Premium Only Content

How to Turn Everyday Expenses Into Tax Write Offs

JOIN THE TAX-FREE WEALTH CHALLENGE! MARCH 10th-14th, 2025

https://join.taxalchemy.com/join-thechallenge?utm_source=youtube&utm_medium=description

Book a Professional Tax Strategy Consultation ▶ https://taxalchemy.com/consultation?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Cost Segregation Tax Savings Calculator ▶ https://taxalchemy.com/cost-segregation-calculator?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com/?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Watch this FREE Webinar on How to Cut Your Tax Bill in Half as a Real Estate Investor ▶ https://join.taxalchemy.com/registration?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

We earn commissions when you shop through the links below.

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326&u=2911896&m=53954&urllink=&afftrack=

People who know how to implement tax strategy correctly can successfully turn everyday expenses into tax write-offs. If you can learn how to do this, then you will most likely find that you can turn many more different types of expenses into deductions than you might have previously thought.

In this video, tax expert Karlton Dennis explains how you can turn everyday expenses into write-offs correctly and in full compliance with tax law. Importantly, he also provides a detailed explanation of expenses that you are not allowed to turn into tax write-offs. Knowing the difference is crucial to prevent audits and penalties.

It is also important to understand that not all taxpayers are allowed to write off the same expenses. So, Karlton also explains who is able to write off certain types of everyday expenses, and who is not. Watching this video can help you get a better understanding of the deductions you may qualify for.

CHAPTERS:

0:00 Intro

0:18 Employees vs Business Owners

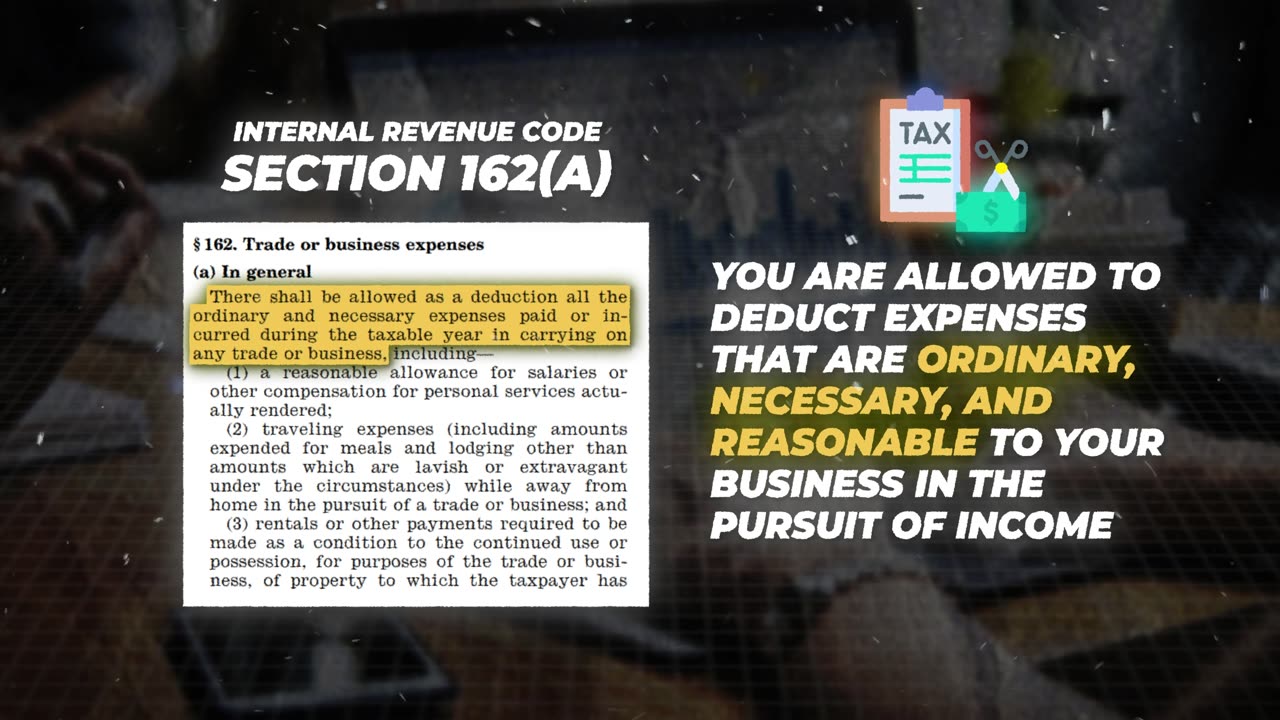

1:03 Code Section 162(a)

1:43 Expense #1: Home-Related Expenses

3:02 Expense #2: Laptop

3:44 Expense #3: Cell Phone

4:17 Expense #4: Vehicles

5:43 Expense #5: Meals

7:11 Expense #6: Travel

8:54 Subscriber Question!

9:43 Outro

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#taxdeductions #writeoffs #taxplanning

-

10:59

10:59

Karlton Dennis

7 days agoThe Smart Way to Deed Property to Your LLC

17 -

LIVE

LIVE

Glenn Greenwald

4 hours agoGlenn Answers Your Questions on an Un-American Candidate in TX, Escalating War with Venezuela, Trump's Loyalty to Miriam Adelson, and More | SYSTEM UPDATE #554

7,700 watching -

1:03:20

1:03:20

BonginoReport

2 hours agoCNN’s Colorblindness Strikes Again! - Nightly Scroll w/ Hayley Caronia (Ep.191)

29.6K14 -

DVR

DVR

Nerdrotic

5 hours ago $7.89 earnedHollywood PANICS! Netflix WINS Warner Bros | RIP Star Trek - Friday Night Tights 383

110K10 -

1:33:57

1:33:57

Russell Brand

5 hours agoThe Venezuela Flashpoint: How Fast Could This Spiral? - SF659

130K28 -

1:26:58

1:26:58

vivafrei

5 hours agoJan. 6 Suspect ADMITS to Planting Bombs, Claims to be Trump SUPPORTER? The Blaze RETRACTS? & MORE!

51K92 -

22:00

22:00

Jasmin Laine

3 hours agoTrump’s Peace Medal Triggered the Biggest Liberal Meltdown of the Year

11.6K20 -

30:47

30:47

The HotSeat With Todd Spears

4 hours agoEP 221: Bonus Friday Episode! 2025 Spotify Recap

23.1K54 -

LIVE

LIVE

LFA TV

20 hours agoLIVE & BREAKING NEWS! | FRIDAY 12/05/25

978 watching -

![MAHA News [12.5] Glyphosate Study Retracted (MONSANTO), Vaccine News (COVID), DMSO Chat](https://1a-1791.com/video/fwe2/02/s8/1/0/u/D/F/0uDFz.0kob-small-MAHA-News-12.5.jpg) 1:01:00

1:01:00

Badlands Media

14 hours agoMAHA News [12.5] Glyphosate Study Retracted (MONSANTO), Vaccine News (COVID), DMSO Chat

35.1K6