Premium Only Content

3 Big Tax Code Changes Trump & Congress Should Consider in 2025!

As Donald Trump and Congress consider reforming the tax code, I’m sharing 3 bold proposals to simplify taxes, boost the economy, and empower American taxpayers:

1️⃣ Increase the Capital Loss Limitation:

The current $3,000 cap, set in 1986, hasn’t kept up with inflation. Adjusting it to $20,000–$30,000 would give investors the relief they need in today’s economy.

2️⃣ Reduce Capital Gains Taxes:

A flat 10% capital gains tax rate could eliminate the complexity of short-term vs. long-term gains, while encouraging investments across crypto, stocks, bonds, real estate, and more.

3️⃣ Raise the Standard Deduction:

Doubling or tripling the standard deduction (up to $60,000–$70,000) would simplify taxes for millions, increase take-home pay, and reduce reliance on expensive tax prep services.

These changes could revolutionize the tax code, putting more money in Americans’ pockets and promoting fairness across all income levels.

💬 What do you think? Comment below!

#CryptoTax #TaxReform #DonaldTrump #CapitalGainsTax #TaxCodeSimplification #CryptoInvesting #Inflation #MakeAmericaGreatAgain #TaxPolicy #economicgrowth

📝 Get Ready for Taxes:

✍🏻 Sign up for our 2024 Tax Prep Waiting List today 👉 https://www.cryptotaxaudit.com/tax-prep-waiting-list?afmc=yt

Visit 👉 https://www.cryptotaxaudit.com/1099?afmc=yt to organize your records and Safe Harbor plan.

💬 Connect with Us:

Have questions about explorers or crypto taxes? 👉 https://www.cryptotaxaudit.com?afmc=yt

📞 Need Help?

Schedule a consultation today 👉 https://www.cryptotaxaudit.com/crypto-tax-consultation?afmc=yt

▬▬▬▬▬ SPONSOR ▬▬▬▬▬

🐋 Sponsor: CryptoTaxAudit

CryptoTaxAudit is the ultimate solution for ensuring your crypto taxes are precise and fully compliant with the latest regulations. With expert guidance and support, you can avoid costly penalties and enjoy complete peace of mind. Don't take any chances with your hard-earned assets. Become an IRS Guard Dog member today and take control of your financial future! Visit CryptoTaxAudit.com today.

Visit 👉 https://www.cryptotaxaudit.com/?afmc=yt

▬▬▬▬▬ NOTICE ▬▬▬▬▬

⚠️ 𝗕𝗘𝗪𝗔𝗥𝗘 𝗢𝗙 𝗦𝗖𝗔𝗠𝗠𝗘𝗥𝗦 𝗜𝗡 𝗢𝗨𝗥 𝗖𝗢𝗠𝗠𝗘𝗡𝗧𝗦 𝗔𝗡𝗗 𝗖𝗢𝗠𝗠𝗨𝗡𝗜𝗧𝗬 𝗖𝗛𝗔𝗡𝗡𝗘𝗟𝗦

We will never ask you for your personal information on social media. Beware of people masquerading as our host, guests, or sponsor company.

📜 Disclaimer

All opinions expressed by the show’s host and guests are their own. Do not construe them as tax, legal, or financial advice. In addition, they may not represent the policies or opinions of our sponsor, CryptoTaxAudit. Research legal, tax, and financial guidance and advice as needed.

-

32:53

32:53

The Clinton Donnelly Show

1 day agoHow Crypto Scams Really Work in 2025: Forensics Expert Reveals What Victims Don’t Know

391 -

1:21:16

1:21:16

The White House

8 hours agoVice President JD Vance Celebrates Thanksgiving with Servicemembers and Delivers Remarks

33.7K17 -

59:49

59:49

The Quartering

5 hours agoMTG MELTDOWN On X, Hasan Piker Runs From Ben Shapiro & AI Nightmare!

112K48 -

1:16:24

1:16:24

DeVory Darkins

6 hours agoDISTURBING: Eric Swalwell left DUMBFOUNDED after he gets confronted about trans athletes

95.6K59 -

2:06:36

2:06:36

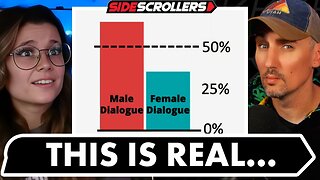

Side Scrollers Podcast

8 hours agoThis is the Dumbest Story We’ve Ever Covered… | Side Scrollers

51.2K10 -

1:13:26

1:13:26

Steven Crowder

10 hours ago🔴 Jay Dyer on Hollywood, The Occult, and the Attack on the American Soul

276K211 -

1:26:28

1:26:28

Sean Unpaved

7 hours agoNFL Thanksgiving Games Are Going To Be ELECTRIC! | UNPAVED

38.7K5 -

29:07

29:07

The Rubin Report

9 hours agoAre Megyn Kelly & Erika Kirk Right About Our Political Divisions?

79.8K59 -

27:09

27:09

VINCE

10 hours agoSaving America's Schools with Norton Rainey | Episode 177 - 11/26/25 VINCE

192K99 -

2:03:57

2:03:57

Benny Johnson

9 hours agoFBI Director Kash Patel Makes January 6th Pipe Bomber Announcement: Massive Breakthrough, Stay Tuned

144K126