Premium Only Content

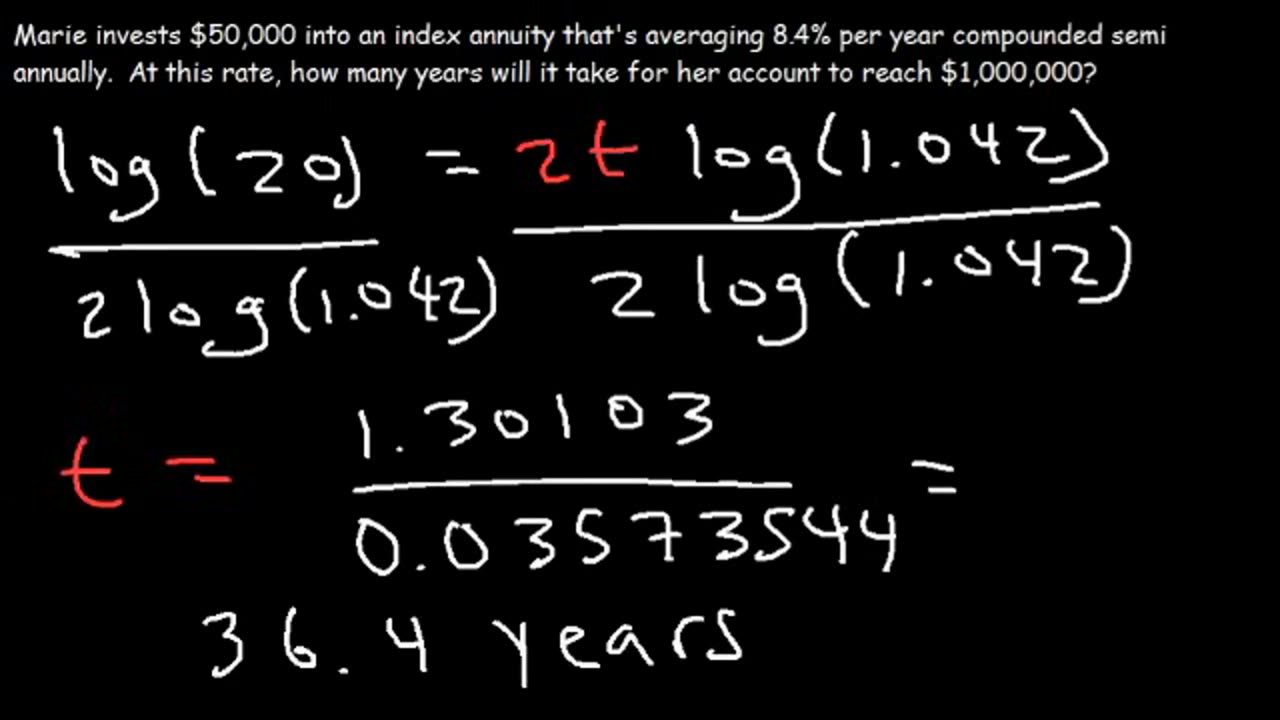

Calculating compound interest.

Calculating compound interest."""Calculating compound interest."""

It's not just simple addition, folks. We're talking about interest *earning* interest. Think of it as your money making little baby money, and then *that* baby money making even *more* money!

The magic formula is this:

A = P (1 + r/n)^(nt)

Where:

* **A** is the future value of the investment/loan, including interest

* **P** is the principal investment amount (the initial deposit or loan amount)

* **r** is the annual interest rate (as a decimal)

* **n** is the number of times that interest is compounded per year

* **t** is the number of years the money is invested or borrowed for

Let's break it down with an example. Say you invest $1,000 (P = 1000) at an annual interest rate of 5% (r = 0.05) compounded annually (n = 1) for 10 years (t = 10).

Plugging that into our formula:

A = 1000 (1 + 0.05/1)^(1*10)

A = 1000 (1 + 0.05)^10

A = 1000 (1.05)^10

A = 1000 * 1.62889462678

A = $1628.89 (approximately)

So, after 10 years, your initial $1,000 would grow to approximately $1,628.89. That extra $628.89? That's the power of compound interest, baby! Now, if that interest was compounded monthly (n = 12), you'd see an even *better* return. Give it a try with n = 12 in the formula. You'll see the difference. Get compounding!Now, let's talk about why understanding compound interest is like having a financial superpower. Knowing how this works lets you make smarter choices about your savings, investments, and even loans.

Think about it: the more frequently your interest is compounded (that's your 'n' value, remember?), the faster your money grows. Daily compounding (n = 365) is generally better than monthly (n = 12), which is better than annually (n = 1). Of course, the difference might seem small at first, but over long periods, those little gains add up BIG time.

On the flip side, when *borrowing* money, understanding compound interest is crucial for avoiding nasty surprises. Credit card companies LOVE compound interest. If you only pay the minimum each month, a huge chunk of your payment goes towards interest that's compounding daily or monthly. That debt can snowball FAST. Knowing this helps you prioritize paying down high-interest debt quickly.

So, whether you're saving for retirement, investing in the stock market, or taking out a loan, take the time to understand the power of compound interest. It's the difference between letting your money work *for* you or working *for* your money! Get that 'n' value working in your favor!

"""

-

9:26

9:26

MattMorseTV

1 day ago $20.90 earnedPam Bondi is in HOT WATER.

18.6K148 -

13:46

13:46

Nikko Ortiz

13 hours agoYour Humor Might Be Broken...

17.5K2 -

2:20:13

2:20:13

Side Scrollers Podcast

18 hours agoVoice Actor VIRTUE SIGNAL at Award Show + Craig’s HORRIBLE Take + More | Side Scrollers

49.4K13 -

18:49

18:49

GritsGG

14 hours agoI Was Given a Warzone Sniper Challenge! Here is What Happened!

10K -

19:02

19:02

The Pascal Show

1 day ago $1.74 earnedNOT SURPRISED! Pam Bondi Is Lying To Us Again About Releasing The Epstein Files

9.9K6 -

6:05

6:05

Blabbering Collector

18 hours agoRowling On Set, Bill Nighy To Join Cast, HBO Head Comments On Season 2 Of Harry Potter HBO!

12.4K3 -

57:44

57:44

TruthStream with Joe and Scott

2 days agoShe's of Love podcast & Joe:A co-Hosted interview, Mother and Daughter (300,000+Facebook page) Travel, Home School, Staying Grounded, Recreating oneself, SolarPunk #514

27.9K1 -

30:49

30:49

MetatronHistory

1 day agoThe Truth about Women Warriors Based on Facts, Evidence and Sources

28.3K12 -

2:59:08

2:59:08

FreshandFit

13 hours agoA Sugar Baby & A Feminist ALMOST Fight Each Other

259K56 -

6:24:23

6:24:23

SpartakusLIVE

11 hours agoFriday Night HYPE w/ YOUR King of Content

109K1