Chime and administered and conducted online by Talker Research between March 13 and 21, 2025.

We are sourcing from a non-probability frame and the two main sources we use are:

● Traditional online access panels — where respondents opt-in to take part in online market research for an incentive

● Programmatic — where respondents are online and are given the option to take part in a survey to receive a virtual incentive usually related to the online activity they are engaging in

Those who did not fit the specified sample were terminated from the survey. As the survey is fielded, dynamic online sampling is used, adjusting targeting to achieve the quotas specified as part of the sampling plan.

Regardless of which sources a respondent came from, they were directed to an Online Survey, where the survey was conducted in English; a link to the questionnaire can be shared upon request. Respondents were awarded points for completing the survey. These points have a small cash-equivalent monetary value.

Cells are only reported on for analysis if they have a minimum of 80 respondents, and statistical significance is calculated at the 95% level. Data is not weighted, but quotas and other parameters are put in place to reach the desired sample.

Interviews are excluded from the final analysis if they failed quality-checking measures. This includes:

● Speeders: Respondents who complete the survey in a time that is quicker than one-third of the median length of interview are disqualified as speeders

● Open ends: All verbatim responses (full open-ended questions as well as other please specify options) are checked for inappropriate or irrelevant text

● Bots: Captcha is enabled on surveys, which allows the research team to identify and disqualify bots

● Duplicates: Survey software has “deduping” based on digital fingerprinting, which ensures nobody is allowed to take the survey more than once

It is worth noting that this survey was only available to individuals with internet access, and the results may not be generalizable to those without internet access.

-

1:43

1:43

SWNS

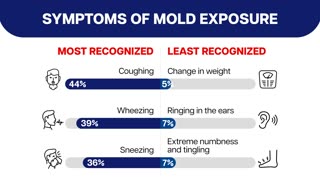

5 days agoNearly half of homes in US may have hidden mold

19 -

7:13

7:13

China Uncensored

18 hours agoChina’s Military Is Out of Control. Can This INSANE Plan Stop It?

5.35K8 -

1:46

1:46

WildCreatures

17 days ago $0.52 earnedButterfly risks its life to drink crocodile tears in the Pantanal

5.13K5 -

24:38

24:38

Professor Nez

17 hours agoTrump Just SHOOK the Democrats to the CORE with THIS MOVE!

19.8K12 -

14:16

14:16

Actual Justice Warrior

3 days agoManhattan DA Says It's Okay To ATTACK Pro Life Activists

20.4K29 -

5:31

5:31

Buddy Brown

1 day ago $3.79 earnedJames Comey Forgot This Video EXISTS! | Buddy Brown

24.4K13 -

20:47

20:47

James Klüg

1 day agoAsking Democrats What Ended The Border Crisis Vol. 3

21.8K34 -

18:09

18:09

Forrest Galante

1 day agoI Survived 24 Hours In The World's Deadliest Jungle

171K21 -

15:23

15:23

GritsGG

16 hours agoBad Start Leads to Ultimate Warzone Victory w/ Bobby Poff!

12.5K1 -

2:03:56

2:03:56

Side Scrollers Podcast

20 hours agoSmash Pro DEMANDS “Woke Echo Chamber” + EA SOLD To Saudis + More | Side Scrollers

54K9