Premium Only Content

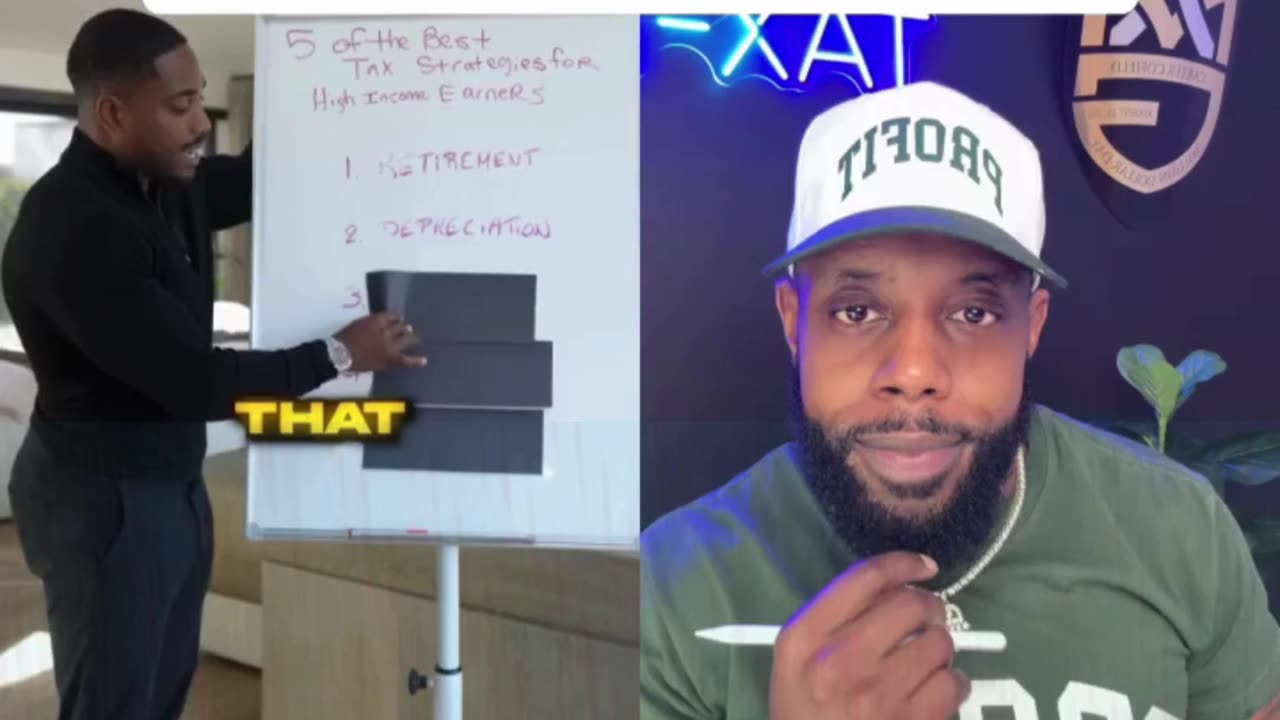

💡 “5 Best Tax Strategies for High-Income Earners” 💰📉

💡 “5 Best Tax Strategies for High-Income Earners” 💰📉

Making money is one thing — keeping it is the real flex.

The wealthy don’t avoid taxes… they use strategies built into the system. 🧠⚖️

Here’s how high earners legally lower their tax bill:

1️⃣ Max Out Retirement Accounts 🧾📆

401(k), IRA, SEP — defer taxes, grow wealth, and protect future income.

Tax-deferred is tax-smart. 💼

2️⃣ Use Depreciation Wisely 🏢

Business equipment, vehicles, even software — it all loses value on paper = huge write-offs. 🧾⚙️

3️⃣ Real Estate Depreciation = Cash Flow Magic 🏠

You can earn rental income while showing a paper loss.

Depreciation + cost segregation = game-changer. 💸📉

4️⃣ Give Through Philanthropy ❤️

Charitable giving = lower taxable income and social impact.

Set up a Donor-Advised Fund for long-term giving power. 🙌

5️⃣ Invest in Oil & Gas ⛽

High-risk, high-reward — but the deductions are elite.

Direct write-offs against active income, even bonus depreciation. 🔥📊

⚡️High income should mean high strategy — not high taxes.

🔥 Learn how to protect and grow your money like the wealthy at dreamers2profit.com

Earn 10% quarterly and master tax-efficient investing. 💼📈

#TaxStrategy #Dreamers2Profit #HighIncomeEarners #SmartMoneyMoves #WealthProtection #PassiveIncome #OilAndGasInvesting #RealEstateWealth #RetirementStrategy #TaxPlanning 📉💡💰

-

LIVE

LIVE

Game On!

17 hours agoBREAKING NFL NEWS: Taylor Swift and Travis Kelce Are Engaged!

4,914 watching -

1:02:09

1:02:09

The Confessionals

20 hours agoThe Supernatural Proof You Can’t Ignore (When Angels and Demons Showed Up) | Lee Strobel

20.7K14 -

15:24

15:24

Degenerate Jay

20 hours ago $0.11 earned5 Best Moments In Batman: Arkham Asylum

2.64K -

12:24

12:24

The Shannon Joy Show

14 hours ago🔥From Flock Cameras to Palantir: America’s Expanding Digital Cage🔥

4.52K2 -

LIVE

LIVE

BEK TV

23 hours agoTrent Loos in the Morning - 8/27/2025

223 watching -

LIVE

LIVE

The Bubba Army

22 hours agoTaylor Swift & Travis Kelce ENGAGED! - Bubba the Love Sponge® Show | 8/27/25

1,820 watching -

40:14

40:14

Uncommon Sense In Current Times

17 hours ago $1.70 earnedThe Dating Crisis in America | J.P. De Gance on the Church’s Role in Restoring Family & Faith

36.2K3 -

12:35

12:35

Red Pill MMA

19 hours agoNow We Know The Truth.. Hero Who Stopped Raja Jackson Speaks Out

10.4K8 -

41:04

41:04

Coin Stories with Natalie Brunell

1 day agoCooking, Culture & Crypto: Norma Chu’s Food Empire Turns Bitcoin Treasury

11.6K -

8:03

8:03

MattMorseTV

18 hours ago $8.87 earnedThings in the UK just got INSANE...

92K138