Premium Only Content

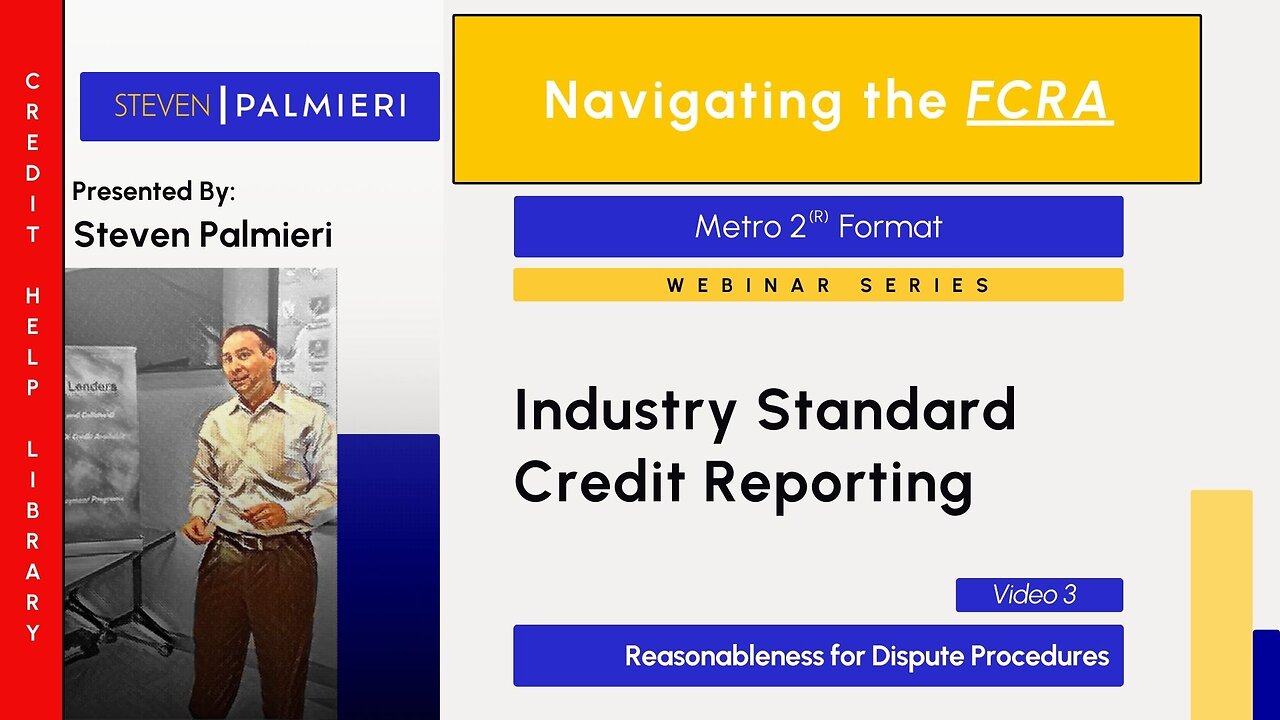

Reasonableness for Dispute Procedures

The video highlights how the Metro 2 industry standard aids in disputing inaccuracies on credit reports under the Fair Credit Reporting Act (FCRA), focusing on the "reasonableness" requirement for dispute procedures. The FCRA mandates that consumer reporting agencies (CRAs) not only maintain reasonable procedures for maximum possible accuracy (as seen in prior discussions) but also conduct reasonable reinvestigations when consumers dispute information. This is outlined in FCRA Section 1681i, the most commonly used dispute pathway, which requires CRAs to reasonably reinvestigate reported errors. The term "reasonable" appears four times in this section, emphasizing its importance.

Metro 2, as an industry standard created and adopted by the credit bureaus, provides a concrete framework for assessing accuracy and identifying errors in credit reports. When disputing inaccuracies, understanding Metro 2 allows consumers to pinpoint deviations from this standard and clearly notify CRAs of specific errors. The video advises against vague disputes or legal accusations (unless one is legally qualified) and instead recommends using Metro 2 to highlight discrepancies. If the CRA fails to correct or delete the erroneous data after being notified, it becomes easier to argue that their reinvestigation procedures were not reasonable, strengthening a case for noncompliance. This approach simplifies the process of reading credit reports, finding errors, and drafting effective dispute letters to CRAs.

-

8:19

8:19

MattMorseTV

11 hours ago $4.94 earnedTrump is ACTUALLY DOING IT.

43.2K37 -

11:30:43

11:30:43

ZWOGs

14 hours ago🔴LIVE IN 1440p! - Tarkov w/ Casey & crgoodw1n, Kingdom Come Deliverance, & More - Come Hang Out!

36.9K5 -

2:30:56

2:30:56

We Like Shooting

18 hours ago $2.71 earnedWe Like Shooting 625 (Gun Podcast)

28K1 -

1:45:02

1:45:02

Glenn Greenwald

8 hours agoIsrael Slaughters More Journalists, Hiding War Crimes; Trump's Unconstitutional Flag Burning Ban; Glenn Takes Your Questions | SYSTEM UPDATE #504

132K178 -

1:29:31

1:29:31

Killerperk

5 hours ago $0.78 earnedRoad to BF6. Come hang out #regiment #bf6

30.2K2 -

4:35:45

4:35:45

Jokeuhl Gaming and Chat

6 hours agoDARKTIDE - Warhammer 40k w/ Nubes Bloobs and AoA

20.9K2 -

7:14:12

7:14:12

Cripiechuccles

7 hours ago😁💚💙MOTA MONDAY WITH CRIPIE💚💙 👌SMOKING, GAMING & WATCHING FLICKS!:😁

16.5K3 -

36:11

36:11

Stephen Gardner

6 hours ago🔥'Burn ALL TRUMP FLAGS’ says Tim Walz + Democrat CAUGHT rigging own election!

25K21 -

10:10

10:10

robbijan

1 day agoHollywood’s Hidden Messages: Predictive Programming & What’s Next

18.3K20 -

40:13

40:13

MattMorseTV

7 hours ago $6.79 earned🔴It's EVEN WORSE than we thought...🔴

33.2K86