Premium Only Content

How to Turn Everyday Expenses Into Tax Write Offs

JOIN THE TAX-FREE WEALTH CHALLENGE! MARCH 10th-14th, 2025

https://join.taxalchemy.com/join-thechallenge?utm_source=youtube&utm_medium=description

Book a Professional Tax Strategy Consultation ▶ https://taxalchemy.com/consultation?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Cost Segregation Tax Savings Calculator ▶ https://taxalchemy.com/cost-segregation-calculator?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com/?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Watch this FREE Webinar on How to Cut Your Tax Bill in Half as a Real Estate Investor ▶ https://join.taxalchemy.com/registration?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

We earn commissions when you shop through the links below.

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326&u=2911896&m=53954&urllink=&afftrack=

People who know how to implement tax strategy correctly can successfully turn everyday expenses into tax write-offs. If you can learn how to do this, then you will most likely find that you can turn many more different types of expenses into deductions than you might have previously thought.

In this video, tax expert Karlton Dennis explains how you can turn everyday expenses into write-offs correctly and in full compliance with tax law. Importantly, he also provides a detailed explanation of expenses that you are not allowed to turn into tax write-offs. Knowing the difference is crucial to prevent audits and penalties.

It is also important to understand that not all taxpayers are allowed to write off the same expenses. So, Karlton also explains who is able to write off certain types of everyday expenses, and who is not. Watching this video can help you get a better understanding of the deductions you may qualify for.

CHAPTERS:

0:00 Intro

0:18 Employees vs Business Owners

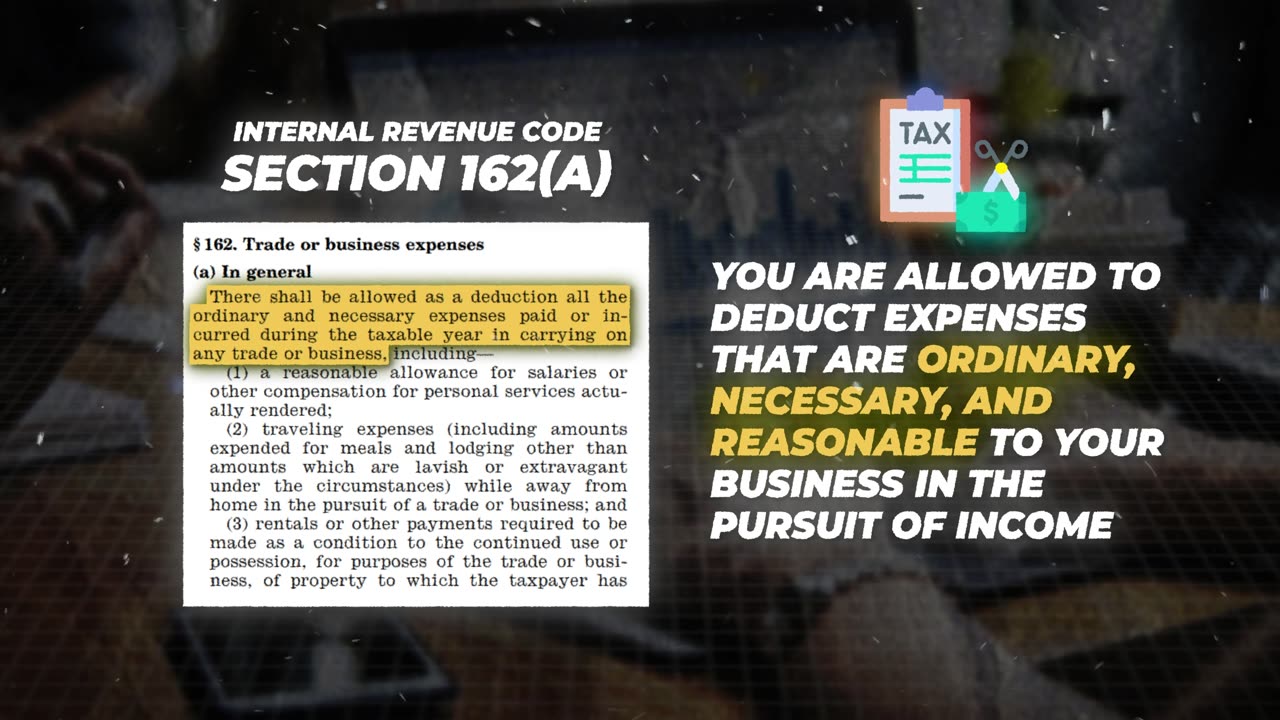

1:03 Code Section 162(a)

1:43 Expense #1: Home-Related Expenses

3:02 Expense #2: Laptop

3:44 Expense #3: Cell Phone

4:17 Expense #4: Vehicles

5:43 Expense #5: Meals

7:11 Expense #6: Travel

8:54 Subscriber Question!

9:43 Outro

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#taxdeductions #writeoffs #taxplanning

-

8:10

8:10

Karlton Dennis

16 days agoHow to Save a Fortune with Bonus Depreciation! (Secret Strategy of the Rich)

7 -

24:14

24:14

DeVory Darkins

1 day agoTrump announces HISTORIC WIN for American families as Costco launches shocking lawsuit

8.9K59 -

20:31

20:31

Actual Justice Warrior

1 day agoOxford Student Who Celebrated Charlie Kirk's Murder Plays Victim

1.25K6 -

23:40

23:40

Code Blue Cam

12 hours agoMan Celebrates Independence Day by Losing His Freedom

1565 -

58:39

58:39

MattMorseTV

9 hours ago $23.16 earned🔴Rand Paul just made a BIG MISTAKE.🔴

46.7K137 -

37:25

37:25

Nikko Ortiz

13 hours agoTerrible Military Deaths and War Crimes

6.16K4 -

24:21

24:21

The Pascal Show

8 hours ago $4.24 earned'CHALLENGE ACCEPTED!' TPUSA Breaks Silence On Candace Owens Charlie Kirk Allegations! She Responds!

9K6 -

19:23

19:23

MetatronHistory

14 hours agoThe REAL Origins and Function of the PRETORIANS in Ancient Rome

4.74K -

2:03:59

2:03:59

Side Scrollers Podcast

18 hours agoKaceytron Publicly Humiliated by H3H3 + Sabrina Carpenter/White House FEUD + More | Side Scrollers

51.4K6 -

2:17:46

2:17:46

The Connect: With Johnny Mitchell

4 days ago $17.00 earnedA Sitdown With The Real Walter White: How An Honest Citizen Became A Synthetic Drug Kingpin

96.3K2