Premium Only Content

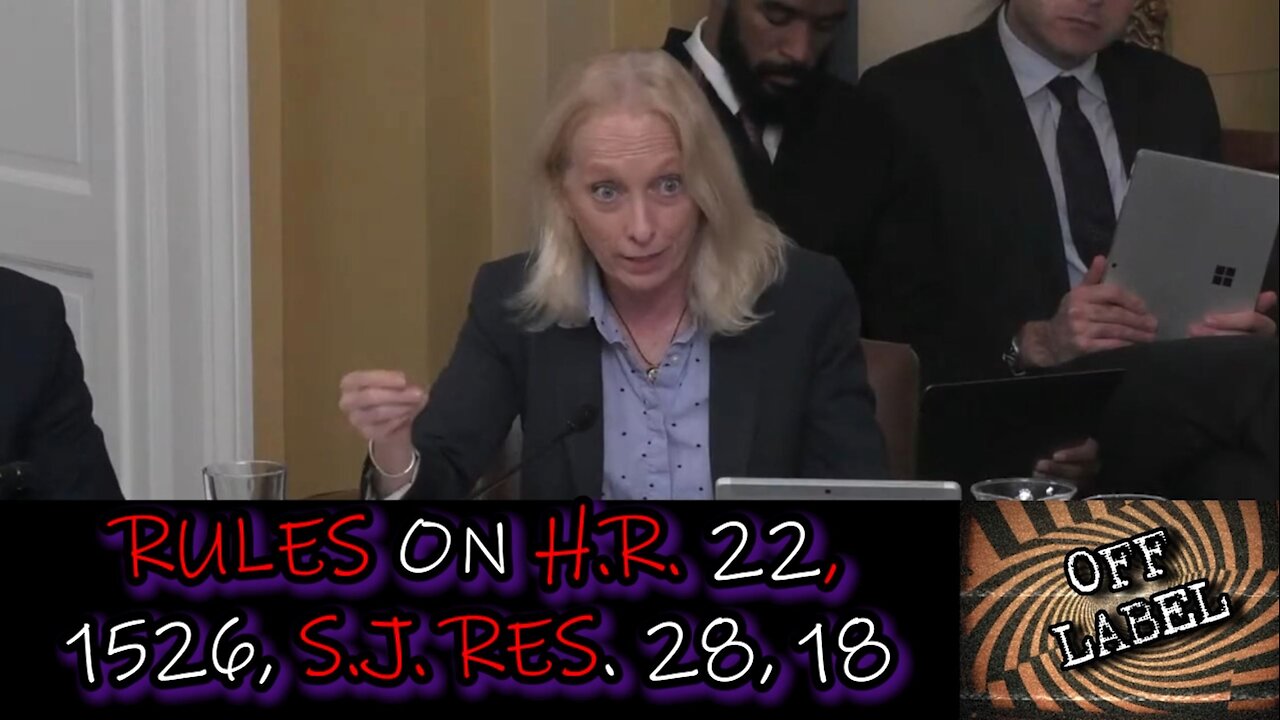

House Rules Democrats Argue Why Proof Of Citizenship Is Bad For Voting

H.R.22 - SAVE Act

This bill requires individuals to provide documentary proof of U.S. citizenship when registering to vote in federal elections.

Specifically, the bill prohibits states from accepting and processing an application to register to vote in a federal election unless the applicant presents documentary proof of U.S. citizenship. The bill specifies what documents are considered acceptable proof of U.S. citizenship, such as identification that complies with the REAL ID Act of 2005 that indicates U.S. citizenship.

Further, the bill (1) prohibits states from registering an individual to vote in a federal election unless, at the time the individual applies to register to vote, the individual provides documentary proof of U.S. citizenship; and (2) requires states to establish an alternative process under which an applicant may submit other evidence to demonstrate U.S. citizenship.

Each state must take affirmative steps on an ongoing basis to ensure that only U.S. citizens are registered to vote, which shall include establishing a program to identify individuals who are not U.S. citizens using information supplied by certain sources.

Additionally, states must remove noncitizens from their official lists of eligible voters.

The bill allows for a private right of action against an election official who registers an applicant to vote in a federal election who fails to present documentary proof of U.S. citizenship.

The bill establishes criminal penalties for certain offenses, including registering an applicant to vote in a federal election who fails to present documentary proof of U.S. citizenship.

https://www.congress.gov/bill/119th-congress/house-bill/22

_______

All Information (Except Text) for H.R.1526 - NORRA of 2025

To amend title 28, United States Code, to limit the authority of district courts to provide injunctive relief, and for other purposes.

https://www.congress.gov/bill/119th-congress/house-bill/1526/all-info

_______

S.J.Res.28 - A joint resolution disapproving the rule submitted by the Bureau of Consumer Financial Protection relating to "Defining Larger Participants of a Market for General-Use Digital Consumer Payment Applications".

This joint resolution nullifies the final rule issued by the Consumer Financial Protection Bureau (CFPB) titled Defining Larger Participants of a Market for General-Use Digital Consumer Payment Applications and published on December 10, 2024. The rule defines larger participants in the general-use digital consumer payment application market (i.e., payment apps) that are subject to CFPB supervisory authority. The rule defines larger participants in this market as nonbanks (1) with an annual volume of at least 50 million transactions, and (2) that are not small business concerns.

https://www.congress.gov/bill/119th-congress/senate-joint-resolution/28

_________

S.J.Res.18 - A joint resolution disapproving the rule submitted by the Bureau of Consumer Financial Protection relating to "Overdraft Lending: Very Large Financial Institutions".

This joint resolution nullifies the final rule issued by the Consumer Financial Protection Bureau titled Overdraft Lending: Very Large Financial Institutions and published on December 30, 2024. The rule revises provisions regarding charges for insufficient funds in a customer’s bank account (i.e., overdrafts) at very large financial institutions. Under the rule, these institutions must (1) cap overdraft charges at $5; (2) with justification, cap charges at a higher amount; or (3) handle overdrafts as credit and comply with applicable Truth in Lending Act disclosure requirements.

https://www.congress.gov/bill/119th-congress/senate-joint-resolution/18

Follow us on Rumble: https://rumble.com/c/offlabel

-

2:25:55

2:25:55

Off Label Podcast

10 days ago $0.23 earnedChuck Schumer Roasted By John Oliver. The Baileys NEVER EXISTED!

4121 -

34:51

34:51

The Brett Cooper Show

1 day ago $1.15 earnedWhy Are Men STILL Invading Women’s Spaces? | Episode 59

5.76K11 -

54:32

54:32

The Why Files

11 days agoAsteroid Apophis is Coming | Ground Zero: California

50.2K183 -

LIVE

LIVE

GritsGG

1 day ago36 Hour Stream! Most Wins 3420+ 🧠

6,278 watching -

57:18

57:18

Dialogue works

1 day ago $0.23 earnedAndrei Martyanov: NATO is being demilitarized

110K19 -

LIVE

LIVE

FyrBorne

11 hours ago🔴Warzone M&K Sniping: Sniping Challenges

266 watching -

11:18

11:18

Dr Disrespect

1 day agoDr Disrespect: THE BEST AND WORST OF GAMESCOM 2025

84.8K13 -

2:08:25

2:08:25

Side Scrollers Podcast

21 hours agoEXCLUSIVE: Marty O’Donnell BREAKS SILENCE On Bungie Drama + Kotaku Hypocrisy + MORE | Side Scrollers

31.7K5 -

3:24:29

3:24:29

Wahzdee

4 hours agoBack on BF2042 – Which Sniper Is Actually Worth It?

3.07K -

2:31:49

2:31:49

MattMorseTV

21 hours ago $0.72 earned🔴Trump's Oval Office BOMBSHELL.🔴

39.7K57