Premium Only Content

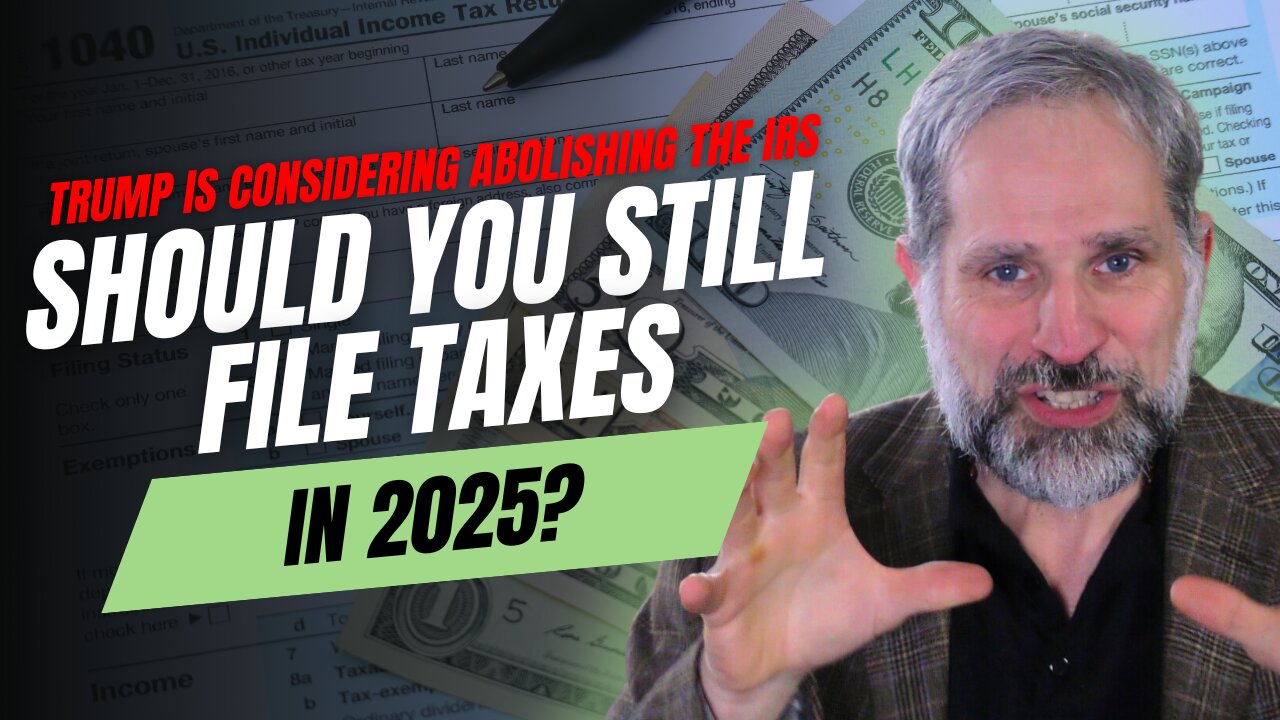

Don’t Risk Your Cash! Should You Skip Filing Taxes in 2025 with IRS Abolition Rumors Swirling?

Donald Trump dropped a bombshell on Joe Rogan: he might kill the IRS, calling it a “stupid mistake.” My last video—seen by over 750,000—broke down how he could do it without Congress lifting a finger. Now the big question: should you file your 2025 taxes if the IRS might vanish? I’m Anthony Parent, a tax attorney with 20 years in the game. Full disclosure: my firm makes money prepping taxes, but I’m shifting to probate law—so this isn’t just about my bottom line.

Here’s the deal: if you’re owed a refund, file. You’ve got three years from the due date to claim it—skip it, and that money’s gone. Owe the IRS instead? You could wait. Filing late might dodge penalties if Trump pulls the trigger and the IRS implodes. First-time offenders can often get penalty relief anyway—just don’t expect mercy if you’ve dodged taxes before. Criminal risk? Slim to none. The IRS indicts under 1,000 people a year for evasion, and they chase fraud, not late filers. Plus, their backlog means you’d likely skate through 2025 unnoticed.

Why file at all? FAFSA needs it for aid, and business partners might sue if you slack on fiduciary duties. My take: grab your refund now, or delay filing if you owe—say, late 2025 or early 2026—and see if Trump delivers. Want to play it safe? Hit up www.irsmedic.com/help for expert help navigating this chaos.

Laws could shift, so talk to a pro. Smash that like button, follow for more tax bombshells, and share if you’re ready to ditch the IRS with me!

-

1:35:02

1:35:02

The Quartering

2 hours agoNuclear Fallout From Jimmy Kimmel Firing, New Head Of TP USA, Obama Whines

179K53 -

23:35

23:35

Jasmin Laine

1 hour ago“We Were Betrayed”—Carney HUMILIATED As His Base REVOLTS Against Him

4.15K2 -

LIVE

LIVE

The HotSeat

1 hour agoChapter 32 Begins: Honoring Charlie Kirk’s Legacy & Jimmy Kimmel Gets Canceled

793 watching -

![[Ep 751] Jimmy Kimmel – You’re Fired! | Freedom of Speech is Not Freedom From Consequence](https://1a-1791.com/video/fww1/bd/s8/1/e/-/h/j/e-hjz.0kob-small-Ep-751-Jimmy-Kimmel-Youre-F.jpg) LIVE

LIVE

The Nunn Report - w/ Dan Nunn

1 hour ago[Ep 751] Jimmy Kimmel – You’re Fired! | Freedom of Speech is Not Freedom From Consequence

294 watching -

1:28:39

1:28:39

Sean Unpaved

4 hours agoBills-Dolphins TNF Battle, Steelers' D in Crisis, & Coaching Hot Seat Alert!

33.6K1 -

59:58

59:58

Human Events Daily with Jack Posobiec

3 hours agoHUMAN EVENTS DAILY WITH JACK POSOBIEC

30.8K31 -

1:12:48

1:12:48

LindellTV

2 hours agoTHE MIKE LINDELL SHOW: JIMMY KIMMEL SUSPENDED

24.8K5 -

1:57:27

1:57:27

The Charlie Kirk Show

4 hours agoMegyn Kelly Remembers Charlie + Jimmy Kimmel Off the Air | 9.18.2025

307K98 -

DVR

DVR

SternAmerican

1 day agoElection Integrity Call – Thurs, Sept 18 · 2 PM EST | Featuring Rhode Island

31K2 -

4:22

4:22

Michael Heaver

4 hours agoLabour Face Brutal UK WIPEOUT

28.9K5