Premium Only Content

How to Turn Everyday Expenses Into Tax Write Offs

JOIN THE TAX-FREE WEALTH CHALLENGE! MARCH 10th-14th, 2025

https://join.taxalchemy.com/join-thechallenge?utm_source=youtube&utm_medium=description

Book a Professional Tax Strategy Consultation ▶ https://taxalchemy.com/consultation?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Cost Segregation Tax Savings Calculator ▶ https://taxalchemy.com/cost-segregation-calculator?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com/?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Watch this FREE Webinar on How to Cut Your Tax Bill in Half as a Real Estate Investor ▶ https://join.taxalchemy.com/registration?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

We earn commissions when you shop through the links below.

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326&u=2911896&m=53954&urllink=&afftrack=

People who know how to implement tax strategy correctly can successfully turn everyday expenses into tax write-offs. If you can learn how to do this, then you will most likely find that you can turn many more different types of expenses into deductions than you might have previously thought.

In this video, tax expert Karlton Dennis explains how you can turn everyday expenses into write-offs correctly and in full compliance with tax law. Importantly, he also provides a detailed explanation of expenses that you are not allowed to turn into tax write-offs. Knowing the difference is crucial to prevent audits and penalties.

It is also important to understand that not all taxpayers are allowed to write off the same expenses. So, Karlton also explains who is able to write off certain types of everyday expenses, and who is not. Watching this video can help you get a better understanding of the deductions you may qualify for.

CHAPTERS:

0:00 Intro

0:18 Employees vs Business Owners

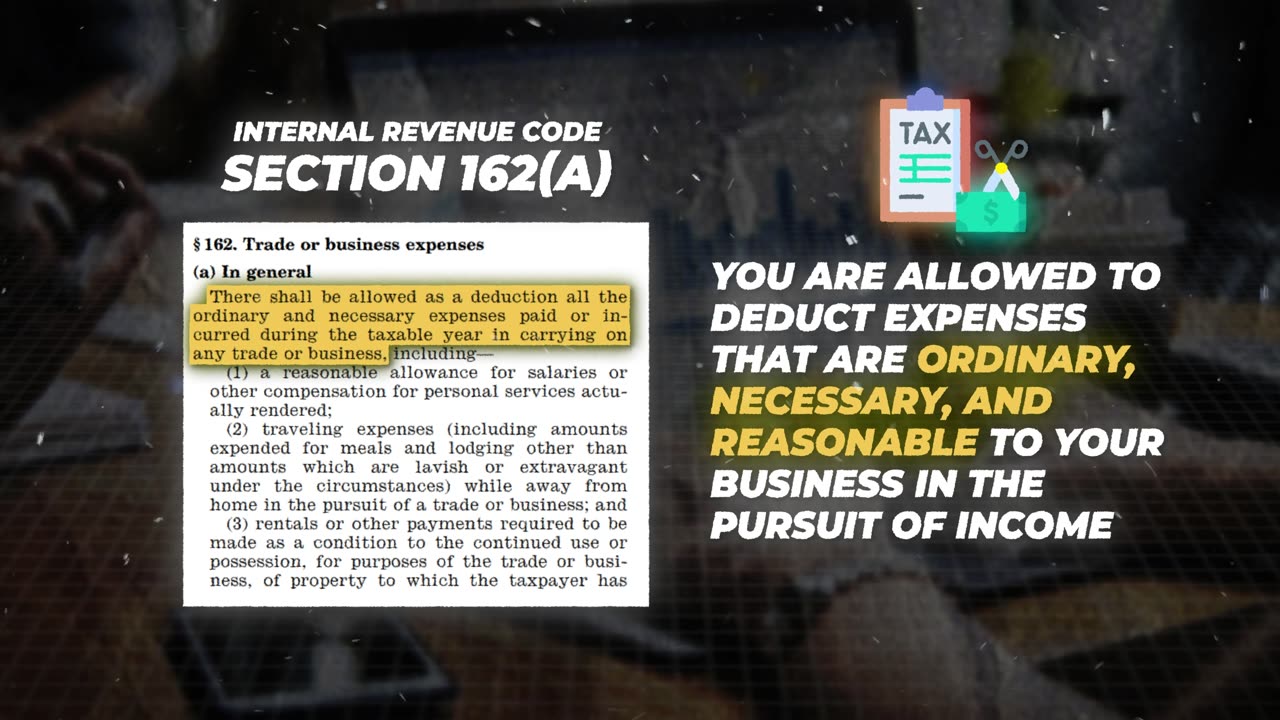

1:03 Code Section 162(a)

1:43 Expense #1: Home-Related Expenses

3:02 Expense #2: Laptop

3:44 Expense #3: Cell Phone

4:17 Expense #4: Vehicles

5:43 Expense #5: Meals

7:11 Expense #6: Travel

8:54 Subscriber Question!

9:43 Outro

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#taxdeductions #writeoffs #taxplanning

-

9:42

9:42

Karlton Dennis

1 month ago5 Personal Finance Moves I Got Right EARLY (And You Should Too!)

351 -

1:48:16

1:48:16

Tucker Carlson

16 minutes agoCliffe Knechtle Answers Tough Questions About the Bible, Demons, Israel, Judas, Free Will, and Death

2 -

LIVE

LIVE

Dr Disrespect

1 hour ago🔴LIVE - DR DISRESPECT VS. JEAN-CLAUDE VAN DAMME - HITMAN

3,744 watching -

1:00:41

1:00:41

Timcast

1 hour agoTrump MOBILIZING National Guard In NATIONWIDE Crackdown

40.5K57 -

LIVE

LIVE

Sean Unpaved

45 minutes agoQuarterbacks, Coaches, & Contracts: Sanders' Draft Drama, Meyer vs. Harbaugh, & McLaurin's Big Deal

141 watching -

2:11:45

2:11:45

Steven Crowder

3 hours agoDonald Trump Vs American Crime: Chicago is Next & Libs Are Freaking Out

183K163 -

LIVE

LIVE

Grant Stinchfield

19 minutes agoDemocrats Try to Turn California Into Predator Playground with Proposed "Child Predator Dream Bill"

136 watching -

LIVE

LIVE

Rebel News

44 minutes agoCdn troops in Ukraine? Poilievre backs self-defence, Hamas thugs cancel Ottawa Pride | Rebel Roundup

321 watching -

LIVE

LIVE

Neil McCoy-Ward

1 hour ago⚠️ OUTRAGE! What They Just Announced For YOUR HOME!!! 🚨

76 watching -

LIVE

LIVE

IrishBreakdown

2 hours agoNotre Dame and Miami Set To Reignite Intense Rivalry

1,195 watching