Premium Only Content

Token Narratives Ep. 63: Ray Dalio’s 15% Bitcoin Allocation | Sponsor: Bitcoin OS

What happens if crypto natives capitulate into Bitcoin?

The fat protocol thesis fueled two entire crypto cycles -- is it over?

Bitcoin’s Civil War, Death of the Fat Protocol Thesis, Tokenized Stocks | Token Narratives Ep. 59

War, Bitcoin & The Blow-Off Top | Token Narratives Ep. 56

Bitcoin’s Institutional Pivot and Altcoin Anxiety | Token Narratives Ep. 53

From Maximalism to Pragmatism: Bitcoin Vegas Recap | Token Narratives Ep. 54

Pump.fun, Hyperliquid, and the Bitcoin Treasury Era – Token Narratives #55

Crypto’s Biggest Liquidation Ever and ETH’s Existential Crisis | Token Narratives Ep. 38

Are MPC Wallets Better Tech and Will Crypto Regulation Reshape Markets? | Token Narratives Ep. 39

The $LIBRA Scandal, Meme Coin Chaos & Bitcoin’s Super Cycle | Token Narratives Ep. 40

Where we are in the cycle and whether meme coins are cooked | Token Narratives Ep. 41

Trump Signs Bitcoin Strategic Reserve EO | Token Narratives Ep. 42

Bitcoin, Tariffs, and the $5.5 Trillion Crash – What Comes Next? | Token Narratives Ep. 43

QT is ending. Does that mean QE is next?

Will Bitcoin dip more than equities if there's another leg down?

XRP ETF Coming Soon?

Are reciprocal tariffs bullish for Bitcoin?

Magic Money Computers and The Core Illusion of Modern Money

Bitcoin Enters Global Rotation, Corporate Treasury Trend Accelerates | Token Narratives Ep. 45

Liberation Day Analysis: What it Means for Bitcoins | Token Narratives Ep. 46

Disillusionment and Hope in Bitcoin’s Evolution | Token Narratives Ep. 47

Rate Cuts, Trade Wars, and the Altcoin Reckoning | Token Narratives Ep. 48

The Fed’s Balance Sheet Pivot, Magic Money Computers, Macro Chaos, XRP ETF | Token Narratives Ep. 44

Where we are in the cycle and whether meme coins are cooked | Token Narratives Ep. 41

In this episode of Token Narratives, we break down where we are in the market cycle and whether Bitcoin’s recent dip marks a local bottom or signals more pain ahead. We discuss ETF outflows, global liquidity trends, and the MVRV Z-score’s implications for the next move.

The team also dives into meme coin exhaustion—is this just a cooldown before the next wave, or have traders moved on for good? We explore what comes next, from real-world assets to utility tokens, and whether meme coins still have a role to play in the broader crypto ecosystem.

We also analyze El Salvador’s IMF deal and its impact on their Bitcoin strategy. Are they stepping away from BTC, or is Bukele simply playing the long game? Meanwhile, Bybit gets hit with a record-breaking $1.5 billion hack, allegedly tied to North Korea’s Lazarus Group. How does this impact the narrative around crypto security and regulation?

Finally, David shares key takeaways from Consensus Hong Kong—what’s the real sentiment among the builders, and how does it compare to the noise on crypto Twitter? Tune in for all this and more on this week’s Token Narratives.

-

3:19

3:19

Bitcoin.com

2 days agoWhat Is a Bitcoin Node? | How Nodes Keep Bitcoin Decentralized and Secure

535 -

17:22

17:22

Professor Nez

1 hour ago💣BOMBSHELL: The Biden AutoPen Scandal JUST GOT REAL!

4.22K9 -

LIVE

LIVE

I_Came_With_Fire_Podcast

10 hours agoRevelations from the Ukrainian Front Lines

324 watching -

52:56

52:56

X22 Report

6 hours agoMr & Mrs X - Big Pharma Vaccine/Drug Agenda Is Being Exposed To The People - Ep 7

67.1K40 -

1:41:59

1:41:59

THE Bitcoin Podcast with Walker America

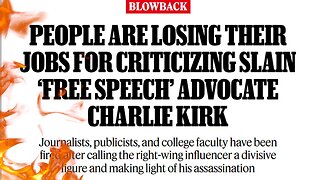

11 hours ago $17.40 earnedThe Assassination of Charlie Kirk | Walker America, American Hodl, Erik Cason, Guy Swann

53.9K32 -

21:33

21:33

marcushouse

5 hours ago $1.19 earnedSpaceX Just Revealed the Plan for Starship Flight 11! 🚀

20.5K9 -

35:03

35:03

Clownfish TV

8 hours ago'Live by the Sword, Die by the Sword.' | Clownfish TV

28.3K80 -

8:15

8:15

Sideserf Cake Studio

4 hours ago $0.34 earnedA Hyperrealistic TAKIS Cake?

19.2K2 -

55:49

55:49

SGT Report

16 hours agoFAKED TRAGEDY, LONE GUNMAN OR PATSY? -- Jeffrey Prather

42.2K188 -

9:30

9:30

Adam Does Movies

14 hours ago $0.32 earnedThe Long Walk - Movie Review

13.9K3