Premium Only Content

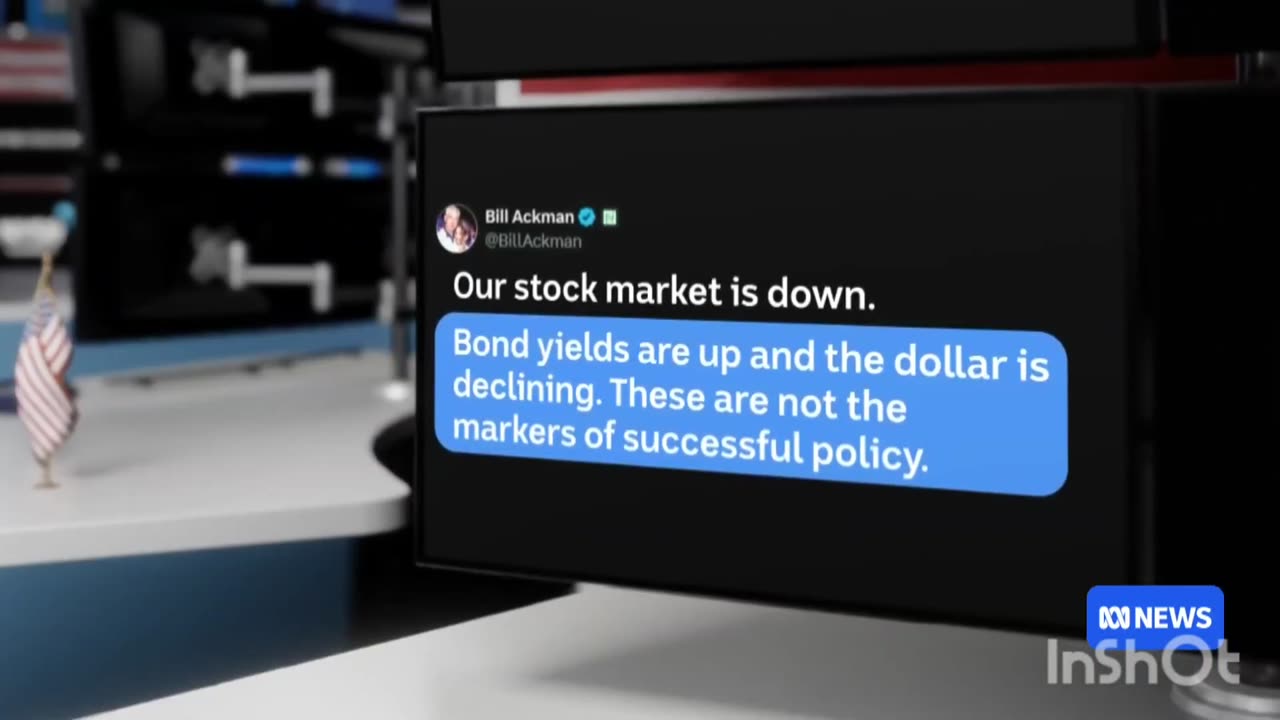

Why Trump's tariffs triggered a 'huge lack of faith' in US bonds | The Business |

Trillions of dollars flowed back into Wall Street, after a tariff backflip from the White House. The benchmark S&P 500 index posted its best one-day gain since October 2008 with a 9.5 per cent rise, while the tech heavy Nasdaq Composite surged 12.2 per cent, driven by the Magnificent Seven stocks with Tesla, with NVIDIA Corp and Apple leading the gains. Australian stocks increased in value by almost $120 billion, as the local sharemarket posted its best one-day gain since 2020. The benchmark ASX 200 index surged 4.5 per cent to 7,710 points, while the broader All Ordinaries index jumped 4.7 per cent to 7,914 points. However, market analysts are generally warning that investors should expect more extreme volatility until the tariff situation is finally resolved. Mr Trump called a 90 day reprieve on his tariff war and slashed the tax to just 10 per cent for all nations except China. For weeks, he's shrugged aside an unrelenting fall on Wall Street as stocks dived on the prospect of lower growth, a spike in inflation and the growing chance of a recession. But on Tuesday, after weeks of discontent, the real power players on financial markets took action. In an unprecedented attack on America's global financial dominance, they began

#viral #news #trump #tariffs

-

1:09:42

1:09:42

Mike Rowe

7 days agoHow Did THIS Dirty Job Make Tommy Mello A Billionaire?! | #447 | The Way I Heard It

88.6K20 -

2:01:37

2:01:37

MG Show

18 hours agoTrump Says Soros Should be Charged with RICO; Bill Gates Pulls Out of Arabella Advisors

12.9K26 -

1:19:55

1:19:55

TruthStream with Joe and Scott

1 day agoLisa, Michelle and Carole join Joe for Healing and Inspiration. Next healing will be on Aug 28th at Noon and 4pm eastern https://www.balancingbodyandsoul.com/?ref=TRUTHSTREAMSHOW

3.54K1 -

1:14:00

1:14:00

Steve-O's Wild Ride! Podcast

6 days ago $1.88 earnedLilly Singh Talks S*x Education With Steve-O | Wild Ride #264

17.7K3 -

52:48

52:48

Futures Edge: Finance Unfiltered with Jim Iuorio and Bob Iaccino

1 day ago $1.34 earnedTrump’s Latest Initiatives Explained

18.9K -

4:36:31

4:36:31

FreshandFit

9 hours agoAfter Hours w/ Girls

69.8K112 -

2:04:11

2:04:11

Side Scrollers Podcast

18 hours agoCracker Barrel CANCELS Rebrand + OG YouTuber Has Brain Tumor + More | Side Scrollers IN STUDIO

33.1K5 -

19:26

19:26

GritsGG

10 hours agoChat Picked My Hair Color! All Pink Loadout & Operator Challenge!

9.99K3 -

1:27:34

1:27:34

TruthStream with Joe and Scott

3 days agoArchitect Richard Gage: 911 truths and more #482

16.3K3 -

3:47:17

3:47:17

The Pascal Show

19 hours ago $1.80 earnedBREAKING! Mass Shooting At Annunciation Church In Minneapolis Multiple Shot

25K7