Premium Only Content

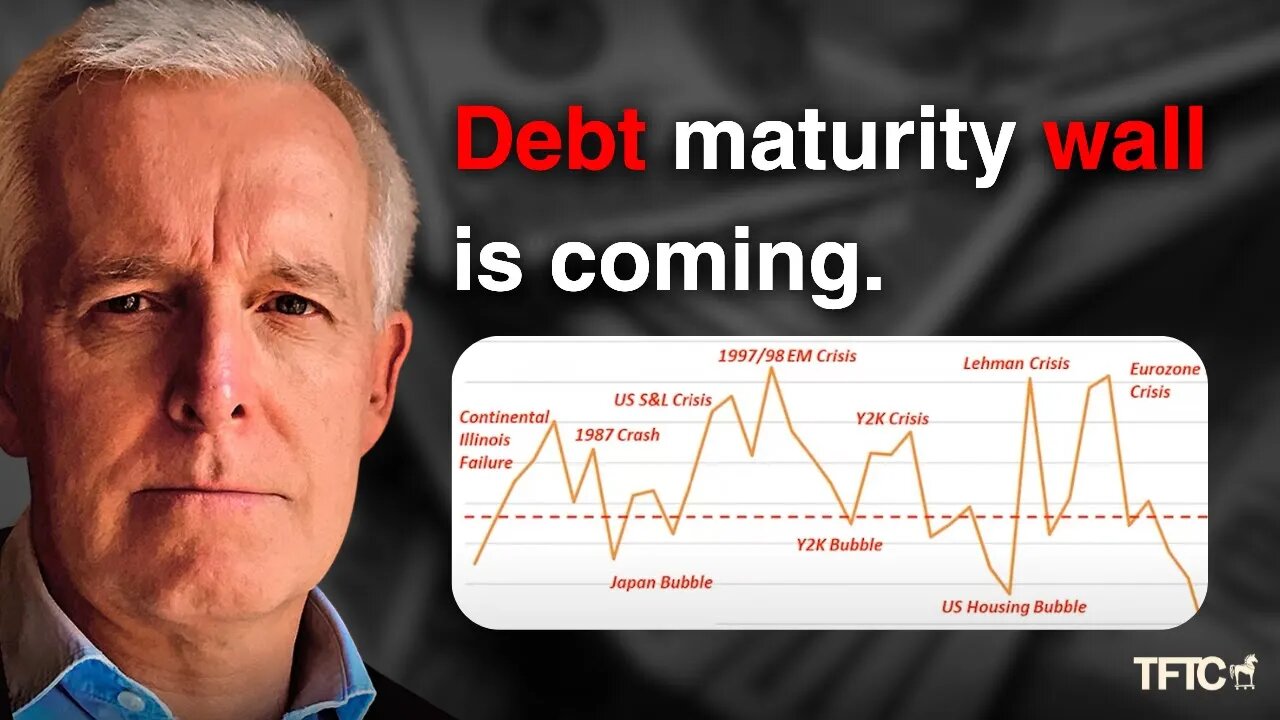

Collateral Crisis: Why 77% of Global Lending Is Now Teetering on Edge - Michael Howell

Michael Howell analyzes the global financial system's vulnerabilities, focusing on the critical debt-to-liquidity ratio approaching danger levels. He explains why traditional economic measures miss the real risks of a refinancing crisis as COVID-era debt comes due at higher rates. The discussion covers China's strategic gold purchases, Treasury Secretary Bessent's refinancing challenges, and investor positioning at historically defensive levels. Howell outlines how monetary devaluation is the likely path forward and considers Bitcoin's role as a hedge against currency debasement in an increasingly unstable monetary system.

Crossborder Capital on Twitter: https://x.com/crossbordercap

Capital Wars Substack: https://capitalwars.substack.com/

Shoutout to our sponsors:

Fold

https://foldapp.com/marty

Bitkey

https://bit.ly/TFTCBitkey20

Unchained

https://unchained.com/tftc/

Zaprite

https://zaprite.com/tftc

Salt of the Earth

https://drinksote.com/tftc

0:00 - Intro

0:39 - Is liquidity crunch incoming

6:16 - Explaining the crisis

16:15 - Fold & Bitkey

17:57 - The Fed’s ineffective measures

20:47 - Powell/Trump standoff and China selling

28:20 - Unchained Evernt

29:45 - Digging out with better assets

34:52 - Bessent's reset & BitBonds

40:04 - Weimar & gold

45:29 - Cutting red tape

50:01 - Clear skies beyond the storm

Join the TFTC Movement:

Main YT Channel

https://www.youtube.com/c/TFTC21/videos

Clips YT Channel https://www.youtube.com/channel/UCUQcW3jxfQfEUS8kqR5pJtQ

Website

https://tftc.io/

Twitter

https://twitter.com/tftc21

Instagram

https://www.instagram.com/tftc.io/

Nostr

https://primal.net/tftc

Follow Marty Bent:

Twitter

https://twitter.com/martybent

Nostr

https://primal.net/martybent

Newsletter

https://tftc.io/martys-bent/

Podcast

https://www.tftc.io/tag/podcasts/

-

1:28:47

1:28:47

TFTC

13 days agoThe Bitcoin Code Change Coming in 2025: What You Need to Know

2321 -

LIVE

LIVE

Benny Johnson

55 minutes agoSHOCK: Massive Food Stamp FRAUD Exposed: 59% of Welfare are Obese Illegal Aliens!? Americans RAGE…

3,775 watching -

LIVE

LIVE

Wendy Bell Radio

5 hours agoAmerica Deserves Better

7,141 watching -

22:01

22:01

DEADBUGsays

1 hour agoDEADBUG'S SE7EN DEADLY HALLOWEENS

4.49K1 -

LIVE

LIVE

Total Horse Channel

12 hours ago2025 IRCHA Derby & Horse Show - October 31st

52 watching -

1:10:29

1:10:29

Chad Prather

14 hours agoStanding Holy in a Hostile World

44.9K21 -

LIVE

LIVE

LFA TV

13 hours agoLIVE & BREAKING NEWS! | FRIDAY 10/31/25

2,468 watching -

1:04:43

1:04:43

Crypto Power Hour

13 hours ago $5.98 earnedCrypto Price Swings Explained — What Every Investor Needs to Know

45.9K7 -

21:31

21:31

Clownfish TV

23 hours agoOG YouTube is Officially ENDING! Employees Offered BUYOUTS?! | Clownfish TV

21.6K32 -

5:54

5:54

Gun Owners Of America

20 hours agoThe Virginia Election Could Shift The Balance of Power Nationwide

29.9K5