Premium Only Content

Cost Accounting: Sultan Company uses an activity-based costing system. At the beginning of the year

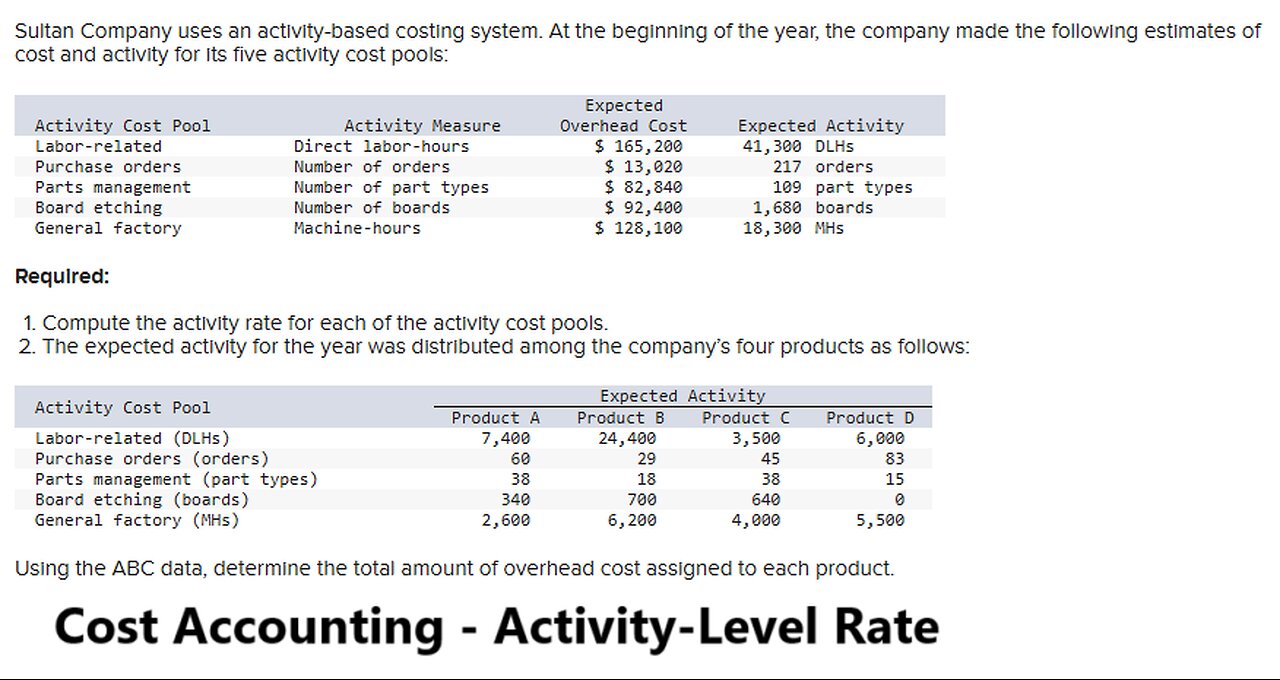

Sultan Company uses an activity-based costing system. At the beginning of the year, the company made the following estimates of cost and activity for its five activity cost pools:

Activity Cost Pool Activity Measure Expected Overhead Cost Expected Activity

Labor-related Direct labor-hours $ 165,200 41,300 DLHs

Purchase orders Number of orders $ 13,020 217 orders

Parts management Number of part types $ 82,840 109 part types

Board etching Number of boards $ 92,400 1,680 boards

General factory Machine-hours $ 128,100 18,300 MHs

Required:

Compute the activity rate for each of the activity cost pools.

The expected activity for the year was distributed among the company’s four products as follows:

Activity Cost Pool Expected Activity

Product A Product B Product C Product D

Labor-related (DLHs) 7,400 24,400 3,500 6,000

Purchase orders (orders) 60 29 45 83

Parts management (part types) 38 18 38 15

Board etching (boards) 340 700 640 0

General factory (MHs) 2,600 6,200 4,000 5,500

Using the ABC data, determine the total amount of overhead cost assigned to each product.

#CostAccounting

#Accounting

#Cost

#ActivityLevel

-

13:09

13:09

Forrest Galante

8 hours agoWildlife Expert Reacts To Deadly Australian Animal TikToks

17.2K2 -

12:08

12:08

Zoufry

1 day agoThe Mystery of Gaddafi's Final 24 Hours

1872 -

18:25

18:25

Liberty Hangout

13 days agoAnti-Ice Demonstrators Love Poop!

18.6K46 -

9:39

9:39

MattMorseTV

14 hours ago $0.89 earnedVance just DROPPED a BOMBSHELL.

30.5K62 -

23:47

23:47

GritsGG

1 day agoThe Forgotten Best Sniper Support AR!

6.44K2 -

1:15:48

1:15:48

The Pascal Show

16 hours ago $0.06 earnedMUGSHOTS RELEASED! Emmanuel Haro's Parents Mugshot Released To The Public

4.99K1 -

14:45

14:45

BlabberingCollector

19 hours agoKings Cross Station SET LEAKS! | Harry Potter HBO Show Update & News

4.67K -

33:20

33:20

SB Mowing

9 days agoHealth Struggles + Endless Rain = A Yard Out of Control

13.2K18 -

1:09:42

1:09:42

Mike Rowe

4 days agoHow Did THIS Dirty Job Make Tommy Mello A Billionaire?! | #447 | The Way I Heard It

71.3K20 -

10:11:30

10:11:30

SpartakusLIVE

11 hours agoThe BADDEST Duo in WZ Exhibits PEAK Physique || Duos w/ Sophiesnazz to start, quads later

170K1