Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

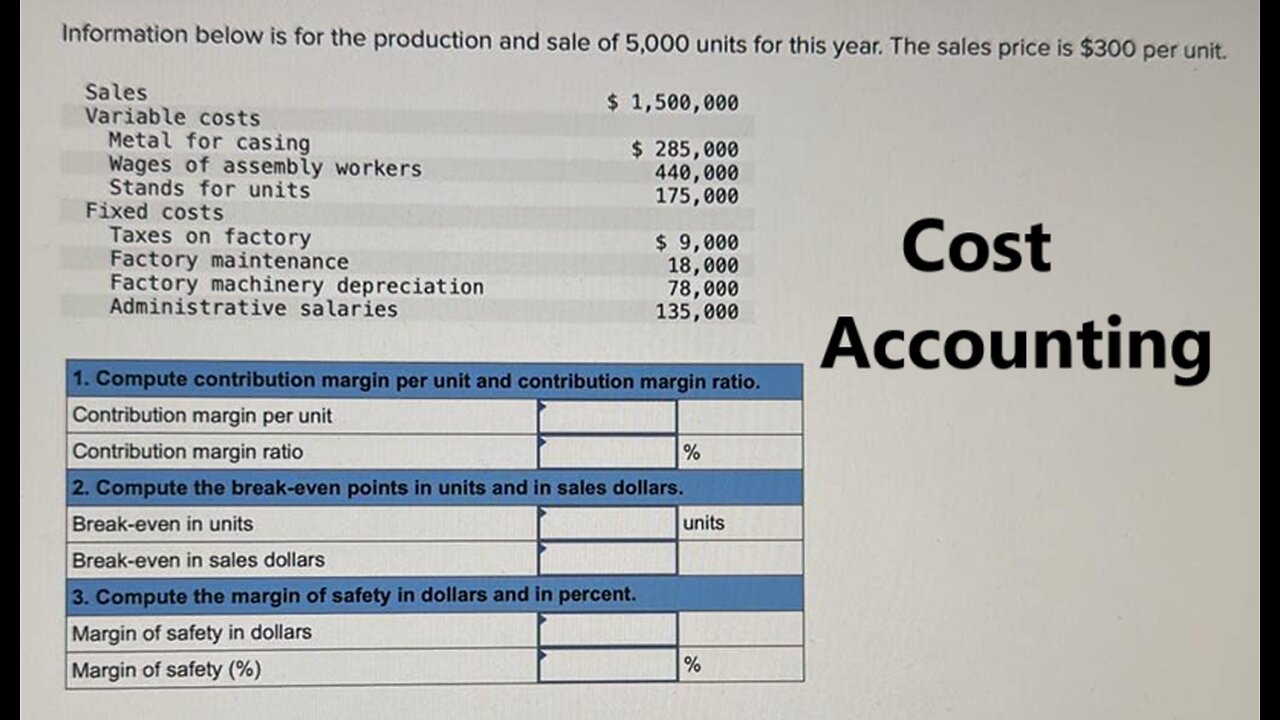

Cost Accounting: Information below is for the production and sale of 5,000 units for this year. The

6 months ago

15

Information below is for the production and sale of 5,000 units for this year. The sales price is $300 per unit.

Sales

Variable costs

$ 1,500,000

$285,000

Metal for casing

Wages of assembly workers

Stands for units

Fixed costs

Taxes on factory

Factory maintenance

Factory machinery depreciation

Administrative salaries

440,000 175,000

$ 9,000

18,000

78,000

135,000

1. Compute contribution margin per unit and contribution margin ratio.

Contribution margin per unit

Contribution margin ratio

%

2. Compute the break-even points in units and in sales dollars.

Break-even in units

units

Break-even in sales dollars

3. Compute the margin of safety in dollars and in percent.

Margin of safety in dollars

Margin of safety (%)

%

#CostAccounting

#Accounting

Loading comments...

-

2:10:26

2:10:26

Badlands Media

10 hours agoDevolution Power Hour Ep. 383

49.2K6 -

3:17:28

3:17:28

TimcastIRL

5 hours agoTrans Shooter Targets Catholic Kids In Mass Shooting, Leftists Reject Prayers | Timcast IRL

210K54 -

1:31:29

1:31:29

Brandon Gentile

1 day ago25 Year Wall Street INSIDER: $1M Bitcoin Soon Is Just The START

12K -

LIVE

LIVE

SpartakusLIVE

6 hours ago#1 Birthday Boy Celebrates with MASSIVE and HUGE 4.8-Hour Stream

323 watching -

55:54

55:54

Man in America

8 hours agoFrom Oil Barons to Pill Pushers: The Rockefeller War on Health w/ Jeff Adam

36.3K3 -

3:02:18

3:02:18

Barry Cunningham

5 hours agoBREAKING NEWS: PRESIDENT TRUMP THIS INSANITY MUST END NOW!

82.9K153 -

StevieTLIVE

4 hours agoWednesday Warzone Solo HYPE #1 Mullet on Rumble

29.6K -

5:58

5:58

Mrgunsngear

5 hours ago $2.88 earnedBreaking: The New Republican Party Chairman Is Anti 2nd Amendment

23.2K8 -

2:28:35

2:28:35

Geeks + Gamers

5 hours agoGeeks+Gamers Play- MARIO KART WORLD

24.6K -

![(8/27/2025) | SG Sits Down Again w/ Sam Anthony of [Your]News: Progress Reports on Securing "We The People" Citizen Journalism](https://1a-1791.com/video/fww1/d1/s8/6/G/L/3/c/GL3cz.0kob.1.jpg) 29:34

29:34

QNewsPatriot

5 hours ago(8/27/2025) | SG Sits Down Again w/ Sam Anthony of [Your]News: Progress Reports on Securing "We The People" Citizen Journalism

18.5K2