Premium Only Content

Cost Accounting: The following year-end information is taken from the December 31 Leone Company

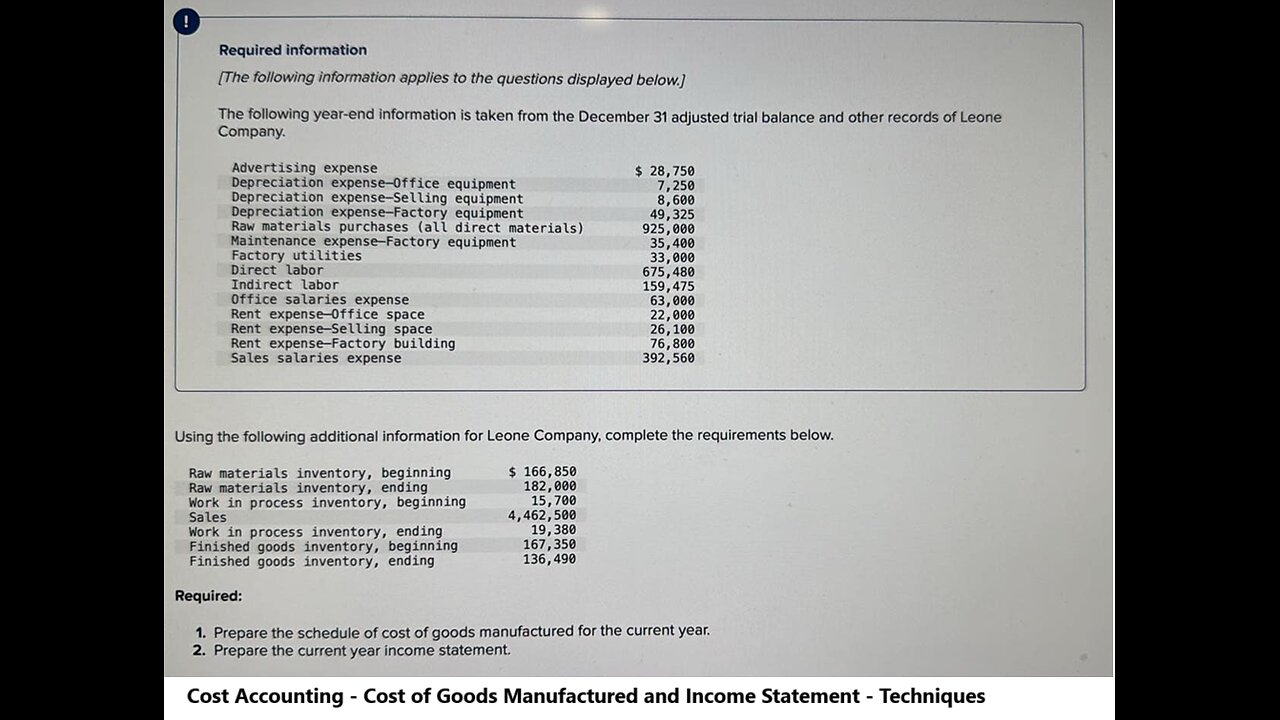

[The following information applies to the questions displayed below.]

The following year-end information is taken from the December 31 adjusted trial balance and other records of Leone Company.

Advertising expense

$ 28,750

Depreciation expense-Office equipment

7,250

Depreciation expense-Selling equipment

8,600

Depreciation expense-Factory equipment

49,325

Raw materials purchases (all direct materials)

925,000

Maintenance expense-Factory equipment

35,400

Factory utilities

33,000

Direct labor

675,480

Indirect labor

159,475

Office salaries expense

Rent expense-Selling space

63,000

Rent expense-Office space

Rent expense-Factory building

Sales salaries expense

22,000

26,100

76,800

392,560

Using the following additional information for Leone Company, complete the requirements below.

Raw materials inventory, beginning Raw materials inventory, ending

Work in process inventory, beginning Sales

Work in process inventory, ending Finished goods inventory, beginning Finished goods inventory, ending

Required:

$166,850

182,000

15,700

4,462,500

19,380

167,350

136,490

1. Prepare the schedule of cost of goods manufactured for the current year.

2. Prepare the current year income statement.

#costaccounting

#Techniques

#Solutions

#incomestatement

-

29:54

29:54

Afshin Rattansi's Going Underground

18 hours agoUkraine: Prof. Anatol Lieven SLAMS Europe’s ‘BLOODY STUPIDITY’ as Trump Negotiates with Putin

12.4K3 -

15:27

15:27

robbijan

1 day ago $2.35 earnedThe Emperor’s New Labubu & The Spiritual War Behind Everything

37.3K38 -

LIVE

LIVE

GritsGG

16 hours ago36 Hour Stream! Most Wins 3420+ 🧠

332 watching -

2:05:47

2:05:47

TimcastIRL

5 hours agoTrump FBI Raids John Bolton Amid Classified Docs Investigation | Timcast IRL

164K55 -

2:15:23

2:15:23

TheSaltyCracker

5 hours agoFinally Someone Gets Raided ReEEeStream 8-22-25

73.5K193 -

LIVE

LIVE

I_Came_With_Fire_Podcast

17 hours agoChina's New Ship Killers, EU Dead, Shooter HOAX, and The Missing Woman

174 watching -

DVR

DVR

SynthTrax & DJ Cheezus Livestreams

13 hours agoFriday Night Synthwave 80s 90s Electronica and more DJ MIX Livestream OUTSIDERZ Edition

21.8K -

3:39:16

3:39:16

VapinGamers

4 hours ago $0.06 earnedFortnite Friday with BrianZGame and Community! #1 Controller Scrub NA - !rumbot !music

8.32K -

LIVE

LIVE

iCheapshot

4 hours ago $0.02 earnedTrying Out The Finals | Complete Newb

31 watching -

1:59:06

1:59:06

HogansAlleyHero

7 hours ago💥2XP WEEKEND - BF6 REWARDS UNLOCK GRIND 💥

3.31K