Premium Only Content

Cost Accounting: The Polaris Company uses a job-order costing system. The following transactions

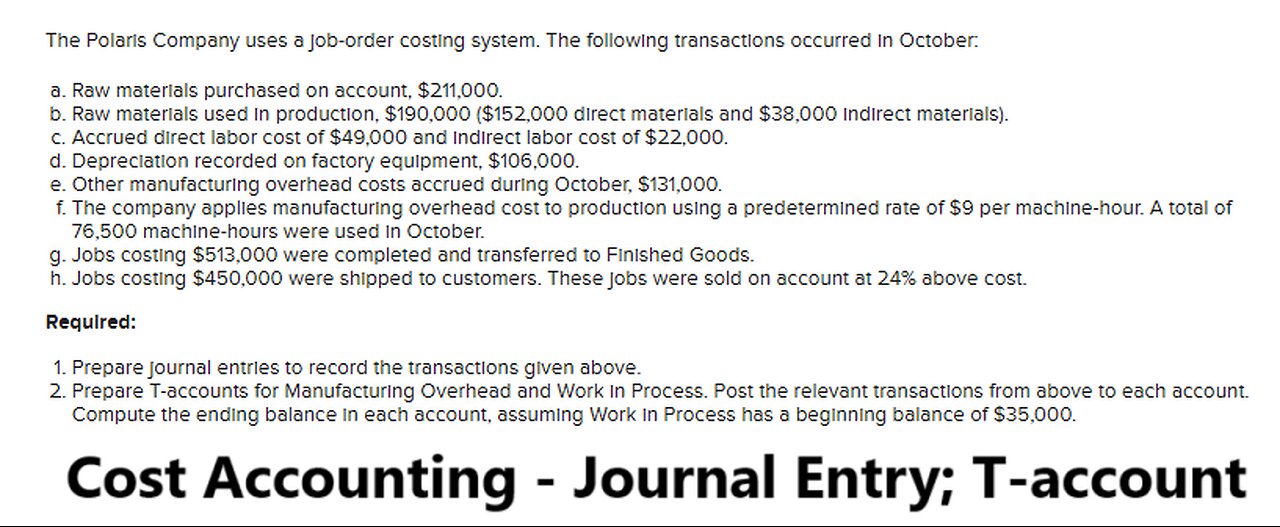

The Polaris Company uses a job-order costing system. The following transactions occurred in October:

Raw materials purchased on account, $211,000.

Raw materials used in production, $190,000 ($152,000 direct materials and $38,000 indirect materials).

Accrued direct labor cost of $49,000 and indirect labor cost of $22,000.

Depreciation recorded on factory equipment, $106,000.

Other manufacturing overhead costs accrued during October, $131,000.

The company applies manufacturing overhead cost to production using a predetermined rate of $9 per machine-hour. A total of 76,500 machine-hours were used in October.

Jobs costing $513,000 were completed and transferred to Finished Goods.

Jobs costing $450,000 were shipped to customers. These jobs were sold on account at 24% above cost.

Required:

Prepare journal entries to record the transactions given above.

Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming Work in Process has a beginning balance of $35,000.

#CostAccounting

#Taccount

#JournalEntries

#Techniques

-

1:22:54

1:22:54

Game On!

17 hours ago $1.28 earnedNFL Preseason Week 3 Preview and Best Bets!

21.3K1 -

LIVE

LIVE

JuicyJohns

1 hour ago🟢#1 REBIRTH PLAYER 10.2+ KD🟢

75 watching -

30:53

30:53

Clickbait Wasteland

15 hours ago $2.18 earnedAsking New Yorkers Who They Support For Mayor: Jackson Heights

22.4K12 -

23:05

23:05

Blackstone Griddles

15 hours agoEpisode 6 | Breakfast, Lunch, and Dinner

13.1K -

1:12:00

1:12:00

The Car Guy Online

14 hours ago $1.63 earnedAutomakers EXPOSED, Whistleblowers SILENCED! NextGen Engineer Speaks Out!

12.5K10 -

1:17

1:17

The Lou Holtz Show

15 hours agoThe Lou Holtz Show S2 EP16 | Hugh Freeze on Faith, Football & Restoring American Values #podcast

11.5K2 -

2:01:21

2:01:21

BEK TV

1 day agoTrent Loos in the Morning - 8/22/2025

10.3K -

LIVE

LIVE

The Bubba Army

23 hours agoHogan's Death: Bubba Called it FIRST AGAIN! - Bubba the Love Sponge® Show | 8/22/25

1,852 watching -

38:40

38:40

ZeeeMedia

18 hours agoMax Pace’s Crypto Revolution Story: Four Strategies to Win | Daily Pulse Ep 93

28.5K14 -

2:16:46

2:16:46

"What Is Money?" Show

2 days agoBitcoin vs War, Violence, & Corruption w/ Gary Mahmoud

25.2K